Contributor: Jill Pagsiat

Be In The Know: Investing and the Rising Trend of ESG

Natural resources deterioration, unconventional social order, poor corporate governance have raised awareness of the sustainability and financial system relationship. With these as the current issue, how do companies in various industries assess social responsibility? If there is, does the approach meet new generation of investors?

What is ESG?

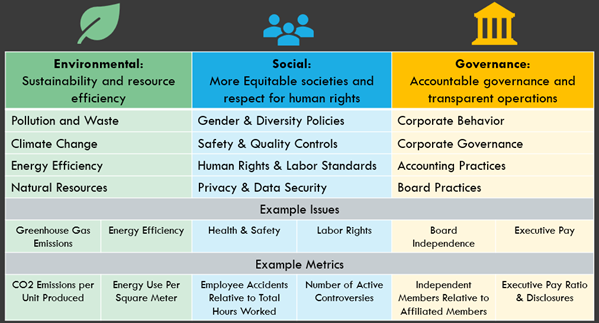

Environmental, Social, and Governance (ESG) is a framework for assessing a company’s long-term viability and ethical impact. It allows stakeholders to understand how a company manages risks and opportunities in terms of the environment, social issues, and governance.

ESG is frequently used in the context of investing, as most socially responsible investors incorporate these non-financial factors into their analysis process. Customers, suppliers, and employees are also considered stakeholders, in addition to the investment community. They are all becoming more interested in how long an organization’s operations can be sustained.

For instance, consumer behavior has changed over time to become more sustainable. Consumers would like to recycle, reduce waste, and contribute to making more environmentally responsible choices. This behavior has an effect on financial and investment decisions as well.

As a direct consequence, investors prefer to invest their funds into firms that adhere to these guidelines. ESG investing, also referred to as sustainable investing, has grown at an exponential rate as investors seek to provide capital to companies whose values on environmental sustainability and social responsibility are similar to their own. Overall, they seek to ensure that the companies they fund are responsible environmental stewards, good corporate citizens, and led by accountable managers.

Investors can use a variety of analytical approaches and data sources to address ESG concerns. Understanding the relative strengths and weaknesses of the three central factors can help to develop a more complete picture of ESG opportunities and threats.

Environmental factor considers how a company safeguards the natural resources, including corporate policies addressing the environment, climate change and carbon emissions, energy consumption and use, for example.

Environmental Factors Include the Following:

- Pollution of the air and water

- Depletion of natural resources

- Biodiversity

- Deforestation

- Energy conservation

- Pollution and waste management

- Scarcity of water

- Animal care and treatment

Social factor examine how it manages relationships with employees, suppliers, and customers. A company’s social score rises when it is well integrated into its local community.

Social Criteria Examples Include:

- Diversity and employee relations

- Child labor and slavery are examples of working conditions.

- Data security and privacy

- Labor regulations

- Community relations; clearly seeks to fund projects or institutions that will serve poor and underserved communities across the world.Customer satisfaction

- Health and safety

- Conflict

Governance factor deals with corporation polices itself, focusing on company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Examples of Governance Include:

- Company leadership

- Executive remuneration

- Board composition, including diversity and structure

- Corruption and bribery

- Donations and political lobbying

- Executive compensation and policies

- Tax strategy, including audit committee structure, internal controls and regulatory policies

- Whistleblower schemes

History of ESG

Previous versions of sustainability-focused strategy and regulatory frameworks identified the risks and opportunities created by changing conditions.

ESG by Another Name in The 1700s

ESG criteria originated centuries before the term “ESG.” In the 1700s, Quakers and Methodists in the United States and Europe excludes slave labor from their investment practices because religion, moral norms, and social traditions were the main motivations.

1970s: EHS (Environmental, Health, and Safety)

Since 1970, organizations in the United States have considered managing compliance with the vast array of environmental laws that protect environmental resources for all citizens. In accordance with this, the Occupational Safety and Health Act of 1970 was enacted into US law to manage workplace standards in order to protect employees from hazards that jeopardize their safety and health.

1990s: Corporate Sustainability (1990)

In the 1990s, EHS evolved into a growing divestment movement. This arose as some management teams desired to focus on reducing their company’s environmental impacts beyond what was legally required of them.

2000s: CSR (Corporate Social Responsibility)

By the early 2000s, ideas on how companies should respond to social issues had been integrated into the Corporate Sustainability movement, which became known as Corporate Social Responsibility. When the United Nations Global Compact (UNGC) was launched in July 2000, ten principles covering human rights, labor, the environment, and anti-corruption were established.

2010s: ESG (Environment, Social, and Governance)

ESG finally entered mainstream finance practices in the late 2010s and early 2020s, and it began to emerge as a much more proactive (rather than reactive) movement that looks at stakeholder well-being through a more holistic lens.

Industries That Have Adapted ESG

ESG adaptation are now being seen as opportunity generator for most companies in various industries. These industries include:

- Hospitality Industry

- Retail and Consumer Industry

- Banking Financial Services and Payments Industry

- Healthcare and Pharmaceutical Industry

- Technology, Consulting and Outsourcing Industry

- Food Industry

- HR Services Industry

- Media and Entertainment Industry

- Aviation, Aerospace and Defense

- Automotive Industry

- Public Utility Holdings

- Energy, Telecom Industry

Some companies in the aforementioned industries are now incorporating an ESG approach. These companies are the well-known multinational fast-food corporation McDonald’s and Goldman Sachs, the world’s leading investment banking, securities, and investment management firm.

McDonald’s ESG Policy:

Considerations for the environment:

McDonald’s is focusing on reducing emissions in restaurant operations, engaging suppliers to reduce emissions in supply chains, and transitioning to more efficient buildings, to meet climate action goals, supporting and advancing suppliers’ climate strategies, using of lower-emission sources of energy, accelerating sustainable and regenerative farming, transitioning to more sustainable packaging and toy materials and supporting deforestation-free supply Beef, soy for chicken feed, palm oil, coffee, and fiber for guest packaging are examples of primary commodity chains.

Considerations for society:

They have been developing and localizing policies, as well as training for crew and managers, in all markets around the world to mitigate and help prevent harassment, discrimination, retaliation, and violence in all restaurants. Their Connections and social Charities continue to help families achieve medical care for their children.

Considerations for governance:

Through the assistance of their key governance bodies — their Board of Directors and Cross-Functional Leadership team — their cross-functional teams manage ESG issues and seek to deliver long-term value for customers, stakeholders, and communities.

ESG Strategy at Goldman Sachs:

Considerations for the environment:

They are dedicated to seizing market opportunities to aid in the fight against climate change. Their initiatives in each of their business segments are outlined in the Environmental Policy Framework. Key highlights include climate mitigation, adaptation, risk management, and a climate approach in their operations.

Considerations for society:

Their firm has been defined by a culture of collaboration and client service for over 150 years. Today, nearly 40,000 Goldman Sachs colleagues work together to serve their clients and communities around the world, building on a rich history of exceptional people’s innovative ideas.

Considerations for governance:

The Board of Directors and management at Goldman Sachs have long acknowledged the importance of corporate governance practices that contribute to an environment of proper monitoring and strong accountability. One of their key Business Principles states, “Our assets are our people, capital, and reputation, and if any of these are ever diminished, the last is the most difficult to restore.”

In-depth knowledge to wise investing is now on the trend. Top investment banks are now adding ESG masters to their recruitment bucket list. Earning the right technical skills and soft skills offers you both practical application and technical knowledge in the vast and growing field of ESG investing.

Romero Mentoring has honed globally competitive students that exhibits mastery of ESG investing in practice. Are you looking to be one of them? There are more than enough courses to get you started. Find out more about Romero Mentoring’s programs and get started today.