Starting a business from the ground up is a difficult yet exciting process. Most entrepreneurs spend the majority of his/her time trying to find capital to grow their business. The capital accumulated can be spent on recruiting the right talent, preparing a marketing budget, launching a prototype, etc. Capital provides fuel to the engine and ensures the business runs smoothly and sustainably. However, finding people to invest in one’s idea can be extremely hard and never-ending. This article walks you through the process of capital raise and different funding rounds.

Discover the elements of capital-raise

Before diving deep into the different stages of funding, it is essential to understand the different elements involved in the funding process. First, there are business owners or individuals trying to find investors to invest in their business in exchange for equity. As the business becomes mature, it tends to advance through different funding rounds. [2]

On the other side, there are investors willing to invest their capital into your business. The motivation could be their belief in the business and the opportunity to earn returns on their investment. If the company grows, its returns grow with it. [2]

Before investing in a business, investors typically analyze the valuation of the business. The valuation of a business is contingent on several factors like market risk, industry size, historical performance, maturity level, and growth aspects. This valuation number typically determines the amount of capital a business could accumulate. [2]

Content Preview

How does funding work?

Start-ups typically have to go through multiple rounds of funding to achieve their milestones. As a business progresses, it advances to different stages of funding. At every round, entrepreneurs are looking to trade equity for capital. Convertible notes can also be used in earlier series of funding when investors face more risk or when founders need an extra push to advance through to the next financing round. [2]

The process of funding in each round typically includes 8 steps:

1) Gather your data

2) Research investors

3) Create a winning pitch deck and hone the presentation

4) Attend investors meetings and pitch

5) Build lasting relationships

6) Field Term Sheets and Offers

7) Survive due diligence

8) Close the process by completing the paperwork and receiving the funds

What are the different stages of funding?

Pre-Seed Funding:

This is the earliest stage of funding when the founders are just getting their operations off the ground. The most common pre-seed funders are the founders themselves, as well as close friends and family. Depending on the nature of the business and the set-up costs, the funding stage can happen very quickly or could take a long time. Investors investing at this stage typically don’t trade capital for equity. The money collected can be used to hire the right talent and to develop a prototype. The amount of capital raised in this round ranges from less than $1 million – $3 million. [1]

Seed Funding:

This is the first official stage of funding. Seed funding helps the company finance its initial steps and paves the way for the future. Some companies do not even proceed to further rounds of funding. With a steady stream of cash flows and focused management, the capital accumulated can pay dividends for years to come. This round helps companies establish their target demographic, build their products, and conduct extensive market research. [1]

There are many potential investors in this round: founders, friends, family, incubators, VCs, and more. One of the most common types of investors is known as Angel Investors. These investors have an appetite for riskier investments. The capital raised in this round could range from $150k – $6 million. [1]

Series A:

A company may opt for this round of funding only if they have been able to develop an established track record. Investors participating in this round are typically looking for founders with great ideas and a full-proof strategy to turn those ideas into reality. Typically, Series A rounds raise approximately $2 million – $15 million. The average Series A funding of 2020 was $15.6 million. The capital accumulated in this round is used to scale the product across different markets and generate desirable returns. [1]

Investors involved in this round are traditional venture capital firms: Sequoia Capital, Benchmark Capital, Greylock, etc. Investors also participate in the political process and lead the company. Many companies use equity crowdfunding to accumulate capital as the majority of the companies find it hard to generate enough interest in investors to invest in their business. [1]

Series B:

Once the business crosses its development stage, founders can proceed to this stage of funding. Series B Funding is all about taking the business to the next level. Series A proves the company’s business model and product demand. It also gives investors enough confidence in the business to invest additional money. [1]

The average capital raised in this round is $33 million. Most Series B companies are valued between $30 million and $60 million. [1]

Investors in this round of funding are the same as the ones in Series A. However, a new wave of investors also steps in to take the business to its next level. [1]

Series C:

Successful businesses reach this round of funding. Capital raised in this round is used to develop new products, enter new markets, and/or acquire other companies. Companies understand the importance of acquiring other companies as it gives them a competitive advantage over other players in the industry. Strategic acquisitions can help businesses streamline their costs, build profitable revenue synergies, and eliminate competition. [1]

As operations get less risky, more investors start to step in; such as Hedge Funds, Investment Banks, Private Equity Firms invest alongside Venture Capital firms. Each of them wants a share of the pie that is determined for success. The average capital raised in this round ranged from $60 million to $200 million. Companies also enjoy high valuations. [1]

Analysts value the companies in this round based on the company’s historical performance and hard data rather than future expectations. This is typically the last round of funding as, by this round, companies can stand their ground and grow their business organically. However, some companies also participate in Series D, E, F, and G rounds of funding to prepare themselves for an IPO. [1]

The bottom line:

Understanding the process of funding is extremely important as it is a time-consuming and costly process. The time and money spent on raising capital reflect in the business’s operations. Entrepreneurs must maintain the same amount of energy and focus through the different rounds of funding to attract additional investors. Outside funding also leaves no room for privacy as investors participate in day-to-day business operations. The hard truth about raising capital is that investors only care about the returns. This can come in the way of an entrepreneur’s strategy to introduce new products and/or use the money raised to invest in other areas of the business, which may not give investors the desired internal rate of return.

Having said that, companies must know what they are getting into and must prepare themselves for scrutiny. However, this additional stimulus is also extremely important for businesses to reach the next level.

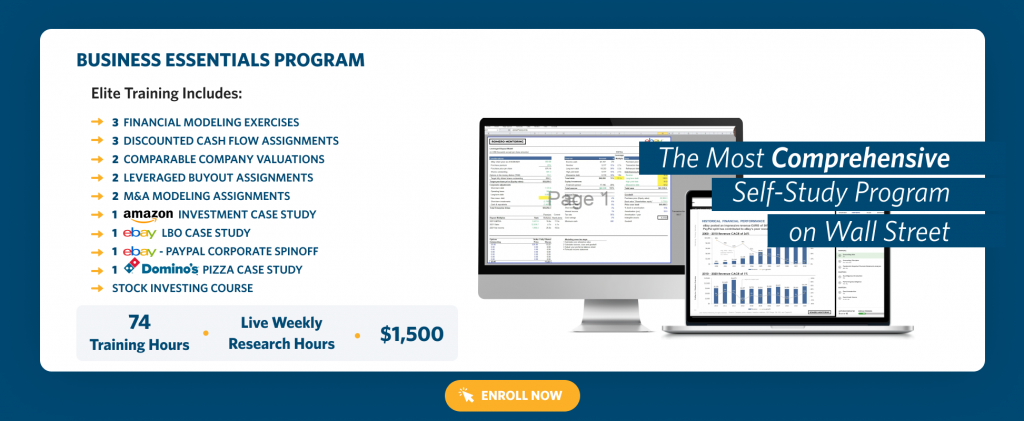

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Sources:

1. Reiff, Nathan. “Series A, B, C Funding: How It Works.” Investopedia. Investopedia, June 1, 2021.

2. Cremades, Alejandro. “How Funding Rounds Work For Startups.” Forbes. Forbes Magazine, December 26, 2018.