Different from the banks where we store and withdraw our money, investment banks assist governments, corporations, or other entities to raise or create capital. Investment banks may provide advice on how much a company is worth and how best to structure a deal on acquisition, merger, or sale. Investment banking analysts are experts who understand the feasibility of large projects. They help investors to identify the risks of their projects before they invest money and time.

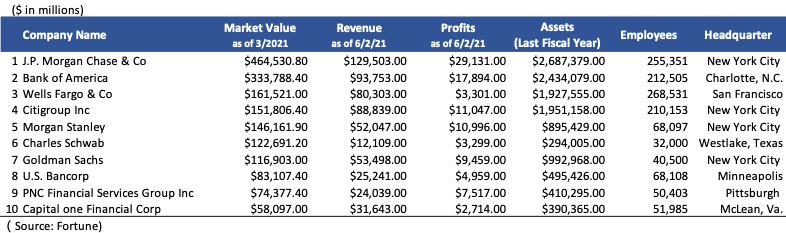

Here’s a list of the top 10 investment banks in the US ranked by Market Value of the firms:

1. JPMorgan Chase & Co – one of the world’s oldest, largest, and best known financial institutions

- Culture – The company fosters a diverse and inclusive community for all its employees and is continually investing in new ways to develop all of its people to grow and be successful.[1]

- Services – The J.P. Morgan side of the company is responsible for its investment banking, asset management, private banking, and private wealth management divisions, while the Chase brand handles credit card services in the U.S. and Canada.[2]

- Global M&A Advisor Ranking – No. 3[3]

- First-year investment banking analyst average base salary: $78,004/year[4]

2. Bank of America Corporation – the second-largest banking institution in the U.S., serving more than 10% of all American bank deposits[5]

- Culture – The company has built a strong culture of inclusion by fostering an environment of trust and engagement, where all employees are empowered to bring their whole selves to work.

- Services – The company focuses on helping individuals navigate every stage of their financial lives, working with large and small companies, and providing insights, ideas, and award-winning research for institutional investors.

- Global M&A Advisor Ranking: No. 4[3]

- First-year investment banking analyst average base salary: $89,263/year[6]

3. Wells Fargo & Co – make money by lending out at a higher rate than it borrows.[7]

- Culture – Wells Fargo strengthen communities through diversity & inclusion, economic empowerment, and sustainability.

- Services – It provides a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

- Global M&A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $92,133/year[8]

4. Citigroup Inc – expertise for companies within the energy, technology, financial intermediaries, and healthcare industries[9]

- Culture – Citi bank, first and foremost, responsibly provides financial services that enable growth and economic progress. They also value responsible finance, core business, ethics, and citizenship.[10]

- Services – The bank’s core activities are safeguarding assets, lending money, making payments, and accessing the capital markets on behalf of their clients.[11]

- Global M&A Advisor Ranking: No. 5[3]

- First-year investment banking analyst average base salary: $ $91,594 – $99,235/year[12]

5. Morgan Stanley – an industry leader in wealth management across all channels and segments[13]

- Culture – The bank puts clients first, leads with exceptional ideas, commits to diversity and inclusion, and gives back.[14]

- Services – offers products and services in brokerage and investment advisory, retirement plans, and financial and wealth planning services, among other things.[15]

- Global M&A Advisor Ranking: No. 3[3]

- First-year investment banking analyst average base salary: $92,949/year[16]

6. Charles Schwab – leading custodian for independent advisors

- Culture – The company believes in every firm of every size deserves world-class support and everything they need to grow and succeed by committing millions in resources.[17]

- Services – It offers banking, commercial banking, an electronic trading platform, and wealth management advisory services to both retail and institutional clients. It provides industry-leading custody service with no asset management minimum, no custody fees, and no intention to raise them.

- Global M&A Advisor Ranking: N/As

- First-year investment banking analyst average base salary: $73,870/year[18]

7. Goldman Sachs – one of the world’s largest investment banks in the world by revenue

- Culture – The company values teamwork, client service, and giving back to the communities they serve.

- Services – It provides services across investment banking, securities, investment management, and consumer banking to a diversified client base, including corporations, financial institutions, governments, and individuals.

- Global M&A Advisor Ranking: No. 1[3]

- First-year investment banking analyst average base salary: $ $82,380 – $96,025/year[19]

8. U.S. Bancorp – No. 1 in the Superregional Banks industry[20]

- Culture – The corporate culture is to create a workplace that reflects your values.

- Services – The bank provides a full range of financial services, including lending and depository services, cash management, capital markets, and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage, and leasing.

- Global M&A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $59,324/year[21]

9. PNC Financial Services Group Inc – No. 2 in the Superregional Banks industry

- Culture – The company holds all employees and managers accountable for demonstrating the values with customers and with one another. The bank’s critical values to success are customer focus, diversity & inclusion, integrity, performance, quality of life, respect, and teamwork.

- Services – Its businesses are engaged in retail banking, including residential mortgage, corporate and institutional banking, and asset management.

- Global M&A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $92,133/year[22]

10. Capital One Financial Corp – one of the largest credit card companies[23]

- Culture – The bank advocates for an equitable and inclusive society. Its mission is to change banking for good by bringing humanity, ingenuity, and simplicity to banking.[24]

- Services – It specializes in credit cards, auto loans, banking, and savings accounts.

- Global M&A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $89,746/year[25]

Closing

Top investment banks are prestigious and glamorous. They are the most desirable place where investment bankers want to work at. However, the companies are highly selective when recruiting. If you wish to work in one of the top 10 investment banks, then it is vitally important for you to gain your competitive edge and become a stronger candidate. You can start preparing yourself early by learning more technical skills and enhancing your soft skills.

Check out Romero Mentoring’s Analyst Prep Program. It teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Romero Mentoring’s Analyst Prep Program

In just 15-weeks, you can become a world-class finance professional. The Romero Mentoring Analyst Prep Program is an all-inclusive internship, mentorship, and training experience like no other. Learn the in-depth principles of finance and apply what you learn through an extensive internship led by a finance professional with over 12 years of experience. Learn more here.

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training and internship programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped hundreds of students start their careers on Wall Street through our Analyst Prep and Associate Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.

In just 15-weeks you can become a world-class finance professional with our fully immersive internship and Investment Banking Training Programs.

Sources:

- https://www.jpmorganchase.com/about/people-culture

- https://fortune.com/company/jpmorgan-chase/

- http://graphics.wsj.com/investment-banking-scorecard/

- https://www.glassdoor.com/Salary/J-P-Morgan-First-Year-Analyst-Salaries-E145_D_KO11,29.htm#:~:text=The%20average%20salary%20for%20a,per%20year%20for%20this%20job.

- https://fortune.com/company/bank-of-america-corp/

- https://www.glassdoor.com/Salary/Bank-of-America-Analyst-Salaries-E8874_D_KO16,23.htm

- https://www.investopedia.com/articles/markets/093014/how-wells-fargo-became-biggest-bank-america.asp

- https://www.glassdoor.com/Salary/Wells-Fargo-Investment-Banking-Analyst-Salaries-E8876_D_KO12,38.htm

- https://www.citibank.com/commercialbank/network/united-states/en/

- https://careers.citigroup.com/why-citi/our-values.html

- https://www.citigroup.com/citi/about/mission-and-value-proposition.html

- https://www.glassdoor.com/Salary/Citi-First-Year-Analyst-Salaries-E8843_D_KO5,23.htm

- https://fortune.com/company/morgan-stanley/

- https://www.morganstanley.com/about-us

- https://www.investopedia.com/articles/markets/082515/how-morgan-stanley-makes-its-money-ms.asp#:~:text=Morgan%20Stanley%20offers%20products%20and,revenues%20and%20net%20interest%20income.

- https://www.glassdoor.com/Salary/Morgan-Stanley-Investment-Banking-Analyst-Salaries-E2282_D_KO15,41.htm

- https://advisorservices.schwab.com/

- https://www.glassdoor.com/Salary/Charles-Schwab-Analyst-Salaries-E144_D_KO15,22.htm

- https://www.glassdoor.com/Salary/Goldman-Sachs-First-Year-Analyst-Salaries-E2800_D_KO14,32.htm

- https://www.usbank.com/about-us-bank/company-blog/article-library/fortune-names-us-bank-one-of-the-2021-worlds-most-admired-companies.html

- https://www.glassdoor.com/Salary/U-S-Bank-Financial-Analyst-Salaries-E8937_D_KO9,26.htm

- https://www.glassdoor.com/Salary/PNC-Financial-Services-Group-Investment-Banking-Analyst-Salaries-E507_D_KO29,55.htm

- https://www.investopedia.com/articles/markets/101415/how-capital-one-makes-its-profits.asp

- https://www.capitalone.com/about/

- https://www.glassdoor.com/Salary/Capital-One-Business-Analyst-Salaries-E3736_D_KO12,28.htm