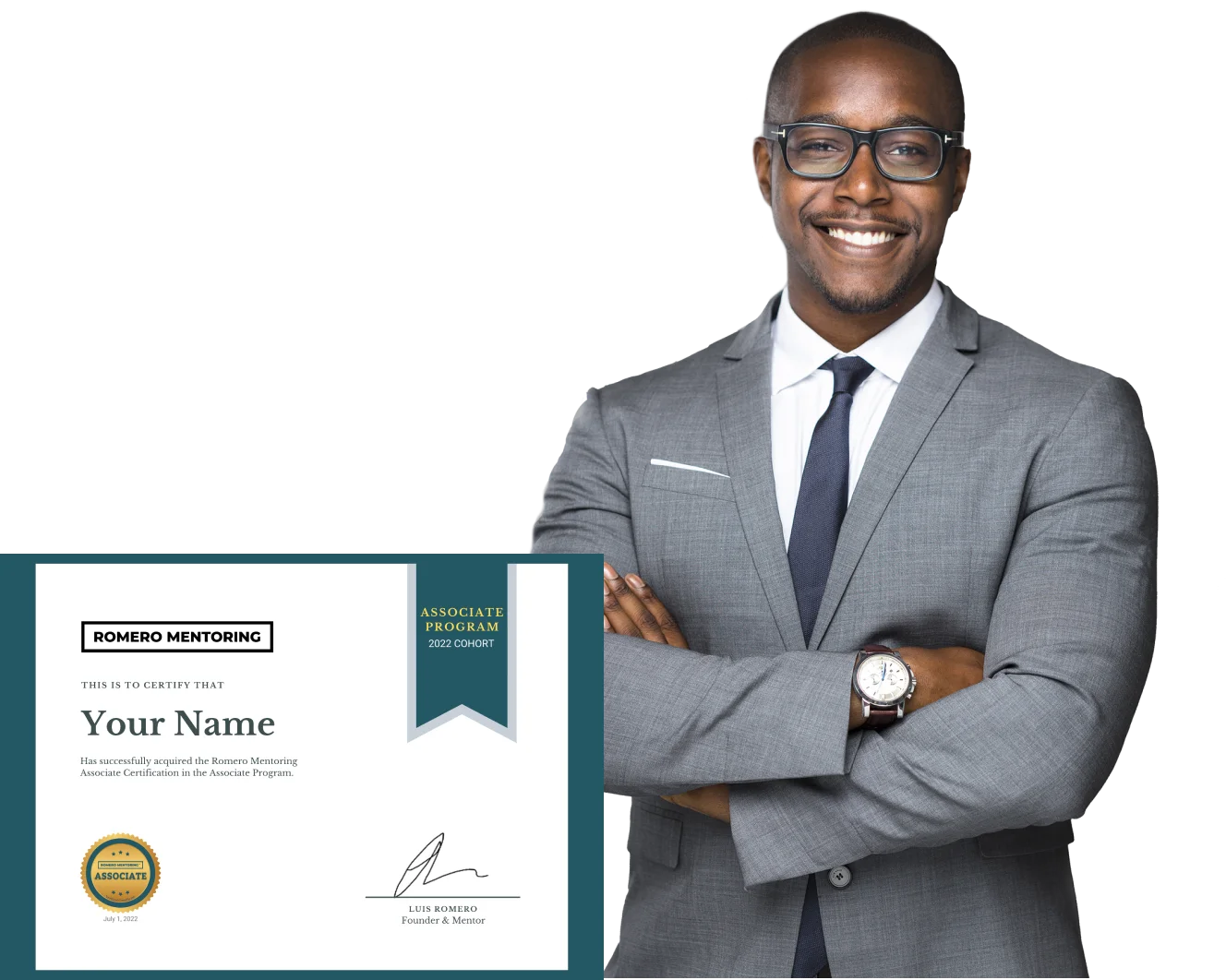

Our Associate Program

We Help Our Students Go From $0 To $100k+ Careers

Develop The Skills Required To Advance

Your Professional Career

Exceptional experience through training, finance internship, mentorship and networking to expedite your success in:

- Investment Banking

- Private Equity

- Hedge funds

- Consulting

- Venture capital

- Startups

Our program certification will help you break into these career fields

Each year, only 10% of 54,000 applicants are accepted into the top 10 MBA programs. After paying ~$132K in tuition, students still lack the in-depth technical skills and professional experience.

Our Investment Banking Career Program helps overcome that.

What Our Program Can Do For You

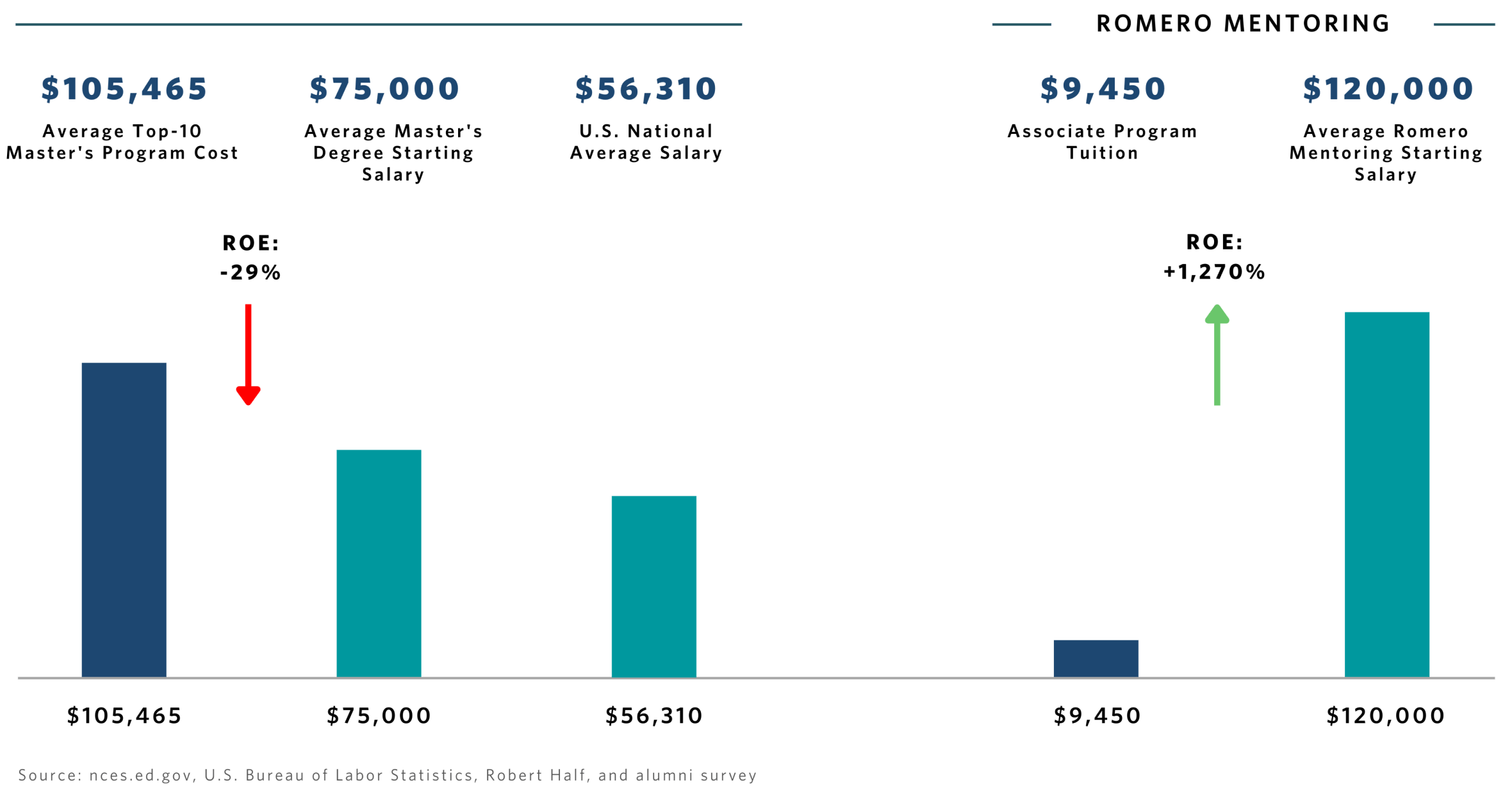

We Deliver Better Results Than Most College Degrees

Most college degrees yield a negative ROI

Our Associate Program is an insurance policy on your academic education and career

The Skills That Deliver Six-Figure Salaries:

Not all graduate degrees are created equal. While a graduate education is a nice-have, it’s still not enough to gain the professional skills Wall Street firms and top employers are looking for.

Romero Mentoring provides a competitive advantage competitive advantage to place you on the career express lane.

Program Details

Certified Investment Banking Career Program

20 Modules. 47 Chapters. 136 Lectures. 210 hours.

Our Associate Program

Our certification program is designed to equip students with the necessary professional skills needed to become top performers on the job. Our goal is to help you become a first-rate professional to pursue six-figure careers and increase your future earnings potential.

- Total professional training hours: 121

- Total assignment & work hours: 89

- Total program hours: 210

- Duration: 15 Weeks

Success Roadmap

Professional skills not taught in a classroom at the undergraduate, master’s, or MBA level

300

Analyst Professionals To Network With

97%

Satisfaction Rate From Our Participants

3.75

Median GPA Of Our Students

4.7%

Acceptance Rate Into Our Programs

$120k

Alumni Average Starting Salary

Meet Our Founder & Instructor

Luis Romero

Our mission is to use education to make the world a better place.

15 Years of Professional Experience

Entrepreneur

- Founder Romero Capital, private fund

- Founder Romero Mentoring, EdTech career mentoring platform

Instructor & Professional Career Mentor

- 15,000 plus hours as a mentor, trainer, and worked with over 700 professionals and students on a one-on-one basis

- Senior Instructor, New York School of Finance

Sell-Side & Buy-Side Analyst

- Hedge Fund Analyst / Trader, Seven Points Capital

- M&A Investment Banking Analyst, Credit Suisse

- Investment Banking Intern, Bank of America Merrill Lynch

- Investment Research Intern, Citi

Education

- City University of New York – Baruch College, Zicklin School of Business

- Major: Finance, Credit Suisse

- Minor: Philosophy

Gain Access to a Strong, Growing Community of Students and Professionals

Broaden your network – Our students attend universities all throughout the nation

Our alumni network of professionals are working at top financial firms

Who is this Program For?

- Anyone looking to advance their careers and their earnings potential

- Anyone who cannot afford the six-figure costs of an elite college education

- Anyone looking to develop professional finance skills

- College students

- Future entrepreneurs

- Future investors

Successful candidates

- Are highly motivated and driven individuals who are intellectually curious and want to learn new concepts

- Are hungry to succeed and want upward mobility

- Possess leadership qualities, strong interpersonal skills, and the ability to thrive in team environments

- Are professional, mature, and are strong communicators

- Have analytical thinking and problem-solving capabilities

- Are not afraid of hard work

Why Students Choose Romero Mentoring

Application Details

Don’t Delay, Advance Your Career Today

Limited seats available

Round 1

Submit Career questioner form after your program application

Round 2

Complete the financial model evolutions entry exam

Round 3

Final video interview round

10-day free access to our program in Round 2

FAQs

No, all majors are welcome and encouraged to apply. The skills gained in our program are transferable skills applicable to any career path.

Our program is competitive and although we have no strict GPA requirements, our current members have GPAs in the range of 3.6-4.0.

Our unique program provides a transformative experience not found anywhere else. We provide a world-class training program designed with real-world practical application to accelerate your learning. In addition, you receive 1-on-1 mentoring, career development and an internship that provides a high level of responsibilities to start your career. Above all, you will connect with our professional alumni community to expand your network.

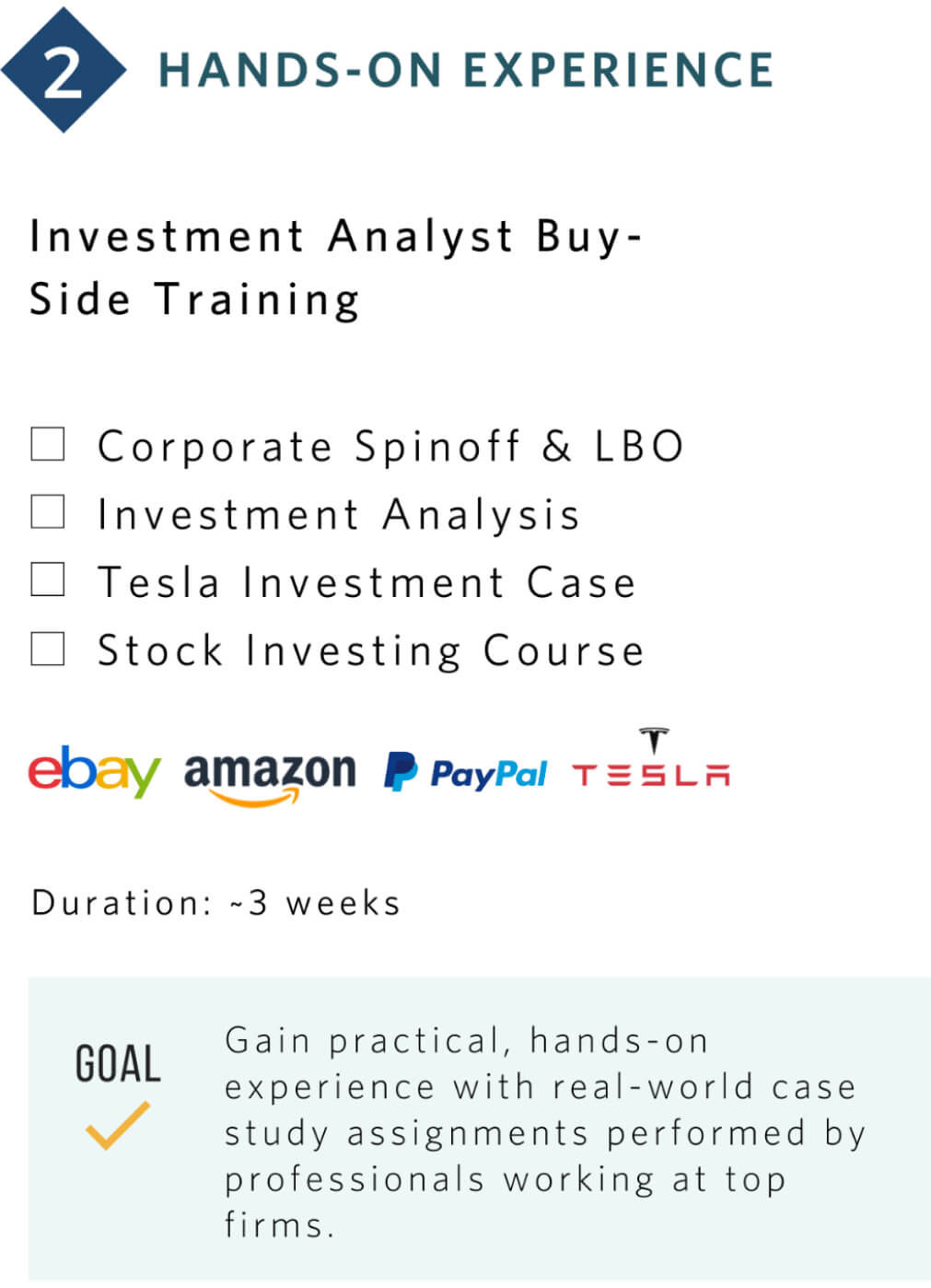

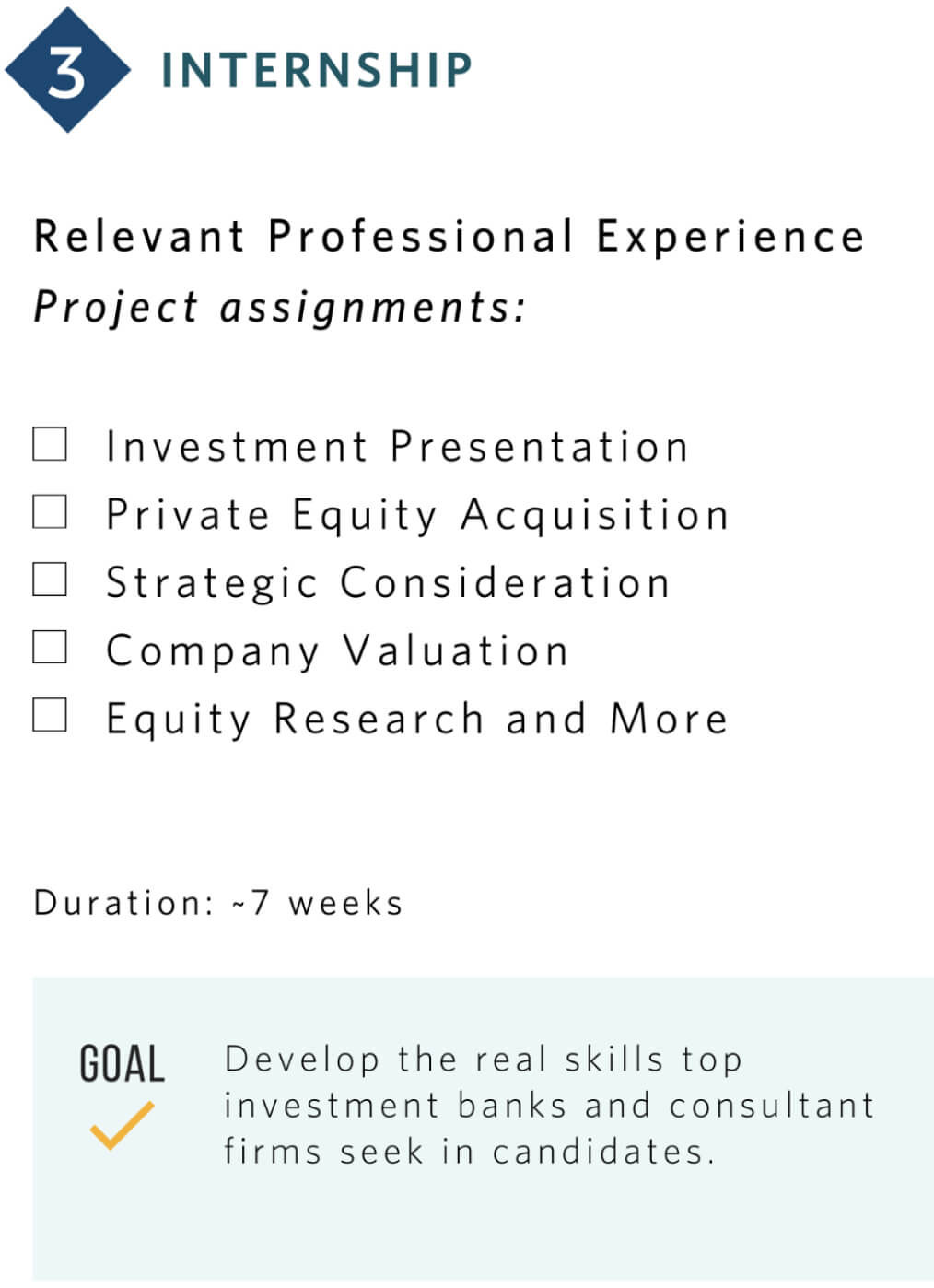

Our training program covers soft and technical skills designed with on-the-job application. You will receive training in building pitch books, financial modeling, corporate valuation, technical analysis, leveraged buyout and mergers & acquisitions modeling. In addition, you will work on case studies designed to emulate situations on the job.

We conduct our training online through our proprietary platform. Students receive access to the training modules and individual 1-on-1 review sessions. Training modules can be accessed at any time and as often as needed to master concepts and techniques discussed.

The training and internship lasts 15 weeks followed by on-going 1-on-1 mentorship and access to our platform, community of students and professional alumni network.

The internship is a rotational experience between investment banking, equity research, trading and asset management. The training and work experience you receive are similar to that of a full-time analyst working at a hedge fund, investment bank or at a bulge bracket firm. You will be working directly with our founder and other Wall Street professionals remotely.

There is a text book and training tuition associated with the program. The cost of the program is affordable and flexible for students who receive acceptance offers.

Yes, we offer flexible payment plan options to make tuition payment more manageable.