Passive Investing Fuels the ETF Bubble and is Increasing Rapidly

As we continue in the digital age where knowledge is plentiful and easy to come by, more and more people are beginning to invest. Not only is it more tempting to invest nowadays because of the influx of information, it’s also easier because of a market that continues to go up. For example, if you took $1,000 and invested it into the S&P 500 in 2019, come 2020 you would have $1,3041, and you could do this in January and not once check the money until the following year. This illustrates the power of passive investing.

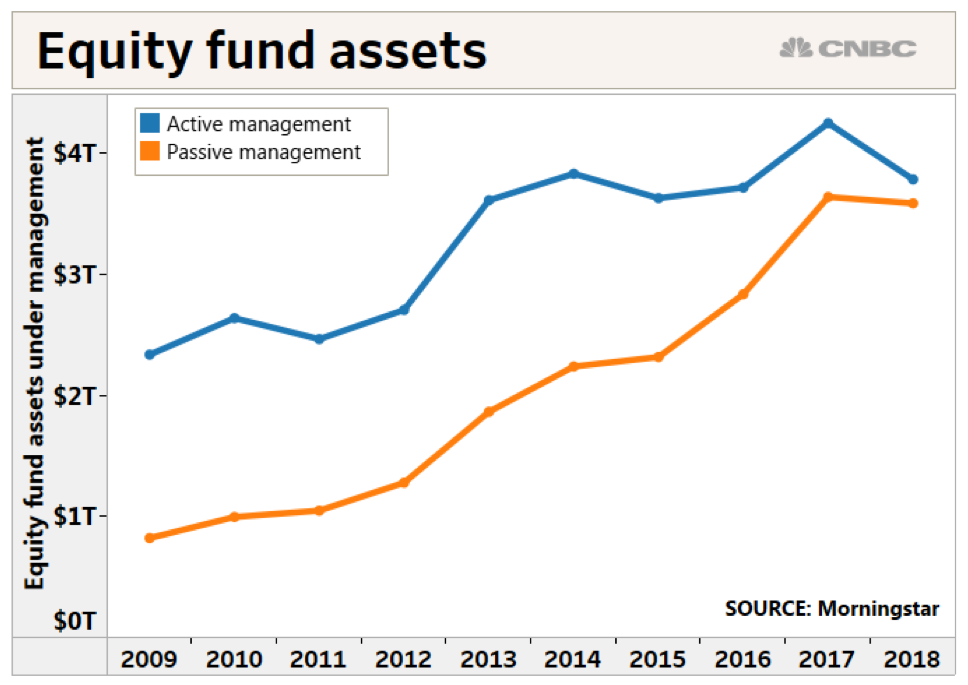

More and more people are recognizing how easy it can be to invest in an index like the S&P 500, which can add instant diversification to your portfolio, and this is evident in that nearly 50% of the money in the market is invested passively.2 The total amount of money invested in ETFs (exchange-traded funds) is currently $5.3 trillion3, and this value is only predicted to increase, with experts at Bank of America saying there will be $50 trillion invested in ETFs by the year 2030.3 Regardless of whether there is an ETF bubble, which we can now get into, the fact remains that the increase in passive investing will worsen the effects of the next financial crisis.

Content Preview

Big Name Investors Realize There is an ETF Bubble

One of the most recognizable names in recent memory claims that passive investing is creating a major bubble in our current economy. Michael Burry, a graduate of UCLA who predicted the collapse of the housing market before the financial crisis of 2008, is once again arguing that there exists a bubble in the ETF market.4 Burry’s main argument boils down to the fact that passive investing and ETFs can make more established companies overvalued while leaving behind smaller companies.4

Steven Bregman, an investor and president of Horizon Kinetics, agrees with Burry that there is indeed a growing ETF bubble. He contends that we are amid the largest, global financial bubble that contains almost every financial asset.5 He bolsters this by arguing that the average investor does not properly understand ETFs and believes that such systems are not helpful to individual investors. In fact, investing in ETFs over time can add risk to your portfolio without you even knowing, continues Bregman. A better alternative to dumping money into ETFs would be to find undervalued stocks that ETFs do not fuel in order to bolster your portfolio.5

Both Burry and Bregman, among many others, believe that the current trend of passive investing is unsustainable and will result in another financial collapse. However, a few things need to happen before this bubble pops.

The Bubble Can Pop Under Specific Conditions

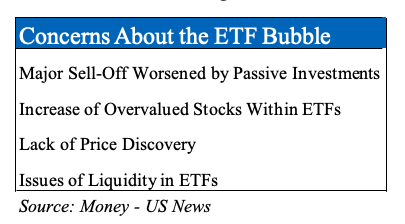

When more people contribute their funds to passive investments, something dangerous can happen. As additional money is spread across ETFs and other forms of passive investments, stocks can slowly become overvalued. As time goes on, this creates a ticking time bomb that could have significant repercussions for the global economy. The idea and exact specificity of this bubble is quite tricky and trickier even is understanding how it can ‘pop.’ For this to happen, there would need to be an external event that shakes enough investors and causes a major sell-off at once. Even worse, ETFs can sometimes have a lack of liquidity which would exacerbate fear during a major sell-off.6 As a worst-case scenario, given liquidity issues, an instant sell-off could result in a low volume of liquidity whereby investors have to unload stocks at a significant discount.

Another contributing aspect to the popping of this bubble is how ETFs appear to lessen risk and, consequently, eliminate price discovery.7 Because stocks are simply placed into an ETF and are purchased in that manner, they can be overvalued and no one is double checking to uncover the true stock prices. ETFs pour so much money into the stocks within them that there is a major concern that all these stocks are inaccurately valued. Instead of performing technical analysis, investors are simply dumping money into ETFs, which negates the entire point of price discovery.

All these concerns point to stocks potentially plummeting and this would be worsened by the overvaluing of stocks due to such an increase in passive investing. Essentially, passive investing grows the bubble and it is only a matter of time before we see the impact of this.

Arguments Against the ETF Bubble do not Affect the Bottom Line

While there is a compelling amount of evidence for the ETF bubble, as highlighted by the incredible increase in passive investments, there are some who oppose the idea. Opponents argue that the increase of investments being poured into ETFs are beneficial for investors, as opposed to the traditional actively managed account.8 This is a valid point, as passive investments are starting to out-perform some actively managed funds. Yet, even though this argument seems to put the interest of the investor first, it does not affect the looming ‘bubble-pop.’ As soon as an external event occurs, with increasing passive investments as well, it may create enough panic in the financial markets that there will be a mass sell-off and the market will go along with it. This could happen within the next week or within the next ten years, but the trend of more passive investing will only make the results worse.

Additionally, an external event that scares the market is not so far-fetched and not as fictional as it sounds. For example, the coronavirus is currently causing terror in the market. On February 24, 2020, the DOW had its third worst drop in three years, losing over 1,000 points in a day.9 The reason behind this drop was the spread of the coronavirus. Clearly, an external event is causing panic in the market, and while this disease may not be the catalyst behind the ETF bubble popping, a different event easily could be. In conclusion, the ETF bubble is only getting worse with the trend of passive investing and could lead to another global financial collapse.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

References

- DQYDJ.com: https://dqydj.com/2019-sp-500-return/

- Quartz: https://qz.com/1623418/index-funds-now-account-for-half-the-us-stock-market/

- Business Insider: https://markets.businessinsider.com/news/stocks/etf-market-grow-50-trillion-assets-2030-bank-america-passive-2019-12-1028763048

- Business Insider: https://markets.businessinsider.com/news/stocks/big-short-investor-michael-burry-calls-passive-investment-a-bubble-2019-8-1028481790?utm_source=msn.com&utm_medium=referral&utm_content=msn-slideshow&utm_campaign=bodyurl

- Seeking Alpha: https://seekingalpha.com/article/4325571-bregman-etfs-creating-biggest-global-financial-bubble-ever

- Investopedia: https://www.investopedia.com/articles/mutualfund/07/etf_downside.asp

- U.S. News: https://money.usnews.com/investing/funds/articles/do-index-funds-etfs-quietly-pose-a-systemic-risk-michael-burry-thinks-so

- A Wealth of Common Sense: https://awealthofcommonsense.com/2017/09/saying-theres-a-bubble-in-etfs-makes-no-sense/

- CNBC: https://www.cnbc.com/2020/02/24/us-futures-coronavirus-outbreak.html