The novel coronavirus has swept the entire globe. Virtually everyone is familiar with the virus. Governments will attempt to spend trillions of dollars to combat this invisible enemy. People have quarantined themselves in their homes for days on end. One might ask what is the novel coronavirus, and where did this virus come from? How might it affect the economy going forward? In this paper, we will look at the origins of the virus, how it has had an effect on the world and what it could potentially do to the U.S. economy going forward in the future.

The Origins

The coronavirus is a family of viruses that cause disease in animals. Only recently has the novel coronavirus, COVID-19, made the leap to humans.1 The virus first emerged in Wuhan, a city in China, in December 2019. While the initial location of the virus is still under investigation, some officials hypothesize that it may have been linked with a seafood market in Wuhan. However, it has come to light that the first of many individuals infected by the virus had no ties with the infamous seafood market.2 Some scientists suggest that the virus could have come from a bat and then somehow transferred to another animal, eventually making its way to humans.3 The initial origin of the virus remains a mystery.

The Result

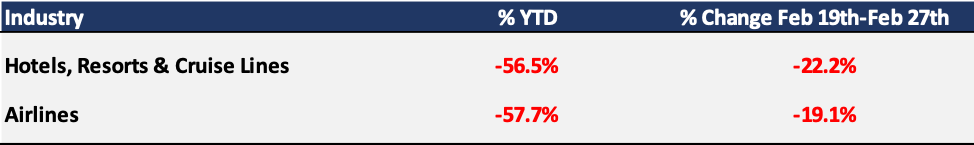

The novel coronavirus has now made its way across the globe, hitting more than 150 countries with more than 1,500,000 cases. In the U.S. alone, there are more than 400,000 cases and 16,000 deaths as of April 8, 2020.4 The effect of the spread of the virus has caused businesses such as casinos, movie theaters, tourist destinations and gyms to cut back or even close their doors. Restaurants have been restricted to take-out orders and gatherings in some areas limited to ten people. Airline companies have severely cut back on traveling, in conjunction with the Trump administration restricting travel to Europe for 30 days in effect since mid-March.5 Sporting events, leagues and other events have been suspended, including the NBA, PGA and music festivals. The virus has also devastated the financial markets, wiping out more than seven trillion dollars since mid-February.6 Below are a couple industries that have been hit the hardest:

The S&P 500 losses have cost Americans, on average, $22,313 a pop.6 That is roughly equivalent to a quarter of the U.S. median household income. Certainly nothing to sneeze at! Congress has recently attempted to pass a stimulus package of around approximately two trillion dollars to combat the damage inflicted from the virus. The package would provide aid to Americans out of work and for distressed industries.8 The Federal Reserve has also pledged to purchase a wide variety of assets, including corporate bonds, for the first time, as well as mortgage-backed securities and treasuries.9

The Affect

The world economy has had no choice but to come to a sudden halt due to the spread of the virus. This could spell trouble for the U.S. economy. Goldman Sachs economists are forecasting a 24% decline in GDP growth for the second quarter of this year.10A decline in GDP, coupled with a recent spike in jobless claims, could adversely affect the labor market. Treasury Secretary Steven Mnuchin suggested that if Congress fails to pass a stimulus bill, the unemployment rate could reach 20%.11

Even with the passage of a stimulus package, the virus could still inflict major damage on the U.S. labor market. Illustrated famously by hedge fund investor Ray Dalio, this adverse effect to the labor market will flow through the economic machine. As laborers are laid off, their income will decrease. As their income decreases, they are unable to spend. If one person’s spending is another person’s income, then incomes will decline further. If workers are laid off and no longer receive an income, they will struggle to meet debt obligations. Those recently laid off will be unable to pay their credit card loans, mortgages, auto loans and so on. The process repeats.

This scenario is quite similar to the 2008 Recession. Incomes began to fall, which led to families struggling to pay their mortgages. What started as a housing crisis then led to the financial crisis. This time, the virus will likely be the catalyst that leads to the next financial crisis, but it will be different. Instead of a housing bubble like the previous recession, it might be the corporate bond market. Here are some highlights per the Organization for Economic Cooperation and Development (OECD)12:

Corporate Bond Market Trends:

- In 2019, the world’s non-financial corporations borrowed an additional USD 2.1 trillion in the form of corporate bonds.

- Global outstanding stock of non-financial corporate bonds at the end of 2019 reached an all-time high of USD 13.5 trillion.

- Compared with previous credit cycles, today’s stock of outstanding corporate bonds has lower overall credit quality, higher payback requirements, longer maturities and inferior covenant protection.

Extended Growth in Corporate Bond Borrowing:

- Since 2008, the annual global issuance of corporate bonds has averaged USD 1.8 trillion – twice the average than between 2000 and 2007.

Long-Lasting Decline in Overall Bond Quality:

- Since 2010, at least 20% of the total amount of all bond issues have been non-investment grade and in 2019 it reached 25%.

- This is the longest period since 1980 that the portion of non-investment issuance has remained so high, which indicates that default rates in a future downturn will likely be higher than in previous credit cycles.

- In addition, in 2019 almost 51% of all investment-grade bond issues were rated BBB – the lowest quality in investment grade.

Lower Credit Quality and Higher Payback Requirements:

- Lower quality bonds that are due for payback or refinancing within the next three years amount to USD 2.5 trillion, equivalent to 41% of their total outstanding amount.

- By the end of 2019 non-financial companies will have to repay or refinance an unprecedented USD 4.4 trillion within three years. This represents a record of 32.4% of the total outstanding amount of corporate bonds.

Longer Maturities and Increased Price Sensitivity:

- The average years to maturity at the issue date have increased significantly during the past two decades for investment grade bonds.

- The combination of longer maturities – associated with higher price sensitivity – and declining credit quality has made bond markets more exposed to changes in interest rates and other monetary policy conditions.

Financial Sector Holds Most of the Corporate Bonds:

- Financial institutions, such as banks, pension funds, insurance corporations and investment funds, have an overwhelming dominance in the domestic ownership of the corporate bond stock.

Exposure to Corporate Bonds Increased Substantially:

- Corporate bond holding by exchange-traded funds who typically use passive, rating-based strategies increased 13-fold from USD 32 billion in 2008 to USD 420 billion in 2018.

Within-Rating Leverage Rations Have Increased:

- Today, the median firm in each investment grade rating has higher leverage rations compared to a decade ago. At the same time, influenced by unprecedented low interest rates since 2008, their ability to cover their current interest obligations has improved.

- If interest rates start to increase or an economic downturn leads to lower earnings, interest coverage and profitability ratios may deteriorate precipitously, limiting their ability to offset the high leverage.

Issuer Quality and Rating Stability:

- For all three major credit rating agencies, the one-year one-notch downgrade probability is lowest for BBB-bonds – the lowest rating notch before crossing the line to non-investment grade.

- The significant increase of BBB-rated bonds and the declining frequency of downgrades relative to upgrades in recent years may suggest that credit rating agencies are mindful of downgrading BBB issuers due to their special status just above the non-investment grade category.

Potential of Sell-Offs and Financial Stability Concerns:

- The outstanding stock of BBB-rated bonds stood at USD 3.8 trillion in 2019.

- The share of BBB-rated issuers downgraded to non-investment grade exceeded its historical average during the financial crisis and in 2015 and 2016.

- Due to rating-based investment limitations, many investors may be obliged to sell in the case of downgrades of BBB-rated bonds to non-investment grade.

- In the case of financial shock similar to 2008, USD 500 billion worth of corporate bonds could migrate to the non-investment grade market, raising financial stability concerns.

In addition to the labor market and corporate bond market, a stimulus package could also adversely affect the economy. The Federal Reserve announced they would purchase a limitless amount of numerous assets. The goal in printing money to buy bonds is to:

- Reduce interest rates on bonds to encourage lending and spending.

- Increase money supply and encourage banks to lend.

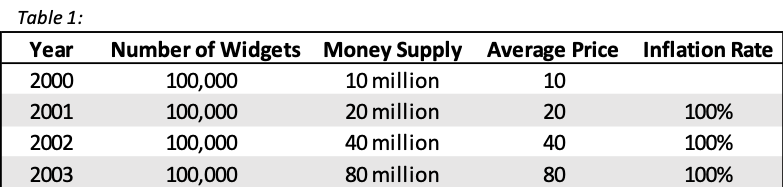

Now, since the Fed will be purchasing bonds, it will in effect drive up the price. But the question is, for how long? There is a dark side with printing lots of money: inflation. By purchasing bonds en masse, the supply of money will expand, which will inevitably lead to inflation. Here is a demonstration in Table 1:

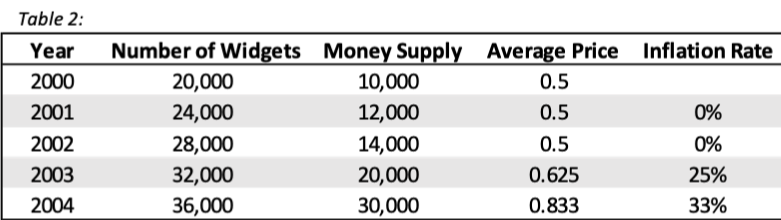

If we do not also have an equivalent, or near equivalent, increase in the amount of goods produced, the price of the existing supply of goods will increase. Below is Table 2 to demonstrate:

If inflation rises, the value of bonds will decline. If the inflation rate rises higher than nominal rates on bonds, the value falls. Investors will want to be compensated more in order to achieve a gain on their investment. Say, for instance, the inflation rate is 8% and the nominal rate on bonds is 5%. If you purchase this bond, all else equal, you will lose 3%. Note, if the price of bonds rises, yields fall. Inversely, if the price of bonds fall, yields rise. This is where the value of bonds would decline to a more suitable level, say 10%, to compensate investors.

Closing Remarks

Forecasting accurately into the future is a tall order. The above-mentioned areas where the economy could be affected by the novel coronavirus are speculative. A counterpoint to the argument for inflation, for instance, is we could get a liquidity trap where consumers save the newly printed money and do not spend it. Also, banks could hold on to the newly printed money, thereby restricting loan growth. Another counter argument to the corporate bond market issue is that with the Federal Reserve announcing they will monetize the debt; this could perhaps help stabilize the corporate bond market and reduce defaults. Again, another side to the coin. However, any way you look at it, with the economy coming to a precipitous stop, it’s extremely possible we will be heading for a recession, if we are not in one already.

Conclusion

The coronavirus, a family of viruses that causes disease in animals, made its first leap to humans in Wuhan, China this past December. Since then, it has gone on to devastate the world, claiming the lives of many and affecting nearly the entire globe. It has forced millions to quarantine themselves in their homes and it has pushed the labor force to work remotely. It has erased more than six trillion dollars in the U.S. financial markets alone, in addition, it has forced governments to draft stimulus packages that amount to trillions. The virus may be the reason many laborers are laid off from their jobs due to business profits declining. The virus may alone be the needle that pops some of the potential bubbles that have developed in the U.S. economy since the previous recession, one of which may be the corporate bond market in its current fragile state. The novel coronavirus may be the catalyst that leads to an increase in inflation and an increase in the expectation of future inflation.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

References

- The Telegraph: https://www.telegraph.co.uk/news/2020/03/23/what-coronavirus-covid-19-how-outbreak-start-pandemic-who/

- Johns Hopkins: https://www.hopkinsmedicine.org/health/conditions-and-diseases/coronavirus

- LiveScience: https://www.livescience.com/first-case-coronavirus-found.html

- Centers for Disease Control and Prevention: https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/world-map.html

- The Wall Street Journal: https://www.wsj.com/articles/coronavirus-outbreak-prompts-trump-to-question-europe-travel-restrictions-11583971156

- Investor’s Business Daily: https://www.investors.com/etfs-and-funds/sectors/sp500-how-much-every-american-lost-in-the-coronavirus-stock-market-drop/

- Market Watch: https://www.marketwatch.com/investing/index/sp500.25301020?countrycode=xx; Fidelity: https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/industries.jhtml?tab=learn&industry=203020

- Reuters: https://www.reuters.com/article/us-usa-stocks/dow-soars-over-11-in-strongest-one-day-performance-since-1933-idUSKBN21B187?feedType=RSS&feedName=businessNews&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+reuters%2FbusinessNews+%28Business+News%29

- CNBC: https://www.cnbc.com/2020/03/23/fed-surprises-market-with-program-to-support-corporate-bonds-amid-pandemic.html

- CNBC: https://www.cnbc.com/2020/03/20/goldman-sees-an-unprecedented-stop-of-economic-activity-with-2nd-quarter-gdp-contracting-by-24percent.html

- Business Insider: https://www.businessinsider.com/mnuchin-us-unemployment-rate-could-rise-without-action-coronavirus-cnn-2020-3

- OECD: https://www.oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm

- Economics Help: https://www.economicshelp.org/blog/634/economics/the-problem-with-printing-money/