2021 – 2022 Tech Crash

How we use the Romero Stock Model to analyze stock markert cycles.

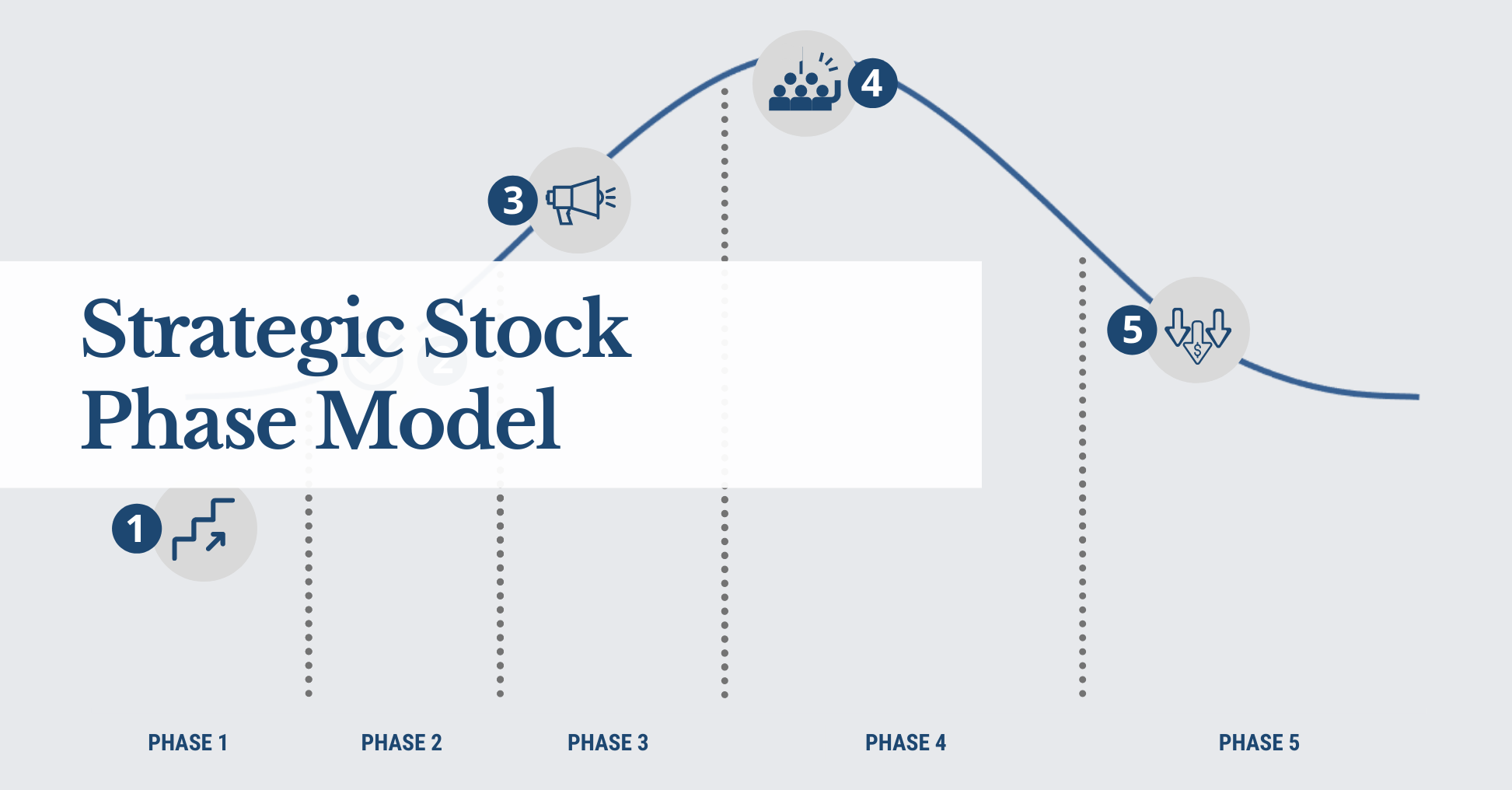

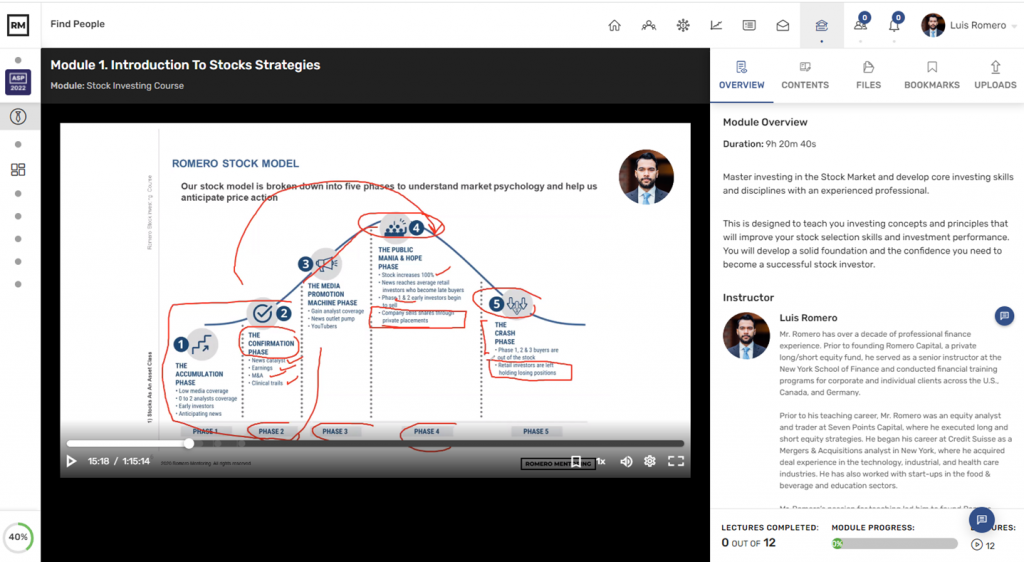

After a decade of research, back-testing, and investing, we designed the Romero Stock Market Model, divided into five phases to understand the stock market’s psychology in stages that explain each cycle. The model helps reduce risk by determining if we are buying at the top or beginning of a significant move. Students enrolled in our Stock Investing Course as part of the Analyst Investing Essentials program are encouraged to use our Stock Market model in conjunction with their financial modeling skill set.

Understanding market psychology: An explanation for each phase

1. The Accumulation Phase: In this phase, a company stock price has low media coverage, with 0-2 analysts covering it. Early investors begin to perform due diligence or homework on the stock to obtain insights into the company’s financial picture and story. Suppose early investors believe the company has strong fundamentals yet to be recognized by the market. In that case, they will buy early positions and wait for the company’s quarterly earnings report to receive confirmation.

2. The Confirmation Phase: In this phase, the company announces better-than-expected financial results or material information that fundamentally affects business operations. The market is surprised, and intelligent investors begin accumulating significant positions in the stock, looking for a 6-12-18 month holding period. The average retail investor is unfamiliar with the quarterly earnings report and misses the opportunities during this period. For this reason, the professionals have an information edge and buy early, anticipating a significant move in the coming months or years.

3. The Media Promotion Machine Phase: In this phase, the media begins to report a bullish story on the company’s earnings report. The positive news reaches millions of market participants (the retail crowd). Many are buying on the final leg of the stock price increase.

4. The Public Mania & Hope Phase: In this phase, everyone is talking about it. The stock is up 100% in twelve months. Wall Street, Twitter, and other trading channels begin to create memes to promote the stock to uneducated first-time investors or fewer experienced ones. The company begin to announce stock splits and share issuances, taking advantage of the inflated and overvalued share price.

5. The Crash Phase: Investors in phase 1, 2, and 3 are out of the stock. Retail investors and rocky fund managers are left holding losing positions or a pile of crap!

The model is not perfect, but it gives a blueprint of what to expect. We can improve our understanding with fundamental analysis, including performing comparable trading multiple and discounted cash flow analysis. Both valuation methodologies are taught to our students in our Analyst prep program.

Examples on the best performing stocks during 2020 – 2021

Many of the stock names illustrated below are down 80% from their peak stock price. Study!

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped over 400 students start their careers on Wall Street through our Analyst Prep and Associate Investment Banking Training Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.