Bitcoin is the first and widely used cryptocurrency built on principles of computer science, cryptography, and economics.

Bitcoin was created in 2008 by Satoshi Nakamoto. We currently do not know who Satoshi Nakamoto is, and he could be she, it, they, etc. but for this paper, we will refer to Nakamoto as he. He published the Bitcoin white paper which explains the inner workings of Bitcoin – the underlying technology behind it and solutions he attempted to solve to make finance decentralized. The white paper envisioned a currency where users do not rely on financial intermediaries like banks or trust anyone to make transactions with each other.

For clarity purposes, Bitcoin (with a capital B) refers to the entire network and community and bitcoin (with a lower-case b) refers to the currency itself, a unit.

Bitcoin was designed to be a deflationary currency, meaning that there will only be a limited number of bitcoins that will ever exist. Bitcoin was created so that there will only be 21 million bitcoins. Today, about 18 million out of the 21 million are in circulation.

Bitcoin represents a shift towards privacy and decentralization – this currency is not backed by any central organization, government, or company.[1]

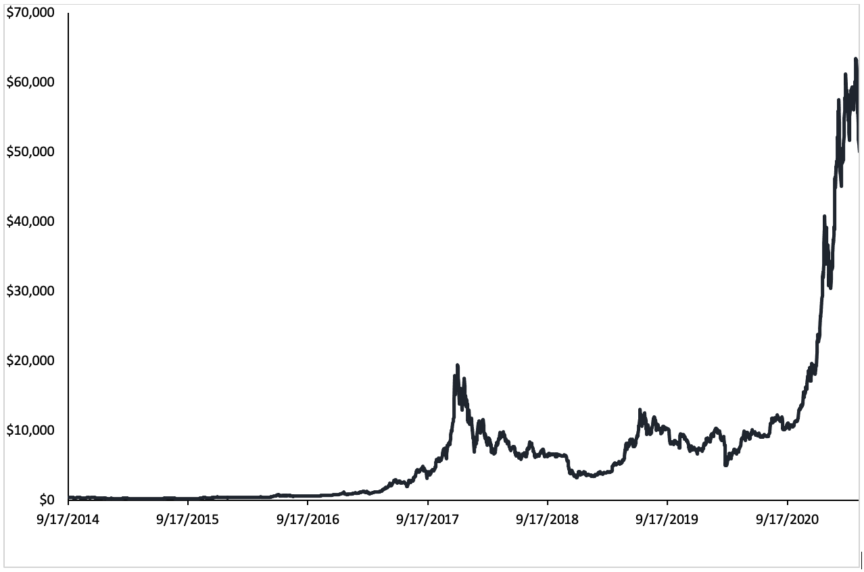

On the price chart of Bitcoin below (courtesy of Yahoo Finance), we can see that the rally behind bitcoin didn’t really start until the end of 2016. At the beginning, Bitcoin wasn’t known to the public. Nakamoto sent the Bitcoin white paper out to a few cryptographers. From there, the people who knew about the project slowly grew. Some people believed in it and mined bitcoin. Most of the bitcoin in circulation today are from mining in the early stages since Nakamoto wanted most of the coins out then. Bitcoin hit its previous all time high towards the end of 2017 reaching almost $20,000. The second surge of Bitcoin’s price came in November 2020. Bitcoin broke its all-time highs of $20,000 and reached up to $63,729 – more than triple! During the second surge, more retail and institutional investors saw the potential behind Bitcoin.

Some key events during Bitcoin’s history are:[2]

- January 2009: Genesis block established (first block of data to be created)

- February 2011: Bitcoin hit $1

- November 2013: Demand for Bitcoin in China along with interest from the U.S. Senate bumped Bitcoin’s price from $30 to $1,000

- September 2015: Bitcoin was declared as a commodity by the U.S. regulator

- December 2017: Bitcoin price hit an all-time high just below $20,000

- January 2018: 80% of the total Bitcoin supply has been mined

- January 2019: Coinstar machines started selling Bitcoin at grocery stores across the U.S.

- July 2020: U.S. regulator permitted banks for cryptocurrency custody services

- December 2020: Coinbase filed for IPO

Content Preview

The History Behind Bitcoin and the Cypherpunk Movement

Cypherpunks write code. We know that someone has to write software to defend privacy, and we’re going to write it.

– Eric Hughes, The Cypherpunk’s Manifesto, 1993[3]

The Cypherpunks is a group of individuals who advocate for the protection of privacy using cryptography.[1] Many consider David Chaum the father of the Cypherpunk movement. In 1990, he started the first serious attempt of building private digital money called Digicash. Digicash couldn’t solve the problem of double spending, consequently, in 1998, the company declared bankruptcy.

Chaum and Digicash paved the way for Bitcoin and all the cryptocurrencies that followed – he laid the groundworks for the development of blockchain technology and without his experiments, Bitcoin wouldn’t exist today.

The members of the movement were concerned about their privacy rights. They were deeply suspicious of central banks and their control over monetary policy after the end of Bretton Woods (the Bretton Woods System required a currency peg to the U.S. dollar which was in turn pegged to the price of gold. This system collapsed in 1970s, but it created a lasting influence on international currency exchange and trade throughout its development of the IMF and the World Bank.[4] Many years later, their suspicions were arguably justified after the financial crisis of 2008, when central banks created massive amounts of money to bail out failing banks.[3]

Bitcoin Theft, Scandals, and Issues

Due to the anonymity of Bitcoin, people would use it for illegal activity. The most notorious scandal was the bitcoin drug scandal on the website, the Silk Road. In February 2011, the Silk Road opened as the anonymous “eBay of Drugs” which uses Tor and Bitcoin.[1] Drugs and other black-market goods became the main use for Bitcoin, but in October 2013, the FBI shut down the site and seized over $3.6 million in bitcoin. The creator of the Silk Road, Ross Ulbricht, is serving a life sentence in prison.

One of the biggest Bitcoin theft occurred in 2010s with Mt.Gox. In 2010, Jeb McCaleb created Mt.Gox which was the biggest online bitcoin exchange at that moment. In 2011, Mt.Gox suffered a significant breach of security that resulted in fraudulent trading. In 2014, Mt.Gox was handling 70% of all bitcoin transactions, but that took a turn because Mt.Gox went bankrupt – this was serious for the Bitcoin community because it was the world’s largest exchange with more than 850,000 bitcoins from thousands of users. This led to more people being skeptical about Bitcoin.

One of the biggest problems with Bitcoin is scalability. Scalability refers to the ability of a technology to be used by an increasing number of people[7] – with Bitcoin, it refers to the number of transactions that a network can confirm in a certain amount of time. In 2015, blocks within that make up the blockchain began to run out of space and transactions went unconfirmed. This is detrimental to the blockchain and the whole concept of having a decentralized system. Having missed transactions can result in increasing transaction fees and delayed processing of transactions that cannot be fit into a block.

Obtaining Bitcoin

There are a few ways to obtain bitcoin: mining, trading with other users, and purchasing from a Bitcoin ATM.

Mining bitcoin was popular during the early stages of bitcoin – it was easy for an individual user to link their computer to the blockchain and mine. However, as more companies are looking towards bitcoin mining, it is hard for individual miners to make a profit. Companies have data mining centers that consists of mine farms.

Here are the steps that a miner would have to complete before getting rewarded:

- Download the entire Bitcoin blockchain (start from genesis block)

- Verify income transactions

- Listen to the Bitcoin network for transactions

- Unconfirmed (pending) transactions sit in the mempool for a miner to include it in a block

- Create a block

- Gather transactions into a block

- Get previous block hash and other necessary metadata

- Find a valid nonce

- Find the proof-of-work

- Expend computational power

- Broadcast your block

- Broadcast to the rest of the network

- Others check transactions in the proposed block

- Profit

- Profit from block reward (coinbase transaction) and transaction fees

It is getting increasingly hard for individual miners to mine bitcoin. There is a smaller pool of bitcoin to be mined and as miners reach mining milestones, this will only increase the difficultly of solving hash problems. The last bitcoin is expected to be mined in 2140.

Once you have obtained your bitcoin, there are a few wallets you might be interested in. Bitcoin wallets keep track of your private key, and it allows you to store, send, receive and list transactions. There are two main categories of wallets: hot and cold (based on their connectivity to the internet).

- Hot wallets are connected to the internet and cold wallets are not

- Cold wallets include paper wallets, hardware wallets and brain wallets

For individual cryptocurrency investors, there are a few simple cryptocurrency exchanges that you can use to buy/sell and store your cryptocurrency. Some of the most popular ones are Coinbase, Binance, and Robinhood. One of the downfalls of using a cryptocurrency exchange is that you do not actually own the coin: you do not have access to the private keys of the cryptocurrency.

Outside of these exchanges, you can also buy bitcoin from a bitcoin ATM. There are currently 8,947 cryptocurrency ATMs and 211,239 non-ATM locations where you can buy or sell cryptocurrencies at across 71 countries.[10]

The Underlying Technology Behind Bitcoin

There are two innovative technologies behind Bitcoin: the blockchain and the proof-of-work consensus protocol.

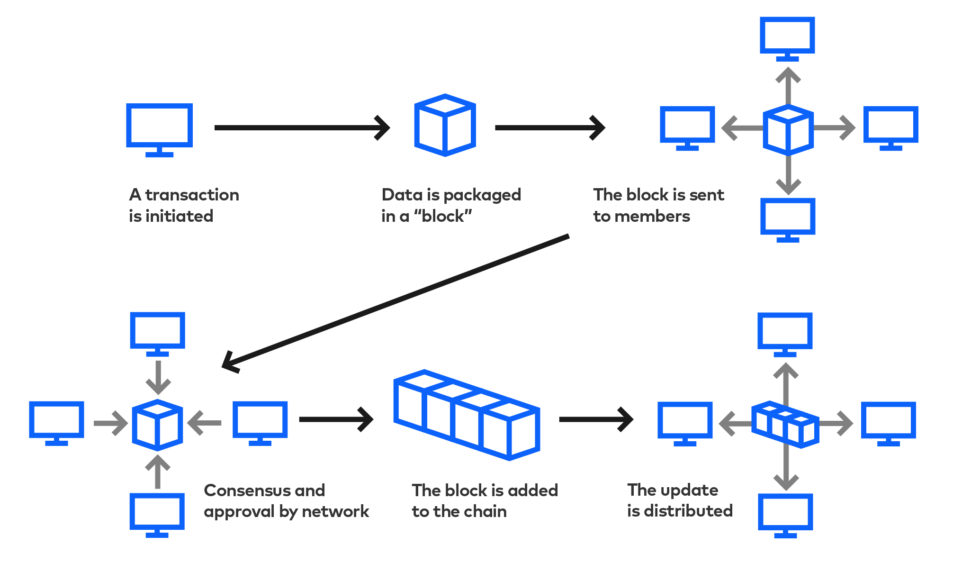

Blockchain technology solved the problem of double spending – the problem of double spending which Digicash failed to solve. Blockchain technology records all transactions on a public ledger where miners can verify each transaction. Once it is verified, it will be added to a data block where it will be chained to other data blocks. Here are the steps that the blockchain operates in:

- Every transaction is updated to the distributed database, the Blockchain ledger.

- The Blockchain ledger is a batch of transactions grouped into what are called blocks

- Every block is built off or chained to a previous block, hence “blockchain”

- Every block is an update, and a chain of blocks represents a history

- If any block is mutated, information within this block and all future blocks will change

The second innovation that Nakamoto created was the consensus algorithm known as “Proof-of-Work”. It is the method of voting that made Bitcoin the first successful cryptocurrency and inspired voting mechanisms for practically all other cryptocurrencies that followed.[1] Any time someone wants to make a change to the Bitcoin networks, they have to solve a computationally difficult problem. Your computer will try a bunch of inputs until it finds a solution to the problem, at which point it will submit the successful input along with the proposed block to the rest of the network. Proof-of-work makes participation in the consensus process expensive, and it prevents malicious entities from tampering with the transaction history. It allows the network to reach consensus without relying on a central authority.

Blockchain Technology

There are four main unique properties that make up the blockchain.

- Pseudonymous: users use pseudonyms, not real-world identities to make transactions

- Decentralized: every user possesses the same copy of the transaction history

- Immutable: it is close to impossible for any users to change the network

- Trustless: users don’t need to trust anyone they are transacting with[1]

Blockchain technology is created by a distributed system of computers that use cryptography and a consensus process to keep the members of the community in sync. A blockchain is useless in isolation.

Fun fact: blockchain was never mentioned in the Bitcoin white papers. Nakamoto referred to it as “proof of work,” and some early Bitcoiners believe that the word blockchain should only be used if proof of work is involved.

Use of Blockchain Technology in Other Industries[6]

Today, blockchain technology can be used in almost all industries. Let us focus on four main industries: financial services, healthcare, agriculture, and entertainment.

- Financial services: Blockchains can serve as a digitized, secure and tamper-proof ledge that enhances accuracy with information sharing in the financial services ecosystem. In financial services, blockchain technology offers a secure and cheap way of sending payments – it also cuts down on the need of third parties.

- Some popular banks that are implementing blockchain technology are Credit Suisse and J.P. Morgan.

- Credit Suisse is using blockchain technology to settle US stock trades, and JPM created their own cryptocurrency called the JPM Coin.

- Healthcare: Blockchains can allow hospitals, payers, and other parties in the healthcare value chain to share access to their networks without compromising data security and integrity. Blockchain can also enforce safer drug production. If errors are made, they can be caught and traced to the source.

- Additionally, in the pharma industry, rather than focusing on clinical testing and FDA approvals, we can use a blockchain ledge to create an efficient system that opens the door for faster innovation and a better regulated production.

- Agriculture: A decentralized blockchain system could improve transactions, market expansions, and product specific logistics throughout the agriculture supply chain.

- A blockchain record can establish a level of trust between merchants and encourage healthy competition between sellers.

- Blockchain tech is already helping to improve safety, traceability, and sustainability in animal breeding and livestock.

- Entertainment: Entrepreneurs are turning to blockchain technology to make content sharing fairer for creators using smart contracts – this can help with pre-determined licenses and revenue distribution between parties.

- Blockchain technology can also help reduce the cost of video traffic by decentralizing video encoding, storage and content distribution. Non-fungible tokens (NFTS) are digital artworks that people can buy, sell and trade on the internet and it is a huge market right now.

Altcoins: Bitcoin Alternatives

Altcoins are alternatives to Bitcoin. The altcoins are generally designed to address a perceived shortcoming with the Bitcoin framework, whether it’s speed, mining cost or some other factor. One of the benefits of using altcoins as a payment method, in addition to secure blockchain technology, is the relatively low transaction fees charged for each transaction.

Almost all altcoins go through the initial coin offering (ICO) process. Entrepreneurs looking to launch a new cryptocurrency can do it through an initial coin offering (ICO), a variation of an initial public offering (IPO). Currently, there’s very little regulation on ICOs in America, meaning if you can get the tech set up, you’re free to try and get your currency funded. In an ICO, a quantity of cryptocurrency is sold in the form of “tokens” (“coins”) to speculators or investors, in exchange for legal tender or other (generally established and more stable) cryptocurrencies such as Bitcoin or Ethereum. The tokens are promoted as future functional units of currency if or when the ICO’s funding goal is met, and the project successfully launches.

Some of the biggest altcoins consist of Ethereum, Litecoin, and Dogecoin.

Ethereum is the second biggest cryptocurrency after Bitcoin. Ethereum is a “community-run technology powering the cryptocurrency, ether (ETH) and thousands of decentralized applications.”[8] Rather than having a coin like Bitcoin, people can run their own distributed applications on top of Ethereum’s blockchain and use their coin, ether, to make transactions. Some of the key features that sets Ethereum, and Bitcoin apart are Ethereum enables smart contracts and distributed applications, and there is finite number of ether. Ethereum releases 18 million ether a year, however, there is no lifetime limit on the potential number of coins.[8]

Litecoin is a complement to Bitcoin. Litecoin is a global payment network that is decentralized and open sourced. One of the main difference between Litecoin and Bitcoin is their algorithm. Bitcoin uses the SHA-256 algorithm, whereas Litecoin uses Scrypt. Litecoin can process more transactions at a faster rate with Scrypt, however, SHA-256 is a more complex algorithm with a greater degree of parallel processing.[9]

Dogecoin, which started off as a meme gained huge popularity due to celebrities and entrepreneurs like Elon Musk promoting it. Only 21 million bitcoins will ever exist, but with dogecoin, there is a total of 129 billion coins!

Although this article isn’t an investment thesis, it is important to understand the beginnings of Bitcoin and its achievements. It is now an asset class and the underlying technology behind Bitcoin (blockchain technology) might revolutionize our industries!

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Sources

- Bitcoin and Cryptocurrencies: edX course at UC Berkeley

- 99bitcoins.com

- nakamoto.com

- Chen, James. “Bretton Woods Agreement and System.” investopedia.com, 28 April 2021

- slalom.com

- “Banking Is Only The Beginning: 58 Big Industries Blockchain Could Transform.” CIBInsights, 3 Mar. 2021

- Sharma, Rakesh. “Bitcoin’s Lightning Network: 3 Possible Problems.” investopedia.com, 20 Mar. 2021

- ethereum.org

- Fernando, Jason. “Bitcoin vs. Litecoin: What’s the Difference?” investopedia.com, 11 Mar. 2021

- atmia.com