As many states reopen retail stores, restaurants, personal care businesses, and recreational facilities, people are delighted that life is returning to “normal.” However, in reality, the coronavirus continues to infect folks and disrupt the flow of goods and people. From gyms to department stores, the coronavirus seems to spare nothing as it wreaks havoc on the U.S. economy. Temporary store closures and falling consumer demand continue to take a toll on the retail industry that was already struggling the past several years as many consumers shifted to online shopping. Even with the reopening of the economy, social distancing measures will likely continue for months, which will affect store capacity for retail stores and restaurants. These measures have led many of the country’s well-known consumer brands to file for bankruptcy.[1]

In most cases, a bankruptcy filing doesn’t mean a company will go out of business. Many companies use bankruptcy to restructure their finances, in hopes of emerging from it stronger and more profitable. This type of bankruptcy is known as Chapter 11 bankruptcy.

Content Preview

Chapter 11 Bankruptcy

Federal bankruptcy laws regulate how companies go out of business or recover from large amounts of debt. One common version of bankruptcy is Chapter 11, which grants companies time to restructure their debts. A bankrupt company, the “debtor,” may use Chapter 11 bankruptcy to reorganize its business and work toward becoming profitable again.[2] Although management continues to run the day-to-day business operations, all significant business decisions must be approved by a bankruptcy court. For this reason, a company only considers Chapter 11 reorganization after careful analysis of all other possible alternatives as this form of bankruptcy filing is usually the most expensive.

During a Chapter 11 proceeding, the company is given the opportunity to propose a reorganization plan. These plans include downsizing business operations to reduce expenses, renegotiating debts, and liquidating all assets to repay creditors. If the plan is feasible and appropriate, the process will move forward, and the court will help the company in restructuring its debts and obligations. Many large U.S. companies have filed for Chapter 11 bankruptcy in the past and remained in business, including General Motors, United Airlines, K-mart, and many other corporations.[3] However, the process is a slow one.

To make bankruptcy easier for small businesses, on February 19, 2020, the Small Business Reorganization Act of 2019 went into effect, adding a new subchapter V to Chapter 11, which defined small businesses as entities with less than $2.7 million. According to the U.S. Department of Justice, the act “imposes shorter deadlines for completing the bankruptcy process, allows for greater flexibility in negotiating restructuring plans with creditors, and provides for a private trustee who will work with the small business debtor and its creditors to facilitate the development of a consensual plan of reorganization.”[4] To further aid small businesses during the coronavirus pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27, 2020. This act raised the Chapter 11 subchapter V debt limit to $7.5 million.[5]

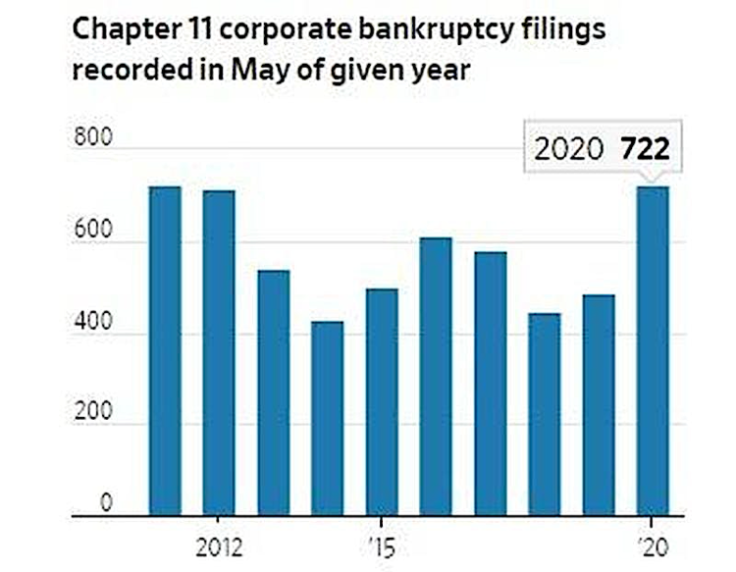

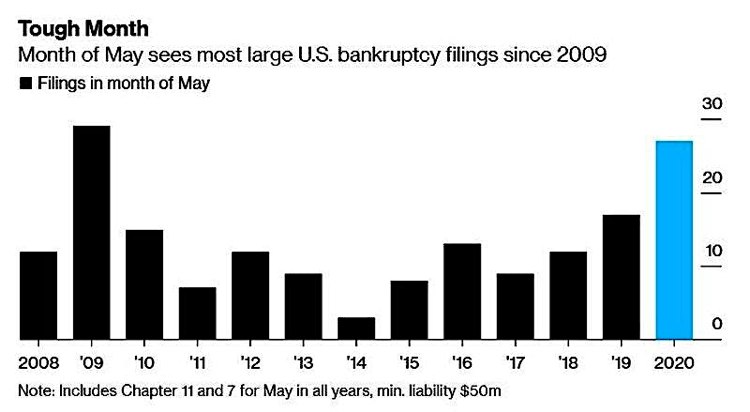

Even with these assistance programs for businesses, the pandemic’s devastation of the U.S. economy continues to test companies’ ability to remain profitable, resulting in many recognizable consumer brands filing for Chapter 11 bankruptcy in May.

J. Crew Group

On May 4, 2020, J.Crew Group, which owns the preppy J.Crew and Madewell brands, became the first national U.S. retailer to file for Chapter 11 bankruptcy. The company expects to stay in business and emerge from bankruptcy as a profitable company and has determined that Madewell will remain part of the business. J.Crew Group’s bankruptcy filing was the initial sign of the pressure the pandemic has placed on retailers.

J.Crew Group has been burdened with a heavy debt load since its 2011 purchase from private equity firms TPG Capital and Leonard Green & Partners in a $3 billion deal. Before the deal was announced in 2010, the company had $50 million in long-term debt. Despite nearly doubling its number of stores, as of February of this year, its long-term debt skyrocketed to $1.7 billion.[6]

Now J.Crew Group is taking the necessary steps to reopen their stores and turn around the business. “As we look to reopen our stores as quickly and safely as possible, this comprehensive financial restructuring should enable our business and brands to thrive for years to come,” J.Crew Group CEO Jan Singer said in a statement.[7]

Gold’s Gym

Gold’s Gym, which operates over 700 gyms in the U.S. and internationally, also filed for Chapter 11 bankruptcy on May 4th. It will use this filing to reorganize its debt and regain profitability amid the coronavirus pandemic. According to a news release, franchisee-owned gyms, which make up a large portion of the Gold’s Gym global footprint, are not included in this filing.[8] The company has already closed 30 company-owned locations, but president and CEO Adam Zeitsiff told Patch that the “brand is strong,” and the Venice location will stay in business.

He added, “We want to be 100 percent clear that Gold’s Gym is not going out of business. The brand is strong, and we’ll continue to innovate and grow our digital business, our licensing program, and our global footprint as we focus on serving our millions of members across the world.”[9]

J.C. Penney

The department store chain JCPenney filed for Chapter 11 bankruptcy on May 15th with an agreement with most of its lenders that will allow it to implement a turnaround plan to stay in business. However, it will close 30 percent, or about 200, of its 846 U.S. stores.[10] Despite the impact of the coronavirus pandemic on retailers, JCPenney had faced financial hardship for several years before the pandemic because of a decade of unsound decisions. Its most profitable year was 2010, but since then it has had total net losses of $4.5 billion.[11]

Additionally, as consumers have turned to online retailers, the entire department store sector has suffered. The Commerce Department data shows retail sales fell 16.4 percent in April, the steepest drop on record thus far, with sales at clothing stores dropping 89 percent from a year ago. Big-box discounters like Walmart (WMT), Target (TGT), and Costco (COST) have also emerged as competitors, offering consumers lower prices and a wide variety of items not found in department stores, such as groceries.[12]

JCPenney is losing out to rivals like Walmart, Target, and Amazon, which have increased their selection of clothing and home goods and spent billions developing their online platforms. As a result, the pandemic will widen the gap between the country’s most successful retailers and the rest. This industry has been damaged the most by the pandemic, which has led to the closure of hundreds of thousands of stores and malls.[13]

What Does the Future Hold for Other Businesses?

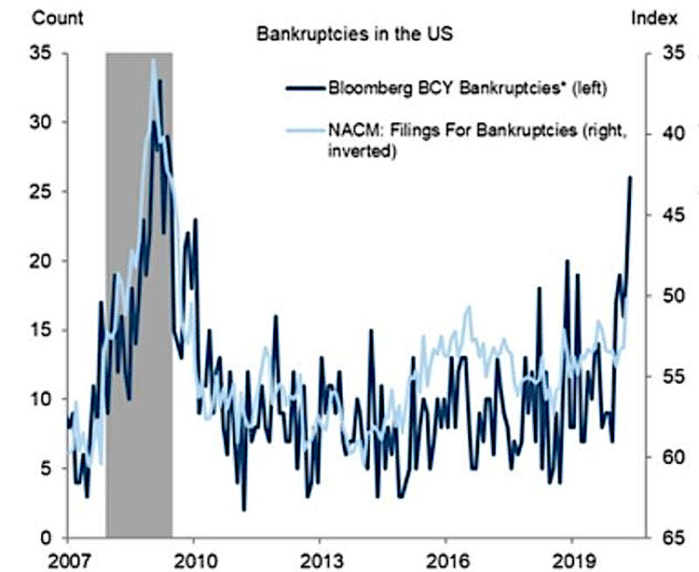

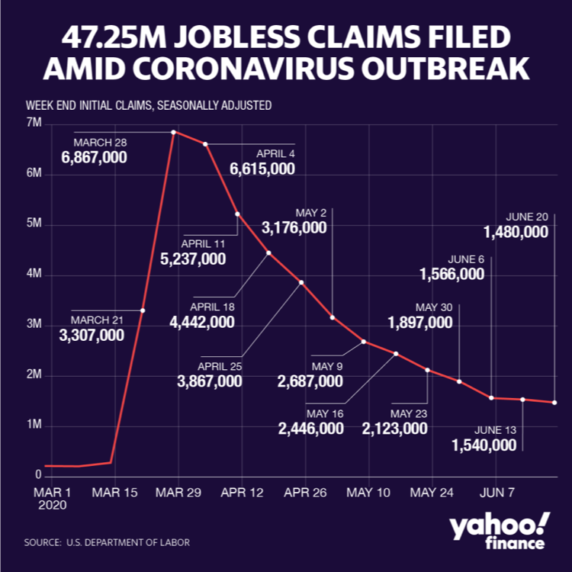

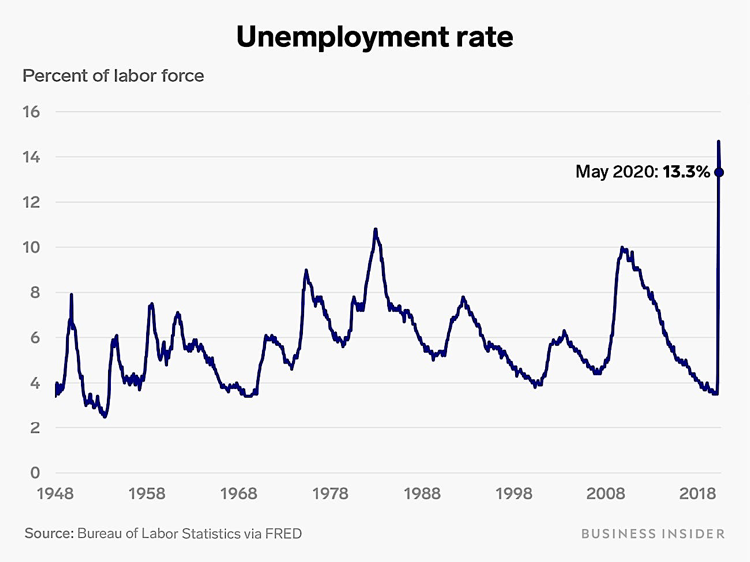

A record 21 million Americans lost their jobs in May, with an unemployment rate of 13.3 percent, a level not seen since the Great Depression.[14] With these horrific numbers, analysts foresee a tidal wave of bankruptcies in the coming months. As companies continue to succumb to the effects of the coronavirus, even a substantial rebound in economic activity over the next few months will not stop them from filing for bankruptcy, likely Chapter 11.

More than 6,800 companies filed for Chapter 11 bankruptcy protection last year, which will undoubtedly be higher this year. Without reform in the system, “we anticipate that a significant fraction of viable small businesses will be forced to liquidate, causing high and irreversible economic losses,” a group of academics said in a letter to Congress in May. “Workers will lose jobs even in otherwise viable businesses.”[15] Although Chapter 11 bankruptcy does not grant money for those businesses, it will provide many of them a chance of survival.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.