Author, Contributor: Kane Wan, Analyst Prep Program, 2022 Alum

What is Strategic Consideration?

Strategic consideration is an advisory process in investment banking where investment bankers develop strategic advice and creative ideas to help clients find solutions and overcome challenges to their companies and businesses. Those companies might face capital structure and valuation problems where they want to know whether their companies are fairly valued and whether their balance sheets are in line with the rest of the industry. Moreover, they would also encounter operational dilemmas on improving the companies’ financial performance and future growth. Common strategies involved include share buyback and M&A activities, which allow companies to expand the business and capture more market shares.

Content Preview

What Do Investment Bankers Do?

Investment Banking is a segment of the financial services industry that assists companies, institutions, and governments with raising capital via Initial Public Offerings (IPOs) and executing transactions such as mergers and acquisitions (M&A).

The two major segments in an investment bank are Corporate Finance and Sales & Trading. Corporate Finance includes many roles in investment banking, including capital raising, advising on mergers and acquisitions, and helping companies to restructure. It is also labeled simply the “Investment Banking Division” (IBD), and it is further divided into product groups and coverage groups. Product groups mainly focus on specific deal types, but they would work in all industries that the bank covers. Some examples of product groups can be Mergers & Acquisitions, Restructuring, and Leveraged Finance. Coverage groups, on the other hand, would work on various deal types but within a specific industry. They would often deeply cooperate with individual companies in the industry. Some examples of coverage groups are Real Estate, Healthcare, Technology, Media & Telecom (TMT), industrials, and Financial Sponsors.

The Sales & Trading (S&T) group at an investment bank helps institutional investor clients, such as hedge funds and private equity firms, to buy and sell securities such as stocks, options, and bonds. During this process, the salespeople and traders at banks would divide up these orders, match buyers and sellers, and get the client’s prices as close as possible to what they expect. The two main divisions in Sales & Trading are Equity Trading and Fixed Income Trading. Equity Trading focuses on companies’ stocks and derivatives, while FICC focuses on municipal bonds, rates, and commodities.

Nvidia Situation Overview

Nvidia (NVDA) is a fabless company that designs graphics processing units (GPUs) for the gaming and professional markets, as well as systems on a chip unit (SoCs) for the mobile computing and automotive market. Nvidia stock price in 2021 was up roughly 60%, with operations exceeding public expectations. In the third quarter of fiscal 2022, Nvidia earnings jumped 61% while sales surged 50%. Gaming chip revenue soared 42%. Data-center chip sales jumped 55%, with Nvidia purchasing Mellanox last year.

Nvidia is one of the leading players in the Semiconductor industry, which is rapidly growing. The U.S. accounted for almost half of the $440 billion in global semiconductor spending in 2021, according to the Semiconductor Industry Association. And semiconductor chips are now the nation’s fourth-largest export. The industry has been extremely active, with Intel just striking a $5.4 billion deal to buy Tower Semiconductor as it seeks to bolster its manufacturing capabilities.

Is Nvidia Stock Fairly Valued, Undervalued, or Expensive Per Your Valuation on a Standalone Basis?

I believe that Nvidia is reasonably valued at current levels, given its strong financial profile. From my comparable company analysis and discounted cash flow analysis, I reached a valuation range from $198.1 to $247.2 and a price target of $235. Revenue is expected to be $8.10 billion, plus or minus 2 percent. Revenue growth for the next few years would be at a double-digit rate due to the increasing demand for Nvidia chips in home computing, video games, and data center fueled by the global pandemic. Nvidia makes chips for car infotainment and autonomous driving systems. As cloud gaming grows around the world, Nvidia’s new cloud gaming service could become a growth driver. Under such context, I maintain a bullish view on Nvidia stock with a strong financial profile in terms of revenues and gross profit margins.

Strategic Recommendations

What is Your Recommendation to the CEO?

The Pro-forma M&A analysis statistics indicate ~92% EPS accretion on an adjusted basis for the year 2028. An acquisition of NXP Semiconductors would increase shareholder value for the long term while providing opportunities for further synergies and growth. An acquisition is the better option for maintaining a competitive advantage and for long-term growth indicated by higher EPS accretion in 2028. Even though Nvidia is a relatively mature company industry, it is still seeking to increase its market share by expanding to the automobile industry. This acquisition would enable Nvidia to gain a competitive edge by acquiring the necessary human capital and technology.

Capital Structure Analysis

Comparable company analysis indicates Nvidia capitalization to debt ratio is on the lower end of its peer group. The industry average and median equity to debt ratio are 92.0% / 8.0% and 93.0% / 7% respectively, while Nvidia has an equity to debt ratio of 98.8% / 1.2%. With a 1.2% debt capitalization, Nvidia can raise ~$46.1 Billion in debt to be more in line with its industry and competitors.

Explain Your Thought Process

After raising $46.1 billion in debt to align Nvidia’s capitalization with its industry, the company is able to use the proceeds to either conduct a share buyback program or perform an M&A activity. Even though a share buyback program can offer quickly return wealth to shareholders and demonstrate confidence in the future of the company with relatively simple execution, it will not improve the company’s fundamentals. M&A activity, however, would allow the company to facilitate long-term growth profiles to enhance valuation, increase market share and competitive advantages, and acquire additional human capital. In the case of Nvidia, NXP Semiconductor can be a suitable target. NXP Semiconductors is a leading supplier of mixed-signal products and now has a significant market share in the automotive market. It supplies microcontrollers and analog chips into automotive clusters, infotainment systems, and radars. The addition of NXP’s technology will greatly enhance Nvidia’s capability in capturing the automobile market, where it initiated partnerships with companies like Land Rover and Ferrari. Though the acquisition might not be easy to fulfill in practice, it would provide a clear direction for Nvidia on what their next acquisition might be in the future. In conclusion, a share buyback program won’t be able to improve the fundamental business, while an acquisition can, making it a better solution for Nvida in this stage.

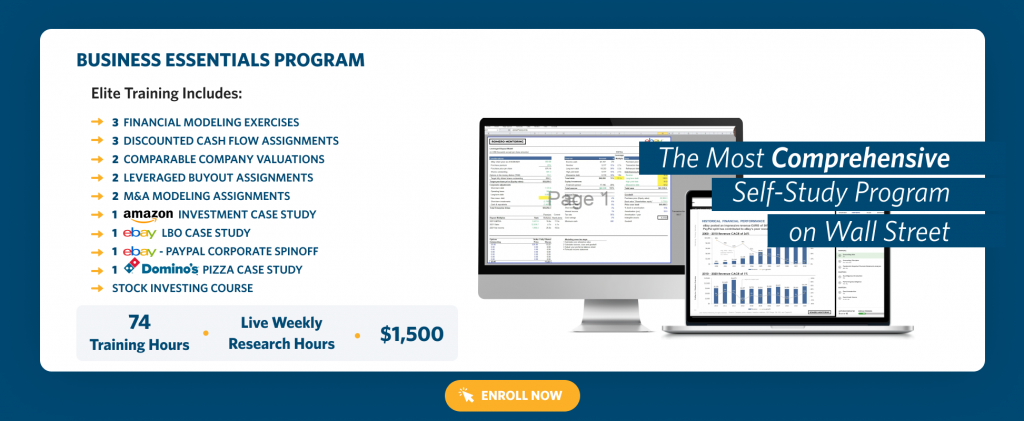

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.