Students Need to Dive into the Technology Sector

If you looked at the stock market in 2019, you would know the technology sector grew immensely. In fact, the two biggest contributors to the S&P 500 this past year were Apple, whose stock increased by 85% in 2019, and Microsoft, whose stock increased by 54% in 2019.1 Technology as a sector also saw incredible gains globally, as the sector jumped to $738.57 billion in 2019, up from $637.25 billion the previous year, nearly a 16% growth rate!2 Clearly, the technological sector has become increasingly important to follow and properly understand. Understanding this sector can lead to personal gains in investments, better understanding of financial markets and operations, and impressing interviewers by knowing one of the top five global sectors.

If you really want to stand out in your knowledge of the tech industry, it is not enough to simply know the ‘top dogs’ like Apple and Microsoft. You must also know how the industry operates and what the top technology deals are year to year.

And that is precisely what this article seeks to do: to teach you about the top five tech deals of the 2019 fiscal year.

The Largest Investment Banking Deal of 2019 was Tech-related

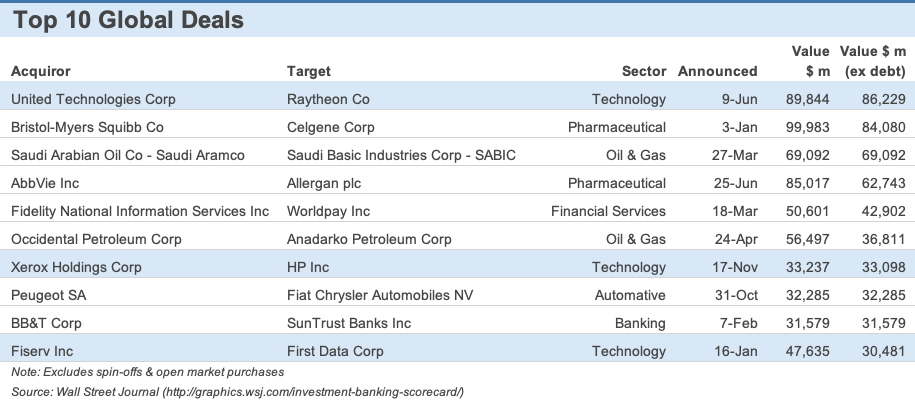

The largest global deal of 2019 was when United Technologies Corp. merged with Raytheon Co., as announced on June 9th.2 The value of this merger was $89.844 billion and created a company worth a grand total of $121 billion.3 United Technologies focuses on the electronics that go into aviation and Raytheon supplies the U.S. with military-grade aviation materials. When they merged, they overlapped their market slightly, while also allowing for profitability and efficiency to increase.

This merger, while clearly significant because it was the top global deal of 2019, also has some interesting aspects to it. First off, there was no premium for either company throughout this merger. Usually in a merger or acquisition, there is some level of a premium to allow for a company to fully overtake the other and own 100% of it. Another interesting fact coming from the deal is that United Technologies will control most of the joint ownership, about 57% total of the new business. Lastly, this deal will complete early 2020 and in three years should see the new company returning $19 billion and trying to pay down their combined debt of $26 billion.3

One of the Most Hostile Investment Banking Deals of 2019 was Tech-related

A technology deal in investment banking was announced on November 17th and quickly spiraled into a hostile takeover that is continuing in 2020. Xerox announced that it would be starting a takeover of HP Inc., which is a significantly larger company specializing in information technologies. For reference, Xerox currently has a market cap of $7.9 billion while HP has a market cap of $31.4 billion.4 HP told Xerox in November that it would need to secure $24 billion to begin this bid in the first place. Xerox, as of January 6th, 2020, has indeed secured the capital required to acquire HP.5

Since Xerox now has the required capital, they are moving forward with this transaction. Raising enough capital was a major obstacle, and since that is out of the way now Xerox can focus its negotiations with HP. While HP’s board of directors previously rejected this transaction, Xerox has managed to buy a significant stake of the company, allowing them the ability to appoint 11 new members on the board of directors, as of January 28th.6 In less than five months, HP’s board must finalize this transaction and because of Xerox’s new stake in the company, we very well may see this smaller company complete a hostile takeover. This transaction, which began in 2019, will finish in 2020 and is something to keep your eye on. However, both Xerox and HP have been in decline, so a transaction where a significant portion of debt might be taken on could have a negative outlook for the companies.

The 10th Largest Investment Banking Deal of 2019 was Tech-related

The acquisition of First Data by financial technology company Fiserv was the 10th largest investment banking deal of 2019, having been announced on January 16th and having a final value of $22 billion.7 This deal initially predicted the EPS of the combined company to increase by 20%, so clearly there was anticipation for this deal. On top of this predicted EPS increase, there was a 30% premium made off First Data’s mid-January stock price. The result initially of the acquisition was that Fiserv would own 57.5% of the total conjoined company. Fast forward to 2020, and analysts are gearing up to see Fiserv’s newest financial reports, which will be released on February 4th. The key thing to look for is whether Fiserv hit the mark for expected revenue, valued at $3.96 billion, and whether it hit the target of an EPS value of $1.14.8

Why IB Tech Deals Matter to YOU

The technology sector dominated the top investment banking deals, taking the 1st, 7th, and 10th places for top global deals. This means that it is increasingly necessary to understand the technology sector and the role it plays in financial markets. Being equipped with market research, industry knowledge, and your own personal company due diligence can propel yourself to the top of your current standing. Whether you are vying for an internship, working as an intern, or simply trying to break into the world of investment banking, having a complete understanding of the technology sector can make you a standout individual. Knowing the in’s and outs of significant transactions such as the ones examined in this article can mean the difference between a mediocre interview and an offer for an internship position.

If you take the time to perform your own due diligence on these companies, there are some next steps you can take. Once you build this industry knowledge, it is time to bolster that with fundamental and technical skills that you can apply on the job. There is no better option to gain these professional and technical skills than through the programs offered by Romero Mentoring.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

References:

- CNBC: https://www.cnbc.com/2019/12/30/apple-microsoft-contributed-most-to-the-markets-2019-gains.html?&qsearchterm=yun%20li

- Wall Street Journal: http://graphics.wsj.com/investment-banking-scorecard/

- Thompson Reuters Corporation: https://www.reuters.com/article/us-utc-m-a-raytheon/united-technologies-raytheon-to-create-120-billion-aerospace-and-defense-giant-idUSKCN1TA0S6

- Yahoo Finance Report of HP Inc.: https://finance.yahoo.com/quote/HPQ?p=HPQ&.tsrc=fin-srch

- Forbes: https://www.forbes.com/sites/sergeiklebnikov/2020/01/06/xerox-secures-24-billion-for-hostile-takeover-bid-of-hp/#4254d1f7b4d6

- The Street: https://www.thestreet.com/investing/stocks/xerox-to-push-on-with-hp-takeover-bid-ceo-says

- CNBC: https://www.cnbc.com/2019/01/16/fiserv-to-buy-first-data-in-a-22-billion-all-stock-deal.html

- Yahoo Finance Report of Fiserv: https://finance.yahoo.com/news/fiserv-fisv-reports-next-week-173105995.html