I know. Reading about Hyman Minsky might seem like the last thing you’d want to do during a global pandemic, but hear me out. This renowned American economist helps offer explanations for many of the issues that we see today, both in the global asset markets and in our daily lives. Even though we should not view models as reality, we can gain interesting perspectives by looking at the world through different lenses.

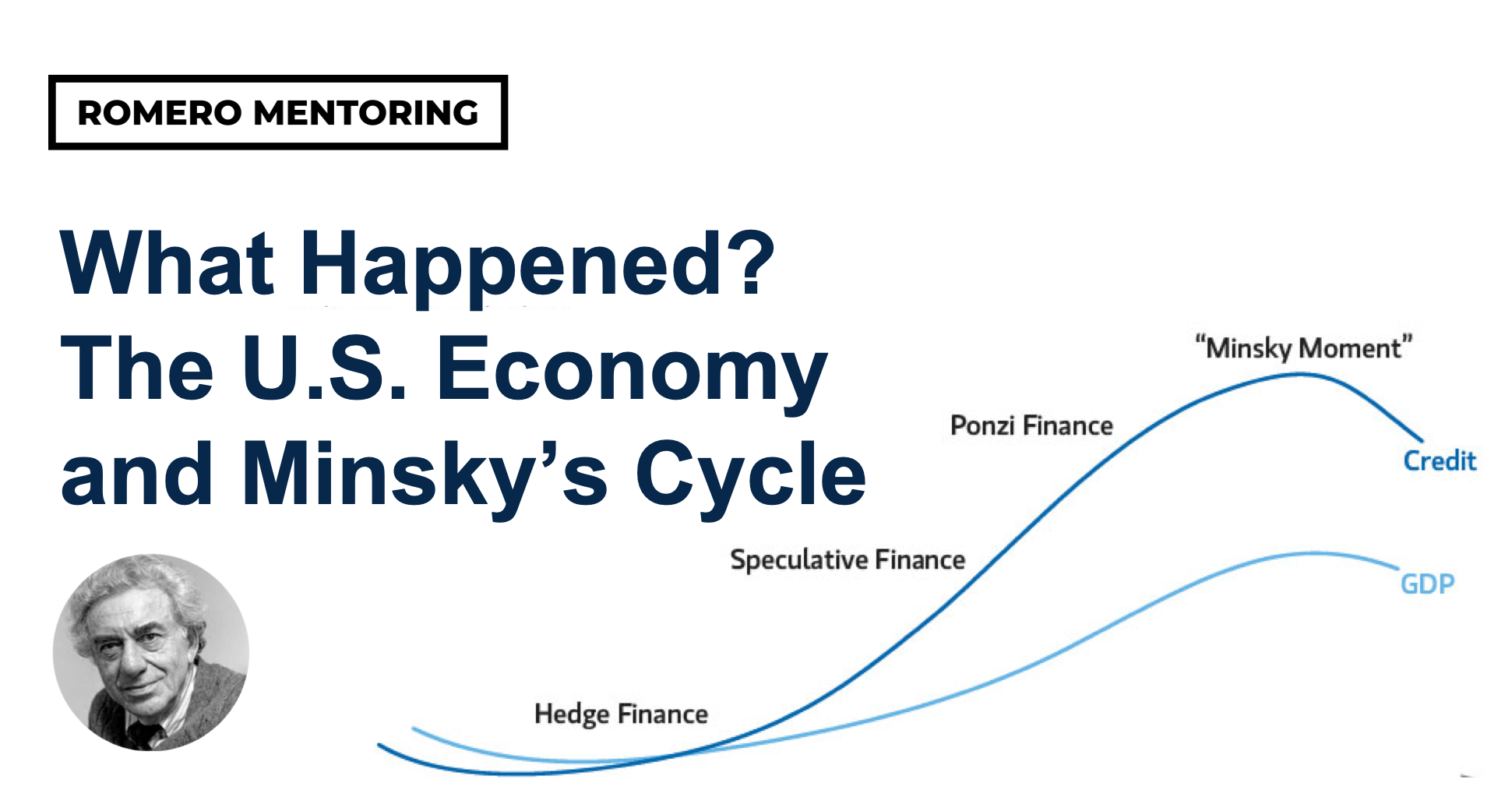

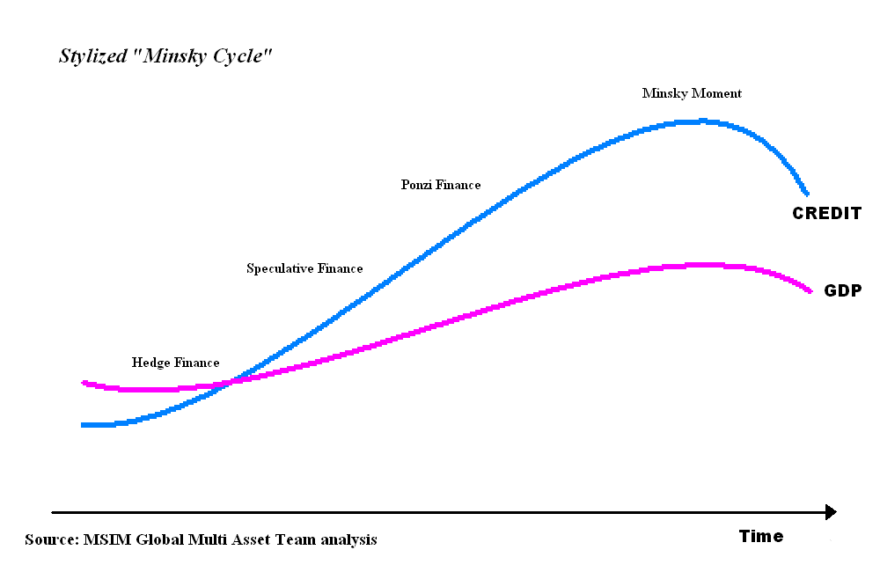

What is Minsky’s Cycle?

It goes as follows. Long periods of stability and times of prosperity lower the perception of risk. As a result, people engage in riskier investments and higher amounts of leverage. In the end, this overconfidence leads people to ignore details and make investment decisions that they normally wouldn’t. Ultimately there is a collapse of asset values, and we can say that many times stability is the breeding ground for future instability.

Let’s classify the effects seen today under what is called Minsky’s Cycle. As Mike Wilson, Chief U.S. Equity Strategist and Chief Investment Officer for Morgan Stanley, explains in the Thoughts on the Market[1]podcast on March 30, 2020:

“In the past month, we’ve experienced a full bear market, down 20%, and a full bull market, up 20%. Of course, this volatility follows a period of calmness, during which we observed some of the lowest volatility readings in history. As noted by famed economist Hyman Minsky, the onset of a market collapse can be brought on by the speculative activity that defines an unsustained bullish period.”

After recovering from the 2008 financial crisis, the United States has experienced strong economic growth with record low unemployment numbers. However, when looking at the Dow Jones Industrial Average it’s evident that the recent COVID-19 outbreak has ended that 11-year bull run.

Last decade’s bull ride has lulled people who have been making large gains by their own ability into a false sense of security. The many successes people have experienced during this time have caused them to disregard certain details. The long duration of this economic prosperity did make many cautious of a potential downturn; however, whenever there were signs of an economic downturn, the U.S. government stimulated the economy by cutting interest rates – thereby calming worried investors. But it was only a matter of time before an unexpected event rocked the boat.

COVID-19’s Impact

The pandemic has put a halt to most global economic activity. Most services and products that require travel or a physical store presence have been shut down. This has cut into the revenue of all kinds of companies, from small brick-and-mortar businesses to Fortune 500 corporations.

In addition, companies that entered this difficult situation highly leveraged will not have the same level of cash flow as they did before to meet interest payments. As a result, companies that do not receive a source of funding may go under.

Fortunately, the U.S. government has passed a stimulus bill that seeks to keep businesses and consumers’ heads above water. For businesses, this bill includes loans of $29 billion for passenger and cargo air carriers, $17 billion for national security businesses, and the remaining $454 billion will go toward states, other businesses, and municipalities, according to CNN.[2]

However, those that cannot afford a slowdown in consumer spending will have to find ways to cut costs. Macy’s, Kohl’s, and Gap have already furloughed a combined total of 290,000 employees, according to ABC News.[3]As a result, rough financial conditions have the potential to bring down highly leveraged firms with underlying financial troubles. This is especially true for those companies that are unable to cut costs sufficiently in relation to a decrease in consumer spending.

Staggering Debt Levels

Due to increasing levels of debt, lacking a source of income can have devastating effects. This is as true for companies as it is for households.

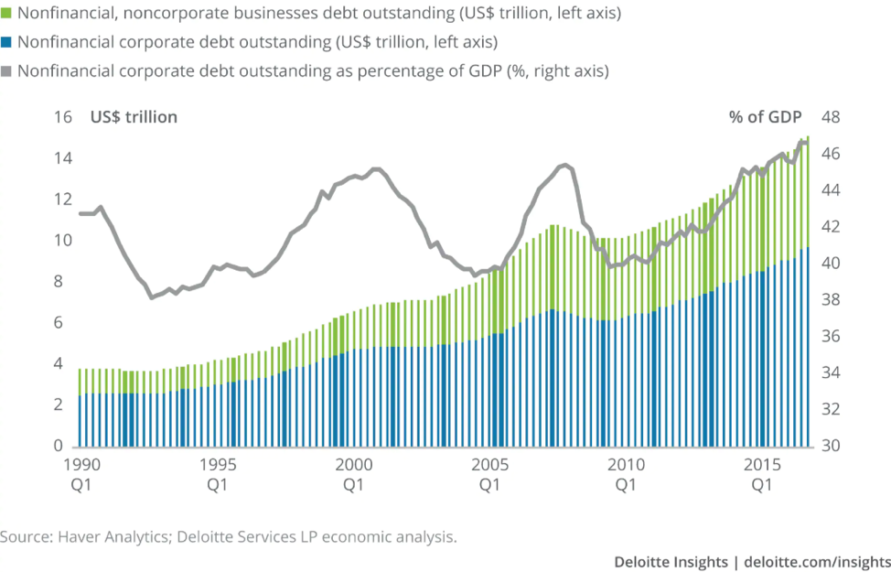

For firms, not being able to generate cash flow to meet interest payments on debt can have a range of consequences, from hurting the companies’ capability to borrow in the future to their not being able to cover the debt anymore and proceeding into bankruptcy procedures. Given that the level of corporate debt has been rising over time, the worst-case scenario of defaulting on the debts is even more likely. However, the U.S. government is providing aid to companies in distress, especially to cover overhead costs such as labor, rent, and utilities.

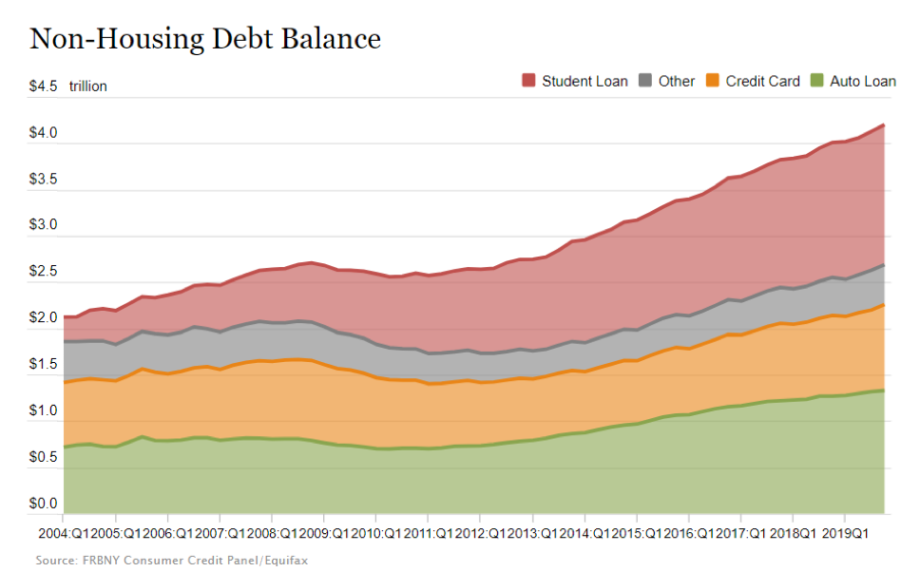

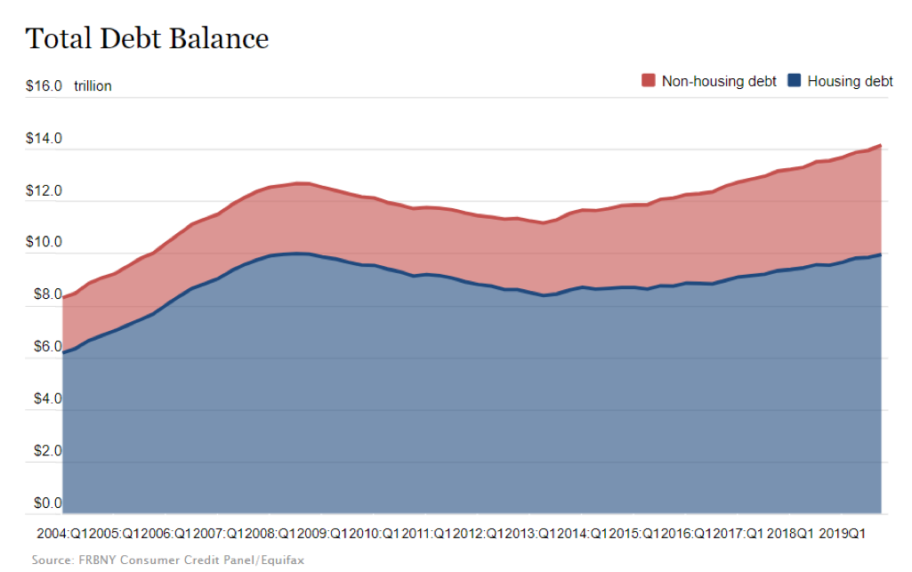

For individuals, household debt has been increasing and surpassed $14 trillion in the last quarter of 2019, according to the Federal Reserve Bank of New York.[5] The majority of the debt is housing-related (mortgages), in addition to student loans, credit card loans, and auto loans.

Similarly, the government stimulus bill will provide aid through student loans, unemployment benefits, and direct payments that individuals can use to meet payments.

Softening the Blow

By being cautious and allocating sufficient resources to making themselves more recession-proof during times of economic prosperity, firms can prepare to soften the blow of unexpected events like those we are experiencing today. This ties back to Minsky’s Cycle: given that stability breeds instability, by being mindful of our decisions during good times we can alleviate our situation during bad times.

So, what does all this mean? We must accept that there will always be systemic risks that are beyond our control. However, by preparing ourselves during favorable times, we are better able to face adverse times. I am not downplaying the adversity that everyone is facing, but I seek to encourage all of us to make the most out of the already challenging situation.

Minsky’s Cycle Is Not Reality, So Why Care?

Models seek to approximate and predict what we are experiencing in the real world. Despite that they come short of describing reality, we can learn interesting things about our world, and it allows us to think about the same issue in multiple ways.

The information and things we learn should be carefully examined to determine whether they make sense. From a careful vetting process, we can consider key takeaways. Trying to look at topics from different points of view will widen our world, and, as a result, our experiences.

Final Remarks

By staying level headed amid these circumstances, we can make our best decisions. I encourage everyone to spend this time working on themselves and thinking about their current business so that we are prepared when this situation subsides. Because we will get through this and when we do there will be a wide range of new opportunities.

Take care of each other and let us all try to support each other as much possible. I hope that all of you and your loved ones stay safe and in good health.

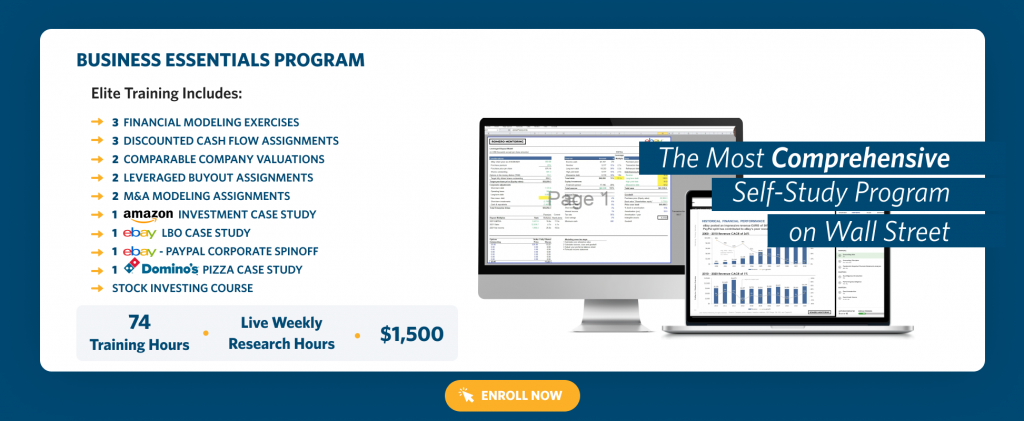

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.