Corporate Debt

Corporate debt is a general term that is used in the corporate finance industry. Also known as bank debt, it refers to a substantial source of capital, especially in leveraged buyout (LBO) transactions. In other words, corporate debt is a method of financing a transaction in which a company receives a loan that is usually issued within the private market community; thus, it is not controlled by SEC regulations or any disclosure requirements.

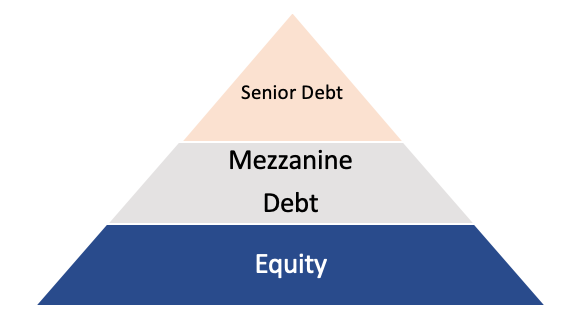

There are a variety of ways financial analysts working in the private equity industry can finance an acquisition. Debt is one of the most common and frequently used forms of financing, and it may cover up to 80% of the cost of the transaction. There are five main types of debt, which include senior debt, also known as senior notes, bonds, high-yield bonds, mezzanine debt, and revolver debt. This article will describe each type of debt, as well as explain the difference between secured and unsecured debt.

Senior Debt

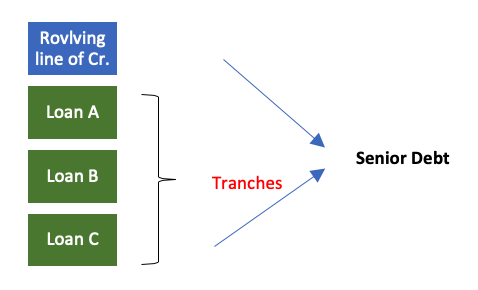

Senior debt is the most prioritized debt among the others, meaning it must be paid off first if a company goes into bankruptcy. Lenders usually issue senior debt based on a company’s ability to generate cash flow. Moreover, based off the company’s cash flow statement, lenders may decide the interest rate that the borrower pays while covering the debt. Therefore, banks issuing the debt may lower their risk of the borrower not paying the entire debt by increasing the interest on that debt. Senior debt is made up of a revolving line of credit and several tranches.

This type of debt may represent 50% of the funding of an acquisition. (CFI) Another way to look at this debt is that it is 2x interest coverage. In other words, whatever the interest expense of this debt would be, the company needs enough cash flow to cover that two times over.

Senior debt is often secured by collateral on which the lender has put in place a first lien. Usually this covers all the assets of a corporation and is often used for revolving credit lines. It is the debt that has priority for repayment in a liquidation. It is a class of corporate debt that has priority with respect to interest and principal over other classes of debt and over all classes of equity by the same issuer.

Content Preview

Bonds

A bond is another form of debt financing. Many investors prefer bonds as a type of financing because it is conservative and reliable. Bonds are usually issued by corporations or a government when they want to raise capital. A company or a government plays the role of a borrower, while an investor acts as the lender.

When an investor decides to buy a bond, he or she basically lends money to the government or company that issued the bond. In return, the entity that has issued the bond needs to agree to pay the investor this money with a coupon value above the face value until the end of the bond’s maturity.

“Think of it this way. When you buy a house, a bank creates a contract—a mortgage in this case—wherein the bank lends you money and you agree to pay the bank back, with interest, at some point in the future. Well, with a bond, you are like the bank, the government or company is like the home buyer and the bond is like the mortgage contract.”[1]

Even though bonds issued by corporations provide no ownership rights, they still give two major benefits by being a part of your portfolio structure. The first potential benefit of owning a bond is having a stream of income as you always receive the interest paid above the face value of the bond. The second benefit is that bonds usually offset some of the volatility that an investor might encounter from owning stocks.

- Face value is the amount the bond will be worth at maturity and the amount the bond issuer uses when calculating interest payments.

- Coupon rate is the interest rate the bond issuer will pay on the face value of the bond.

- Coupon dates are the dates on which the bond issuer will make interest payments.

- Maturity date is the date on which the bond will mature, and the bond issuer will pay the bond holder the face value of the bond.

- Issue price is the price at which the bond issuer originally sells the bonds.

High-Yield Debt (Bonds)

High-yield debt is another version of a bond but with a higher interest rate than investment-grade bonds. The reason is that high-yield bonds are more likely to default. Issuers of these bonds lower their risk by increasing the coupon rates of the bonds on the investors. Issuers of high-yield bonds tend to be start-up companies or capital-intensive companies with higher debt ratios.

High-yield bonds are also known as junk bonds. Even though these bonds are pretty much the same as corporate bonds, there is one major difference. Both types of bonds represent a debt issued by a firm that promises to pay the interest and return the principal; however, junk bond issuers are less creditworthy that the issuers of the regular corporate bond.

Despite the fact that high-yield bonds are also known as junk bonds, they still have a higher return than investment-grade bonds over long holding periods. Moreover, the gain on high-yield bonds can be higher than on investment-grade bonds as there can be more defaults. Investors in high-yield bonds can receive up to 300 basis points in additional yield compared to investment-grade bonds.[2]

“A bond is considered speculative and will, therefore, have a higher yield if it has a rating below “BBB-” from S&P or below “Baa3” from Moody’s. Bonds with ratings at or above these levels are considered investment grade. Credit ratings can be as low as “D” (currently in default), and most bonds with “C” ratings or lower carry a high risk of default.”[2]

Mezzanine Debt/Financing

Mezzanine debt can also be used to finance an acquisition. This type of financing is also known as a subordinated debt, and it incorporates both equity options, such as warrants, and debt. This source of financing is a kind of debt obligation and can be converted into equity in the case of the borrower’s default on the obligations. The difference between these two debts is that the lender of the mezzanine debt has some action rights in the business he has issued the debt to, whereas subordinated debt lenders only require a borrowing company to pay interest and the principal. The equity invested in the mezzanine loan can be any stock warrants or bonuses owned by company.

The use of mezzanine debt provides benefits to both lenders and the borrowing company. The company taking out the debt gets to borrow at a lower rate than it would pay on straight subordinated debt. A mezzanine type loan may be the only way that a company can get a subordinated loan. Meanwhile, the lender gets the benefit of participating in the better results forecast by the additional borrowing. If the borrower is successful in putting the newly borrowed mezzanine financing to work, the return to the lender will be much higher than just providing a subordinated loan.[3] Even though mezzanine debt is the highest-risk form of debt, it also offers one of the highest returns. It can return up to 20% per year.

Using mezzanine financing structures appear to be the most common in leveraged buyouts and M&A. For example, a private equity firm may seek to purchase a company for $100 million with debt, but the lender only wants to put up 80% of the value, offering a loan of $80 million. The private equity firm does not want to put up $20 million of its own capital and instead looks for a mezzanine investor to finance $15 million. Then the firm must only invest $5 million of its own money to meet the $100 million price tag. Since the investor used mezzanine debt, he’ll be able to convert the debt to equity when certain requirements are met. Using this method of financing leverages the buyer’s potential return while minimizing the amount of capital it has to put up for the transaction.

Revolver Debt

The revolver debt is another type of financing structure. This type of debt is usually used by companies who have an uneven cash flow statement or by any entrepreneurs whose income is uncertain and irregular. Access to revolver debt can smooth out cash flow between paychecks. The way this debt works is easy. The borrower is given a maximum line of credit that he wants. At the same time, the borrower can access any amount of money at any time without having any specific terms to pay this loan back. However, the interest accrues on the funds borrowed. For instance, if you were given a loan with a maximum limit of $200,000 to improve your income, you, as a borrower, can take out any amount, starting from $0 through the entire loan amount. But to pay this debt back, you will need to cover the interest accrued on the funds you took out. Moreover, revolver debts usually have high interest rates due to the greater uncertainty in repayments.

Talking about revolver debt in the context of financial modeling is quite complicated. The revolving debt is unpredictable and linear, which makes it almost impossible to create a debt schedule. It is also harder to predict future uses of the revolving debt. Therefore, a financial analyst must use critical thinking and logic to create an exact forecast. (CFI)

Secured and Unsecured Debt

There are two major types of debt: secured and unsecured, and knowing what each of them means is very important when it comes to prioritizing your assets.

Secured Debt

Secured debt is always backed by collateral. In other words, this debt is secured by an asset, like a house or a car. For example, when you take out a mortgage your home becomes collateral for the mortgage. The lender of this loan can easily seize that collateral if you, the borrower, become delinquent. If this happens and the lender takes the asset, it will be sold on auction to cover the unpaid amount. If the selling price of the asset does not cover the rest of the debt the lender can pursue you to get the deficiency balance.

Accordingly, you will never own the asset tied to the secured debt until you pay the entire amount of the loan back.

Unsecured Debt

Unsecured debt is different because lenders who issue this debt do not have any collateral. If you become delinquent and do not pay the rest of the loan back, the lender generally cannot seize your assets for the unpaid debt. However, lenders can take other actions to get repaid on the debt. Lenders usually hire debt collectors to persuade you to pay the debt. In situations when that does not work, the lender can sue you and ask the court to take your assets or put a lien on your assets until you pay the debt back. Credit cards are one of the most widely held unsecured debts.Not paying the debt on time can have a negative impact on your credit report as well, because the lender can report the delinquent status of your payment to credit bureaus.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.