It is no secret that a finance career pays well with prestigious entry roles in hedge funds, private equity firms, and investment banking salaries reaching six figures right out of university. Many people aspiring for a finance career often wonder how much those finance jobs pay, so in this article, we discuss exactly how much can you expect to earn with a career on Wall Street.

Investment Banks

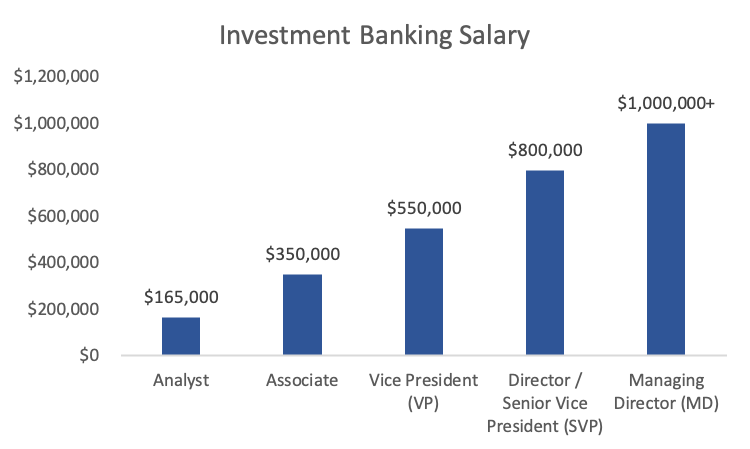

Starting with one of the most competitive finance jobs, investment banking salaries are attractive. It is one of the few entry finance jobs that offer a six-figure salary right out of college. As a first-year investment banking analyst at bulge bracket firms such as Goldman Sachs, JPMorgan Chase, and Morgan Stanley, and middle-market banks such as Jefferies, William Blair, and KPMG, the average starting investment banking salary is $90,000 with bonuses bringing total average compensation to $165,000.[1] If you wish to continue a finance career in the bank, the next position would be associate, followed by vice president (VP), director/senior vice president (SVP), and finally managing director. You can expect base salary and performance bonuses to increase substantially as you move higher up. The average total compensation for each position is shown below.

Management Consulting

If the intense work hours of a finance job are not for you, management consulting is an alternative career path that can provide a six-figure salary with better work-life balance. Total compensation for top-tier consulting firms such as Boston Consulting Group (BCG), McKinsey & Company, and Bain & Capital ranges from $100,000 to $120,000 annually. You typically gain valuable experience and financial skillsets as a management consultant, so exit opportunities to hedge funds and private equity firms are not uncommon.[2]

Hedge Funds

Moving on to other finance jobs and finance careers, hedge funds are one of the most attractive exit opportunities for investment banking analysts and management consultants looking to go to the buy-side. Not only are their salaries higher than investment banking salaries, but the work hours are also typically better. But to work at top hedge funds like Bridgewater Associates, BlackRock, and Citadel requires experience and detailed financial knowledge and skillsets, which is why they typically hire investment banking analysts who have 2-3 years of experience working at investment banks. A hedge fund analyst with 2-3 years of experience can expect an average base salary of $85,000 and performance bonuses to be in the similar range, resulting in an average total annual compensation of $165,000.[3] Salary increases are common and expected, so within 5 years at the fund, an investment banking analyst can see his total compensation increase to $250,000 – $300,000.[4]

Private Equity

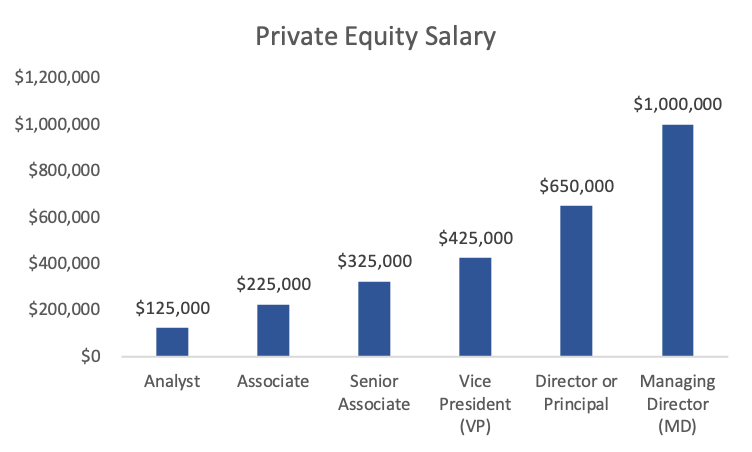

Another promising finance job on the buy-side is to work at a private equity firm. Similar to hedge funds, private equity firms typically recruit investment banking analysts and management consultants with 2-3 years. Salaries are also comparable to investment banking salaries, and top private equity firms such as Blackstone, Carlyle Group, and KKR pay anywhere from $100,000 – $150,000 for analysts.[5][6] The finance career path of private equity firms is similar to that of investment banks, with a promotion to associate after 2-3 years as an analyst, followed by senior associate, VP, director, and finally MD. The average total compensation for each position is shown below.[7][8]

Conclusion

With investment banking salaries being six figures right out of university and various exit opportunities paying even more, a finance career is a lucrative one, but also extremely competitive. The intensity of the jobs is comparable to that of playing a professional sport, and only about 5% of applicants receive an offer from investment banks each year. So in order to be a competitive candidate, you must develop strong relevant skillsets and have extensive industry knowledge. Relevant work experience and training such as our Analyst Prep Program is a must when it comes to developing the fundamental as well as technical skills needed for a successful career on Wall Street.

Romero Mentoring’s Analyst Prep Program

In just 15-weeks, you can become a world-class finance professional. The Romero Mentoring Analyst Prep Program is an all-inclusive internship, mentorship, and training experience like no other. Learn the in-depth principles of finance and apply what you learn through an extensive internship led by a finance professional with over 12 years of experience. Learn more here.

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one.

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped over 400 students start their careers on Wall Street through our Analyst Prep and Associate Investment Banking Training Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.

Sources:

- DeChesare, Brian. “Investment Banker Salary and Bonus Report: 2021 Update”. Mergers & Inquisitions.

- Management Consulted. “Management Consultant Salary”.

- Buyside Focus. “2019 Hedge Fund Salaries”.

- DeChesare, Brian. “The Hedge Fund Analyst Job: The Complete Guide”. Mergers & Inquisitions.

- Banking Prep. “Hedge Fund Salaries”.

- Zucchi Kristina. “How to Become a Private Equity Associate” Investopedia, October 7, 2020.

- DeCHesare, Brian. “Private Equity Salary, Bonus, and Carried Interest Levels: The Full Guide” Mergers & Inquisitions

- Buyside Hustle. “Private Equity Salary and Bonuses – From Analyst to Partner”.