Introduction

Welcome – chances are you’re reading this article because (1) you don’t know what career to pursue, (2) you’re in the process of switching careers, or (3) you don’t know where to start with making a career plan. Career planning is the continuous process of self-evaluation and planning done by a person to have a career path that is aligned with their interests, passions, and goals. It allows individuals to focus on where they want to be professionally at specific points in their lives and how they can get there. This article will cover goal setting, job searching, creating a personal value proposition, and more. Let’s dive into it.

Content Preview

Step 1: Self-assessment

At the start of your career planning journey, there are four main things you want to consider: your interests, skills, values, and preferences.

- Interests are what you are passionate about and would be willing to spend time and money delving deeper into. To figure out what you are interested in, you may ask yourself, “What do I do in my free time?” or “What do I find interesting?” Books on your bookshelf, apps on your phone, or the type of news you read can help you gain an idea of what you’re interested in.

- Skills are what you excel at – your strengths. Ask yourself, “What am I good at?” “What do I do better than anyone?” For example, if you’re creative and excel at problem-solving, you may look into consulting as a possible career choice. Skills don’t need to be what you’re naturally good at – they can also be developed over time. Romero Mentoring’s programs help students and professionals develop highly-valued and sought-after skill-sets in the business world such as financial modeling, using Excel like a Wall Street professional, and many more.

- Values are the ways you want to make a difference. Ask yourself, “What problem am I passionate about solving?” “What makes me really sad, happy, or angry?” “What cause would benefit from my skills and experience?”

- Preferences can help you decide which career path may suit you best with the work-life balance you desire. Things such as where you prefer to work and what you prioritize over work can help you figure out which career path may best suit your preferences.

Step 2: What’s important to you?

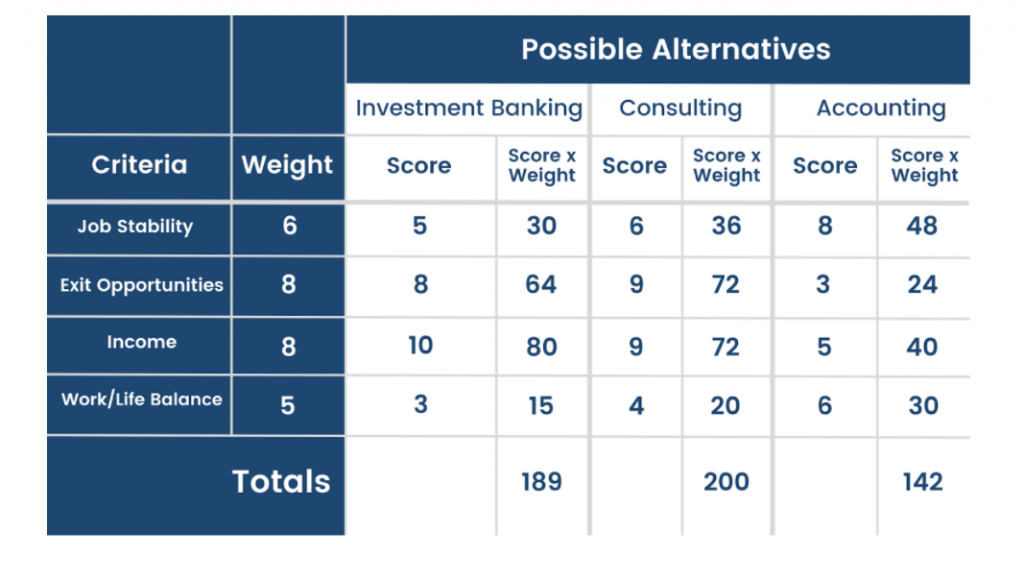

In order to find a career that aligns with your interests, passions, and goals, you should first figure out what is important to you and how they can fit within a potential career path. Making a decision matrix is highly beneficial for figuring that out. The different steps of creating a decision matrix are listed below.

- Define the Problem or Opportunity: For example, “I don’t know what career I should pursue.”

- Generate Alternatives: You may be choosing between pursuing a career in investment banking, consulting, or accounting. Make a column for each of those possible career alternatives.

- Identify Relevant Criteria: What matters to you? Possible criteria can be job stability, income, work/life balance, exit opportunities, etc. Make a row for each of the different criteria.

- Weigh the Criteria: Weigh the importance of each criterion to you on a scale from 1-10. Note that two criteria can have the same weight.

- Evaluate Each Alternative on Each Criterion: For example, consulting has an 8 in income, investment banking has a 9, and accounting has a 6.

- Compute the Optimal Decision: Multiple each alternative’s score for the different criteria by the weight of the criteria and then add it up to find out which one has the highest score. That would be your optimal decision.

There is no “correct” decision matrix as it is very subjective. Here is an example of what a decision matrix could look like:

Step 3: Setting short-term and long-term goals

Organize your goals by short-term and long-term. Goals you can achieve within a few months are short-term goals, while long-term goals need time to mature.

Use the SMART Goals list as a guide for making and setting both short-term and long-term goals.

- Specific

- Measurable

- Attainable

- Relevant

- Time-based

Step 4: Job researching

Spend time looking for and at possible employers. Doing so will give you an idea of which companies have openings in certain sectors of an industry. You’ll be able to determine the criteria for what companies consider a “qualified candidate.” Do extra research on companies that stand out to you specifically. Knowing specifics about the company’s goals, mission, products, policies, and company culture will enable you to understand why you want the job in the first place and how it aligns with the goals you’ve set in the step prior.

Additional Tips:

- Attend career fairs and on-campus recruitment

- Sign up for employer workshop series

- Do an informational interview by talking to someone in your profession

- Read professional journals, books, and trade magazines

- Join LinkedIn or other forums to find groups related to your industry

- Utilize directories to narrow down your company search

Step 5: Create a unique personal value proposition

At the core of your career strategy is your personal value proposition (PVP). Once you have done your research, setting a clear target will make you most effective. You will prefer certain paths over others, so find one that needs what you have or will have to offer. Next, identify what your strengths are. Hone in on what you know and what you can do. By tying the strengths to your target career path, your PVP will bridge the gap between you and your dream position. You must consider an employer’s perspective and know why they should hire or promote you. After putting yourself in their shoes, you will realize that you need evidence to back up your strengths. Your strengths may be what the employer wants, but you need achievements and skills to back them up. A great way to give an employer an idea of your strengths and your achievements is through an exemplary resume. Additionally, knowing what to say in an interview is key.

- Resume – Constantly look to build on and update your resume (Do not just look for big names, look for real experience)

- Interviews – Attend mock interview opportunities, practice by yourself, prepare base answers for technical questions, take on as many interviews as you can, and be confident in yourself whether you succeed or learn.

Step 6: Find a mentor

Now it is time to identify your weaknesses. Everyone has them, whether they have to do with your resume or the technical and communication skills you possess. Do not worry; it is okay to get started before you are “perfect” for your industry sector of choice.

However, once you have identified these weaknesses, a good rule of thumb is to find someone who has been where you are before and learn from them. That’s where Romero Mentoring comes in to make the path of conquering your weaknesses in the field of finance effective and efficient. We provide many in-depth, hands-on programs that train

you in the technical aspects of finance, such as financial modeling. We help you build confidence in these areas through the intense training and interview prep we offer, providing you with real sample questions a firm would ask in an interview.

Additionally, we help you not only build your resume but show you how it should look and the message it should convey. We offer courses with 200+ hours of training, internships, one on one sessions, the list goes on. 90% of our Analyst Prep Program mentees have secured positions at top firms in the finance industry, and we want to help you do the same!

Step 7: Expand your network

Strong professional networks can have a significant impact on your career success. By networking, you will develop and improve your skillset and stay current with in-demand trends in your field and job market. Moreover, networking can help you advance your career and open up more job opportunities. Increasing your contacts can also pave the way for new business, career advancement, and personal growth opportunities. A key benefit of networking is sharing information, advice, and support on challenges, experiences, and goals to gain new insights that you may not have otherwise gained. The more you put yourself out there and meet new people, the more you learn and develop valuable social skills and confidence that you can take with you wherever you go.

Here are some tips to help you get started:

- Meet new people through the people you know

- Take advantage of social media

- Share your story

- Be a good listener

- Make sure you follow up on the lead

Step 8: Gain practical experience

In school, mistakes are bad. However, in real life, mistakes help you learn and become better. Although theoretical education is important, practical experience is vital for helping you apply the knowledge and skills you learn. Practicing what you learn in class will improve your understanding of the material. As a result, your thinking process matures, and your memory of the knowledge is strengthened. For example, a business student needs to understand both business concepts and technical prerequisites to become a stronger candidate for the job market. In addition to performing well at school, the student should also look for internship opportunities to gain more practical experience and enhance their understanding of the material.

At Romero Mentoring, we provide practical internship experience immediately after teaching you the essential business knowledge and skills. We aim to improve your learning and ensure that you retain what you learn. Feel free to check out our Analyst Prep Program for college students and our Associate Program for graduate students and industry professionals.

Step 9: Give back to the community

Giving back to the community can bring people together and help bridge economic, social, and political gaps. Helping others will give you the chance to meet many new people and understand the struggles they face. This will help you broaden your horizons and gain more empathy for others. In addition, by collaborating with a diverse group of people, you can enhance your networking communication skills and gain experiences from various perspectives, which can significantly benefit your career. Many companies also consider social responsibility when designing their products and services. In addition to their company-sponsored non-profit programs, they encourage their employees to get involved in the community. By using our power and assisting others to grow, we can make this world a better place together.

Conclusion

In summary, when starting your career planning journey, there are four main things you should consider: (1) your interests, (2) your skills, (3) your values, and (4) your preferences. Make a decision matrix to evaluate which career path best aligns with your interests, passions, and goals. Identify the relative importance of the criteria you’re looking for in a career. Organize your goals by short-term and long-term. Utilize the SMART Goals list as a guide for making and setting goals. Spend time looking for and at possible employers. Doing so will give you an idea of which companies have openings in certain sectors of an industry. Identify what your strengths are. Tie these strengths to your target career path and use your achievements as evidence of the value you bring. Identify your weaknesses.

Once you have, a good rule of thumb is to find someone who has been where you are before and learn from them. Strong professional networks can have a significant impact on your career success. In school, mistakes are bad. However, in real life, mistakes help you learn and become even better. Lastly, giving back to the community can bring people together and help bridge economic, social, and political gaps. Our mission at Romero Mentoring is to empower and prepare our students for the competitive world of finance on Wall Street. We envision building a network of like‐minded students who connect and help one another and simultaneously transform into skilled professionals. So, if you need help with your career plan, building hard and soft skills, or want to elevate yourself above your peers, Romero Mentoring has your back and your future in mind!

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Student Reviews

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

References

- https://www.betterup.com/blog/career-planning

- https://bestcompaniesaz.com/career-goals/

- https://www.montclair.edu/chss/wp-content/uploads/sites/210/2019/03/Feb2011GuidetoCareerPlanning.pdf

- https://www.ef.com/wwen/blog/efacademyblog/importance-giving-back-to-your-community/#:~:text=In%20addition%20to%20the%20health,meet%20lots%20of%20new%20people.

- https://www.guider-ai.com/blog/mentoring-benefits

- http://club.noteshelf.net/7-reasons-why-practical-learning-is-important-to-students/

- https://www.thebalancecareers.com/how-to-research-a-company-2058508

- https://meratas.com/blog/importance-networking-career-success/