Finance is Globally Important

Understanding M&A activity globally can give you a good indicator of healthy industries, where to invest in, and where to put your focus on. 2019 was an impressive year in the world of mergers and acquisitions.

The amount of money spent within M&A globally this past year reached $3.8 Trillion.1 While this singular dollar value alone is impressive, what is even more astounding is the current M&A trend globally.

The U.S., for example, saw M&A activity increase 13% in 2019 alone while The Middle East and Africa saw their M&A activity increase 131% and up to a total value of $155.4 Billion.1

In 2019, mergers and acquisitions were increasing upwards as a trend in both value and amount of deals. This means that it is paramount to not only keep track of financial markets and press releases and the stock market, but it is also important to understand different deals happening in the world of M&A as well as different M&A financial advisors.

If you need another reason to keep an eye on global M&A deals, from 2018 to 2019 the total number of deals increased 21.55% and totaled 57,391 deals.2

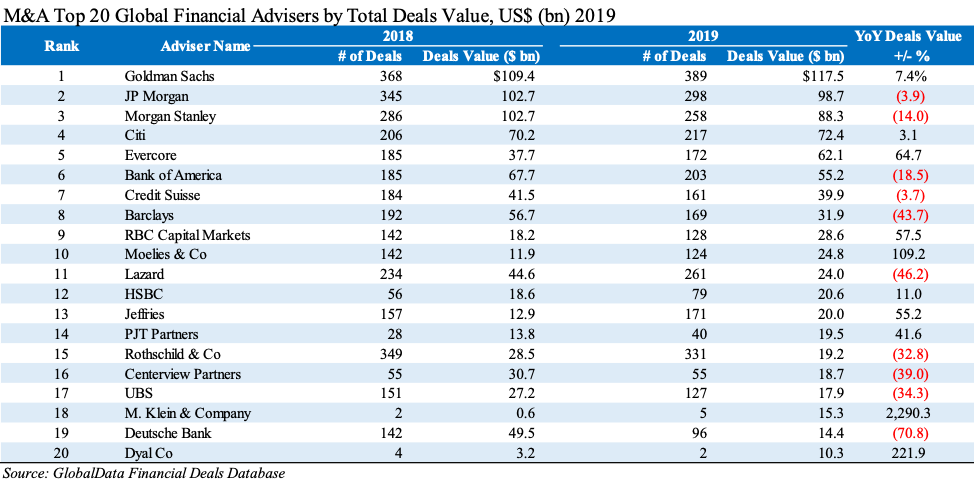

Goldman Sachs, JP Morgan, and Morgan Stanley led 2019 in Global Deals

Goldman Sachs, JP Morgan, and Morgan Stanley led 2019 in the M&A industry in both number of deals and total deals value. Goldman Sachs secured the top spot, taking in $1,174.5 billion in 2019 through 339 deals.2

Goldman Sachs soared this year, increasing their total deal value by 7.36% and generating more than $187 billion more than the second spot from their deals.2

In fact, Goldman Sachs was so impressive that it advised on 25 of the 36 megadeals, or deals valued above $10 billion, in 2019 alone.2

JP Morgan and Morgan Stanley rounded out the second and third spots with similar numbers in both number and value of their deals. Within M&A, the top 20 companies in terms of number and value of their deals made had some interesting pieces of data, summarized in the table below:

A Global Perspective Needs to be Taken for M&A

One of the most interesting things to note from this data are the changes in deal value from year to year. It is impressive how Goldman Sachs was able to increase their deals by 7.36% in terms of value but then a company like Morgan Stanley declined by 14.04%.

However, while larger companies saw variation in their total deals value, smaller companies were able to see significant gains, especially with Moelis & Co. and M. Klein & Company increasing their total deals value by 109.18% and 2,290.31%, respectively.2

Even though M&A activity is increasing in regions like the U.S. or Africa, you cannot assume it is increasing everywhere, as illustrated by the variance in year to year deal value percent change. In the world of finance, it is important to take a global perspective and understand foreign markets as well in order to paint a complete picture.

If we had only looked at the United States’ increase in M&A activity from the first paragraph of this article, we would have wrongly assumed that most top companies also increased their M&A activity. M&A, while becoming increasingly more significant, is also hard to predict and you need to have a close eye on the deals year by year in order to properly understand the global financial markets.

How Mergers and Acquisitions can Benefit You

If you take the time to properly understand global M&A activity, your personal portfolio will benefit tremendously, and your knowledge of the global economy will soar. For example, in 2019, the amount of deals for the Industrial Services sector increased by 18.65%.3

Another example is the technology sector, which increased its deal count by 4.7% in 2019. The increase year to year in number of deals and deal value is a good indicator for each sector. If you can anticipate these big leaps and predetermine expectations around such sectors, your personal investments can grow and your understanding of markets can be bolstered.

If you start paying attention to the global M&A deals year to year, even if it is just the megadeals, you will see your financial understanding and knowledge of current events increase so that you can be a better prepared scholar of finance.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

References:

- Wall Street Journal: http://graphics.wsj.com/investment-banking-scorecard/

- GlobalData: https://www.globaldata.com/goldman-sachs-leads-globaldatas-top-20-global-ma-financial-adviser-league-table-for-2019/

- FactSet: https://www.factset.com/hubfs/mergerstat_em/monthly/US-Flashwire-Monthly.pdf