From cases of acute respiratory illness in individuals in the city of Wuhan, China to a global pandemic, the novel coronavirus (COVID-19) has infected over 2,100,000 people worldwide with more than 650,000 cases in the United States.[1] As the highly transmissible virus continues to infect and claim lives of people around the world, governments, health departments, and federal agencies are scrambling to implement measures to slow the spread of the virus. In the U.S., students are being sent home for the rest of the semester, nearly every state has issued stay-at-home orders, and events that are expected to have more than ten people in attendance have been canceled or postponed due to the preventative measure known as social distancing. For many Americans, this pandemic is eerily reminiscent of 9/11 and the 2008 financial crisis – events that have shaped society in lasting ways, from traveling to buying homes and to the level of security that we endure. Not only has this virus halted “normal” life, but it has also disrupted the flow of goods and people, stalled economies, and is on track to deliver a global recession.

Coronavirus (COVID-19) and “Flattening the Curve”

There are various kinds of coronavirus, and some cause diseases. A newly identified type called COVID-19 has caused an outbreak of respiratory illness in more than 185 countries.[2] Although COVID-19 appeared in Wuhan, China, in December 2019, many health officials are still tracing the exact source of this new virus and how it spread. As of now, COVID-19 primarily spreads through droplets released into the air when an infected person coughs or sneezes. The symptoms generally appear within 14 days of exposure to the virus. Most people infected with COVID-19 will experience mild to moderate respiratory illness and recover without special treatment. However, older people and those with underlying medical conditions such as cardiovascular disease, diabetes, chronic respiratory disease, and cancer are more likely to develop severe illness.[3] As of April 16, 2020, 139,419 deaths have been attributed to COVID-19, with 31,002 deaths in the U.S. alone. However, 528,300 people worldwide and 52,772 people in the U.S. have recovered from the illness.[4]

Currently, there are no known vaccines or treatment for the virus, and there is no reasonable expectation for one to become publicly available until the fall or possibly the middle of 2021. The best way to prevent illness is to follow the Centers for Disease Control and Prevention’s (CDC) guidelines on how to avoid being exposed to it. Protect yourself and others by washing your hands often, covering coughs and sneezes, cleaning and disinfecting frequently touched surfaces, and practicing social distancing, in which a distance of six feet should be kept between yourself and others. Recently, the CDC has released an additional guideline, which recommends covering your mouth and nose with a cloth face cover whenever you must be around others.

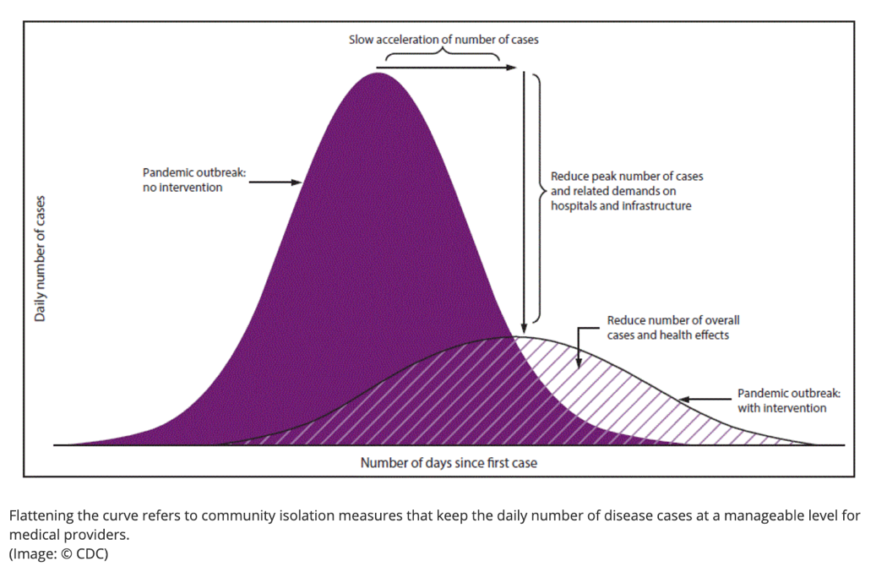

These guidelines have been implemented in an effort to slow the virus’ spread so that fewer people are infected at any given time, which is also known as “flattening the curve.” The curve that researchers are referring to is a graphical diagram that shows, theoretically, the projected number of people contracting COVID-19 over a period of time, with and without interventions like social distancing.

Depending on the virus’ infection rate, which is impacted by preventative measures, the curve will vary between being steep or flat. With no intervention, it will be a steep curve, in which the virus spreads exponentially, and the total number of cases skyrocket to its peak within a few weeks. Steep infection curves also have steep falls; once the virus has infected nearly everyone who can be infected, the case numbers begin to drop exponentially. However, a steeper infection curve results in health care systems becoming overloaded beyond their capacities. When hospitals get overwhelmed, many patients are left without intensive care unit (ICU) beds and many basic medical supplies run out.

Contrarily, a flatter curve predicts that the same number of people will eventually get infected but over a more extended period of time. A slower infection rate will limit the stress on health care systems, and fewer hospital visits on any given day mean fewer ill people being turned away. Flattening the curve will likely work as it did in 1918 when the Spanish flu caused a global pandemic but only through collective action.

Impact on the Economy

With the number of new cases for COVID-19 reaching its peak in New York and potentially nationally, the trajectory for cases and deaths may gradually stabilize and then fall. Even though the effort to limit the spread of COVID-19 is working, it does not equate to the U.S. economy coming back to full capacity anytime soon.

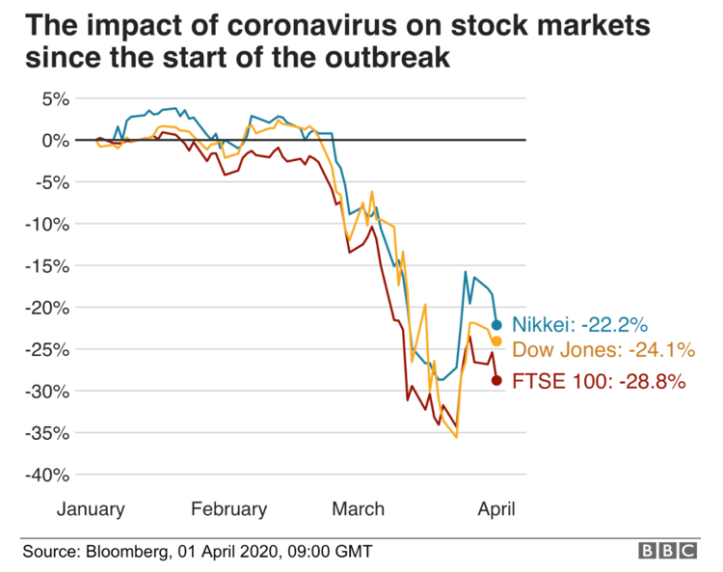

Among numerous economic impacts, global shares have taken a huge hit. Massive shifts in the stock markets can affect many investments in pensions and individual savings accounts (ISAs). As of April 1, 2020, the Nikkei, Dow Jones Industrial Average, and the FTSE 100 Index have fallen -22.2%, -24.2%, and -28.8%, respectively, since December 31, 2019.[5] These are the biggest declines for the Dow and the FTSE since 1987.

Many investors fear the spread of COVID-19 will lead to a rapid economic decline and that government intervention may not be enough to stop it. Analysts and economists at J.P. Morgan, Bank of America, Morgan Stanley, and Goldman Sachs expect the global economy to experience a contraction during the first half of the year as containment measures diminish monthly economic activity. Four of Wall Street’s biggest banks are forecasting U.S. gross domestic product (GDP) to fall between 14% and 30.1%.[6] Even though the number of new COVID-19 cases seems to be stabilizing, aggregate demand and aggregate supply have been significantly affected. Businesses are closing their doors due to a lack of customers, and supply chains are being disrupted because of ill workers. Some health care professionals warn of the possibility of an 18-month pandemic and the likelihood of experiencing multiple peaks in the upcoming 12 months, which may further depress the economy’s growth.

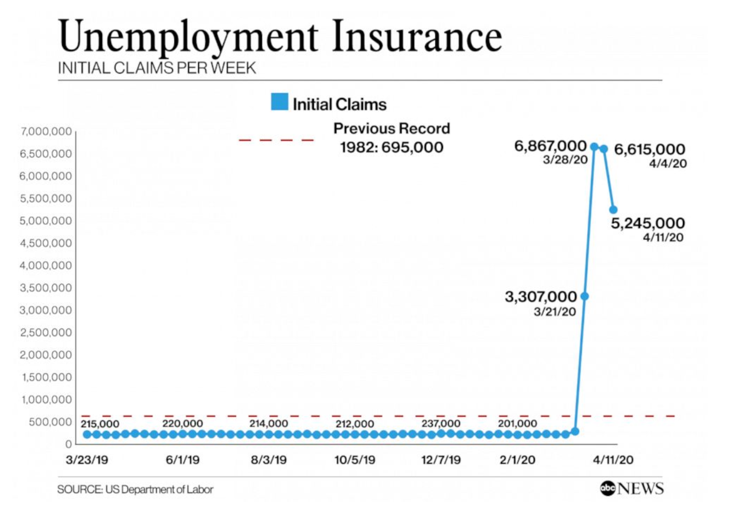

While the GDP is used as an indicator of the economy’s size and how it is performing, the financial burdens of the virus fall upon the people. On April 16, 2020, the U.S. Department of Labor reported that another 5.2 million people had filed for unemployment benefits in only the last week, which increased the number of Americans who had lost their jobs over the last four weeks to over 20 million. The number of recent job losses is more than the most recent recession produced over two years, and it is likely to increase in the next month.[7]

Although analysts and economists from different firms disagree on the exact magnitude of COVID-19’s economic impact, one thing that they seem to reach a consensus on is that the U.S. economy will contract significantly in the near future.

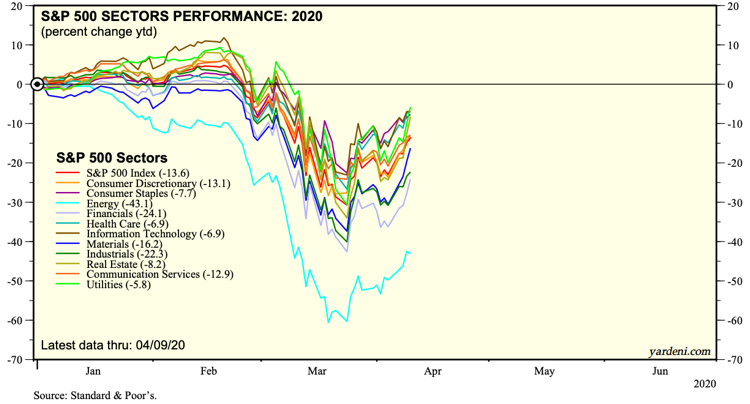

Worst-Performing Economic Sectors

- Energy (-46.03%)

- Financials (-29.41%)

- Industrials (-27.23%)

- Materials (-19.68%)

- Communication Services (-14.76%)

- Consumer Discretionary (-14.26%)

Source: Select Sector SPDR Sector Tracker on a 3-Month Time Frame as of April 16, 2020[8]

Supply and demand shocks caused by the pandemic have inflicted widespread damage to the global economy’s critical economic sectors. However, some sectors have been hit harder than others.

The energy and industrials sectors continue to underperform amid the COVID-19 pandemic. People have stopped traveling long distances, and businesses have halted all operations, so these goods are no longer needed. While energy companies are scrambling to contain the impact of COVID-19, the Organization of the Petroleum Exporting Countries (OPEC) and Russia also failed to reach an agreement on production levels, which further lowers oil prices.[9] The industrials sector, which consists of the transportation industry, is suffering from a sharp decrease in demand and disruptions to its supply chains as international and domestic flights are restricted, the price of oil is in free fall, and ports and factories are being closed.[10] However, the industrials sector, particularly airlines and cruises, have sought billions of dollars in federal aid as these industries forecast significant losses for the rest of the year.

Consumer purchasing of essential products like groceries, toilet paper, and household goods (consumer staples sector) and non-essential products, such as apparel and entertainment (consumer discretionary sector), has been reduced as governments around the world implement travel bans and lockdowns. As demand drop-off persists and supply disruption escalates, the financial sector also worsens with stagnant cash flows and tight financing conditions.[11]

According to the Wall Street Journal, hotel chain Hilton is predicted to lose between $25 and $50 million in revenue.[12] To cut costs and losses in revenue, hotel companies, including Hilton, Hyatt, and Marriott, are releasing tens of thousands of workers. Restaurants and homebuilders are also feeling the pressure from the demand pullback and the lack of supplies. Both the food and housing industries are experiencing a substantial drop in sales, forcing them to lay off workers and potentially shut down. Similarly, employees of the sports and entertainment industries are also left without a source of income as many events and seasons have been canceled by the National Collegiate Athletic Association (NCAA), National Basketball Association (NBA), National Football League (NFL), and more. As a result, consumption has been suffering from supply and demand shocks.

Impact on Businesses

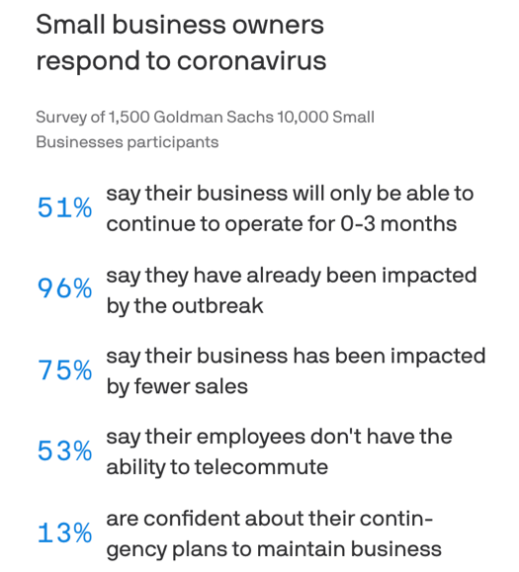

Since the COVID-19 outbreak was declared a pandemic, consumer behavior has been drastically altered. Consumers’ response to fears of infection, social distancing recommendations, and stay-at-home orders have resulted in businesses laying off workers and even shutting down. According to a Goldman Sachs survey, over half of U.S. small business owners do not believe that their business is capable of operating for more than three months because of the economic strain caused by the pandemic.[13]

The effects of the pullback are placing a financial burden on workers who are hourly employees and aren’t paid if they miss work. According to data from the U.S. Bureau of Labor Statistics, only one-third of leisure and hospitality workers have any paid time off.[14] To save their businesses and workers, many business owners are doing everything in their ability to hold on until the economy regains its strength after this pandemic.

Government Response

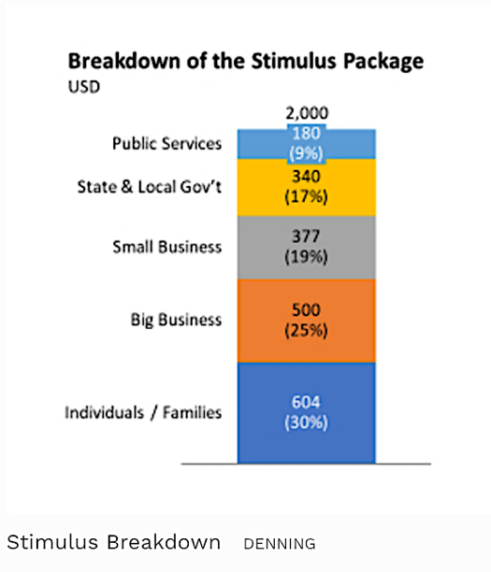

In efforts to curb the spread of COVID-19 and stimulate the economy, the federal government and the Federal Reserve have executed policies that encourage people to continue following CDC guidelines and cushion the impact of the supply and demand shocks. On March 27, 2020, Congress approved the largest stimulus bill in U.S. history, a $2 trillion aid package that provides assistance to nearly all parts of the economy and, just hours later, President Trump signed it into law. “This is a wartime level of investment into our nation,” said Senate Majority Leader Mitch McConnell after the bipartisan agreement.[15] The package extends financial assistance to businesses, consumers, and state and local governments. Hundreds of billions of dollars are being granted as checks sent directly to most Americans, expanded unemployment benefits, paid sick leave, mortgage and renter relief, student loan relief, and more accessible loans for businesses and states in critical conditions.[16]

The Fed has also stepped in with extreme actions to reduce the severity and limit the economic damage from the pandemic. There are two critical crises the Fed is trying to solve. One is the fact that financial markets are collapsing like they did during the 2008 financial crisis, which threatens to worsen the economic crisis, and the other is the widespread business closures that could result in mass bankruptcies, leaving millions of Americans unemployed even once the virus is contained.[17] To support the U.S. economy and financial markets, the Fed has brought its federal funds rate to a range of 0 percent to 0.25 percent, resumed purchasing massive amounts of securities, and offered low-interest rate loans to banks, corporate employers, and small to mid-sized businesses.[18] The Fed also revealed a plan to relaunch the crisis-era Term Asset-Backed Securities Loan Facility (TALF) to support lending to households and consumers.[19] To boost the flow of credit to businesses and workers, the Fed is also utilizing the Commercial Paper Funding Facility (CPFF).[20]

What You Need to Know Moving Forward

No one knows when the pandemic will end and when life will return to “normal;” it could take a few weeks or several months. However, in the meantime, we must understand the resources that the federal government and the Federal Reserve have provided for us. Most notably, the $2 trillion stimulus package, near-zero interest rates, and the Term Asset-Backed Securities Loan Facility (TALF).

As part of the $2 trillion stimulus package, the federal government is sending stimulus checks directly to the hands of millions of Americans. While not everyone will receive a stimulus check, most Americans will. You are set to get a stimulus check if:

- You are a U.S. citizen or permanent resident who has filed federal income taxes for 2018 or 2019 if you meet the income thresholds;

- You receive Social Security retirement, disability (SSDI), or survivor benefits; or

- You receive Railroad Retirement benefits.[21]

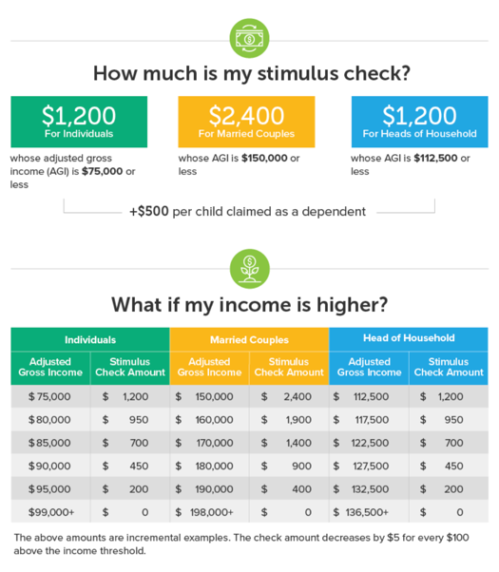

To determine what the income thresholds are and how much money you will receive, refer to the figure below:

The Internal Revenue Service (IRS) has begun sending stimulus checks of up to $1,200 to millions of Americans. In fact, according to the Treasury Department, between 50 million to 70 million Americans can expect to receive their checks via direct deposit by April 15, 2020.[22] If you did not provide your direct deposit information with your tax returns, the IRS will send you a paper check in the mail in the coming weeks.[23]

In addition to the stimulus checks, the near-zero interest rates will lower the cost of borrowing on mortgages, auto loans, home equity loans, and other loans while also reducing the interest income that savers earn. The TALF promotes lending to asset-backed securities holders collateralized by new loans. These loans include student loans, auto loans, credit card loans, and other loans guaranteed by the Small Business Administration (SBA).

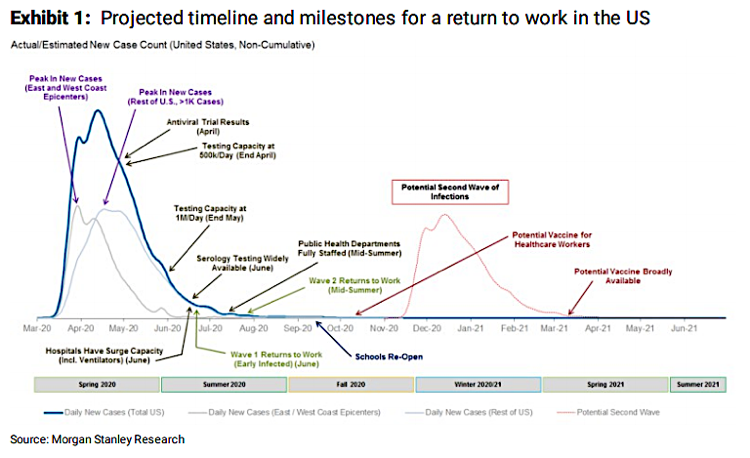

Even with this information, many Americans are eager to get back to work. However, this process will take time as U.S. cases of COVID-19 continue to peak in the coming days. According to research conducted by Morgan Stanley, getting back to work will happen in stages with reduced staffing as diagnostic/serology testing is more widely available and hospital capacity is extended.[24]

For now, the best thing we can do is continue to practice social distancing and wear a face mask or a cloth face cover if we must go out in public. This procedure will protect you, the elderly, who are more vulnerable during this pandemic, and health care workers. The world may be undergoing an economic and health crisis of tremendous scale, but we must come together and protect each other as only through collective action will we overcome this crisis.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.