What is Infrastructure Investment Banking?

According to Goldman Sachs’ Brian Bolster, the traditional infrastructure asset class is associated with “bridges, toll roads, ports,” which produce consistent and low-risk dividends.[1] However, in recent years, the definition of the asset class has expanded to investments that offer higher returns and higher risk such as: “data centers, energy infrastructure, pipelines, and renewable projects.” This infrastructural asset class is capital intensive and has a high barrier to entry, which creates a hyper-competitive market.

Content Preview

Role of an Investment Banking Analyst in Infrastructure Investment Banking:

The role of an investment bank is to raise capital for governments, companies, and other organizations and is responsible for executing deals on acquisition, merger, or sale, which helps investors to save time and money. The investment bank offers clients many different services or products including mergers & acquisitions, equity capital markets, debt capital markets, and leveraged finance. For analysts working in the infrastructure coverage group, the investment banking analyst must focus on the health of the economy, treasury yield, taxes amount, construction budget, and federal funds rate.

Why Infrastructure Investment Banking?

The global infrastructure market size is valued at over $400 billion, and currently, the supply of attractive projects has fallen short compared to the demand. According to the American Society of Civil Engineers, over the next decade, it is estimated that the U.S. infrastructure requires a $2.39 trillion investment to reverse six decades of under-investment.[2] Additionally, the proposal of the Biden administration’s ‘American Jobs Plan’ will allow for more public investments.[5] Currently, the infrastructure sector has extensive funds that are ready to be deployed as investors raised $97 billion in total equity in 2019, however, investment opportunities have been stagnant in North America.[1] Therefore, the substantial amount of capital combined with the initiative to modernize American infrastructure offers a promising outlook for any future investment banking analyst who is interested in covering the infrastructure asset class.

Top I.B. Infrastructure Deals in 2019 – 2020

According to IJGlobal, an infrastructure journal and project finance magazine, the 2020 Infrastructure and Project Finance League Table Report provides a comprehensive view of the global market. The acquisition of 70% in Saudi Basic Industries Corporation (SABIC), in the Middle East and North Africa region, by the petroleum and natural gas company Saudi Aramco was the largest infrastructure finance deal, having been closed on June 17th, 2020. In March 2019, Aramco had agreed to pay $32.90 a share for 70% of Saudi Arabia’s sovereign wealth fund (PIF) stake in SABIC, having a total value of $69.1 billion.[3] The transaction allowed Saudi Arabia’s government to gain a significant amount of cash for the country’s sovereign wealth fund, which was essential to Saudi Arabia’s economic transformation plan to reduce its oil dependency.

Global Top 10 Infrastructure Finance Deals – Full Year 2020

| Rank | Transaction Name | Transaction Location | Transaction Sector | Transaction Value ($m) | Financial Close Date |

|---|---|---|---|---|---|

| 1 | Acquisition of 70% in Saudi Basic Industries Corporation | MENA | Oil & Gas | 69,064 | 17/06/2020 |

| 2 | Area 1 Mozambique LNG | Sub-Saharan Africa | Oil & Gas | 22,578 | 01/10/2020 |

| 3 | Amur Gas Processing Plant | Europe | Oil & Gas | 21,374 | 03/03/2020 |

| 4 | General Electric Refinancing | North America | Renewables, Power | 15,000 | 20/04/2020 |

| 5 | Acquisition of CK Hutchison European Tower Portfolio | Europe | Telecoms | 11,770 | 12/11/2020 |

| 6 | Dogger Bank A and B Offshore Wind Farms (2.4GW) | Europe | Renewables | 10,743 | 26/11/2020 |

| 7 | Acquisition of 49% in ADNOC Gas Pipeline Assets | MENA | Oil & Gas | 10,140 | 23/06/2020 |

| 8 | Saudi Aramco Additional Facility | MENA | Oil & Gas | 10,000 | 07/05/2020 |

| 9 | Glencore Refinancing | Europe | Mining | 9,975 | 20/05/2020 |

| 10 | ExxonMobil Bond Facility | North America | Oil & Gas | 9,500 | 15/04/2020 |

North America Top 5 Deals – Full Year 2020

| Rank | Deal Name | Location | Sector | Value ($m) | Close Date |

|---|---|---|---|---|---|

| 1 | General Electric Refinancing | United States | Renewables, Power | 15,000 | 20/04/2020 |

| 2 | ExxonMobil Bond Facility April | United States | Oil & Gas | 9,500 | 15/04/2020 |

| 3 | ExxonMobil Bond Facility March | United States | Oil & Gas | 8,500 | 20/03/2020 |

| 4 | Acquisition of Zayo Group Holdings | United States | Telecoms | 8,400 | 09/03/2020 |

| 5 | JFK International Airport New Terminal 1 P3 | United States | Transport | 8,087 | 15/06/2020 |

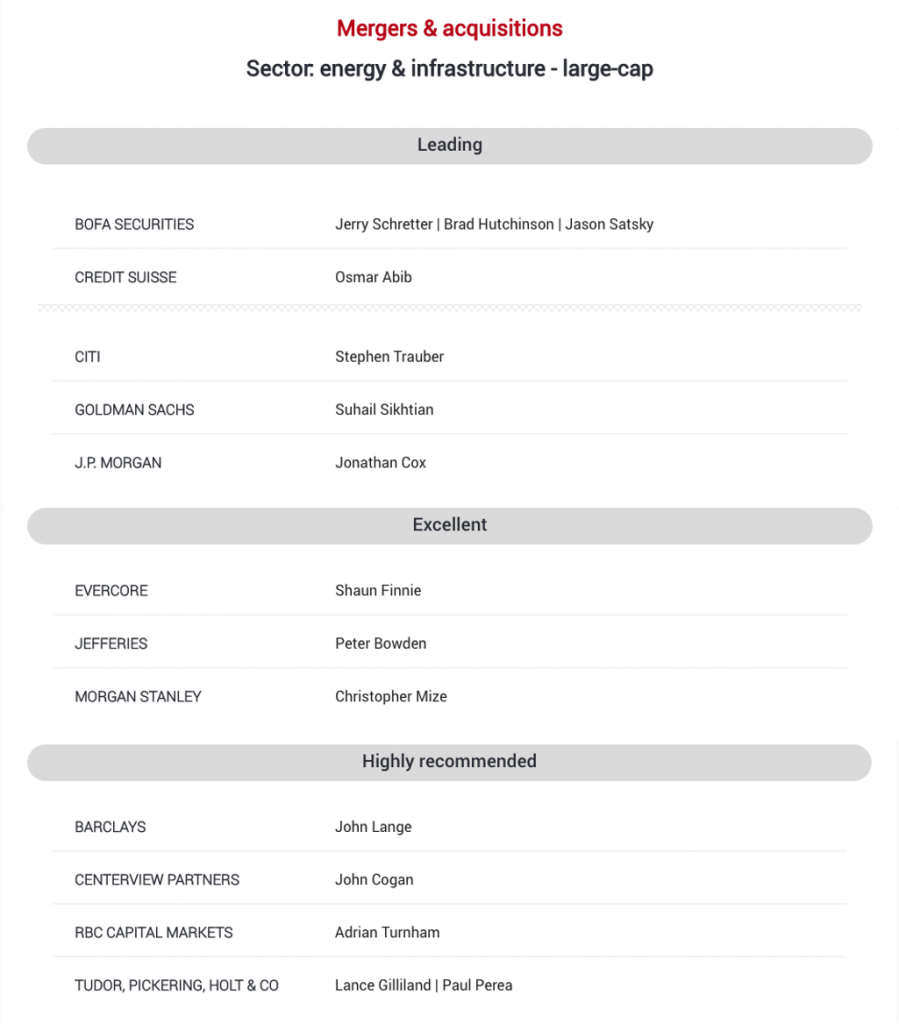

Key Professional Investment Bankers

From the rating agency for top executives, Leaders League, the key professional investment bankers for the energy & infrastructure sector are listed below. For 2021, the leading firms covering energy and infrastructure all belong to the top bulge bracket investment banks. Along with bulge bracket investment banks, elite boutique banks such as Evercore, Jefferies, and Centerview Partners trail closely behind. Among bulge bracket and elite boutique investment banks, Tudor, Pickering, Holt & Co., an investment firm that focuses on the global energy industry, maintains its position as a leading firm.

Source: Leaders League

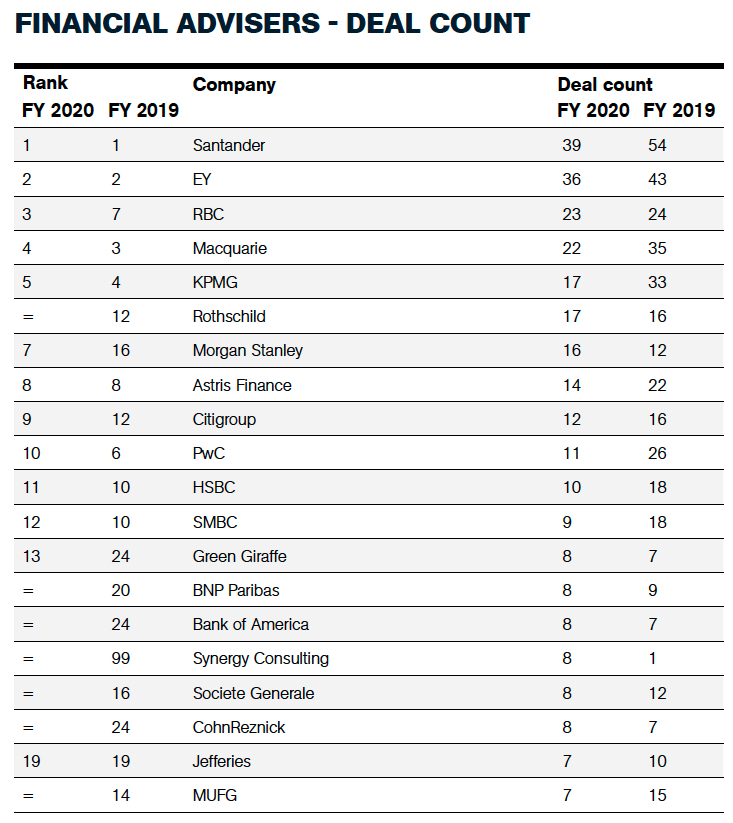

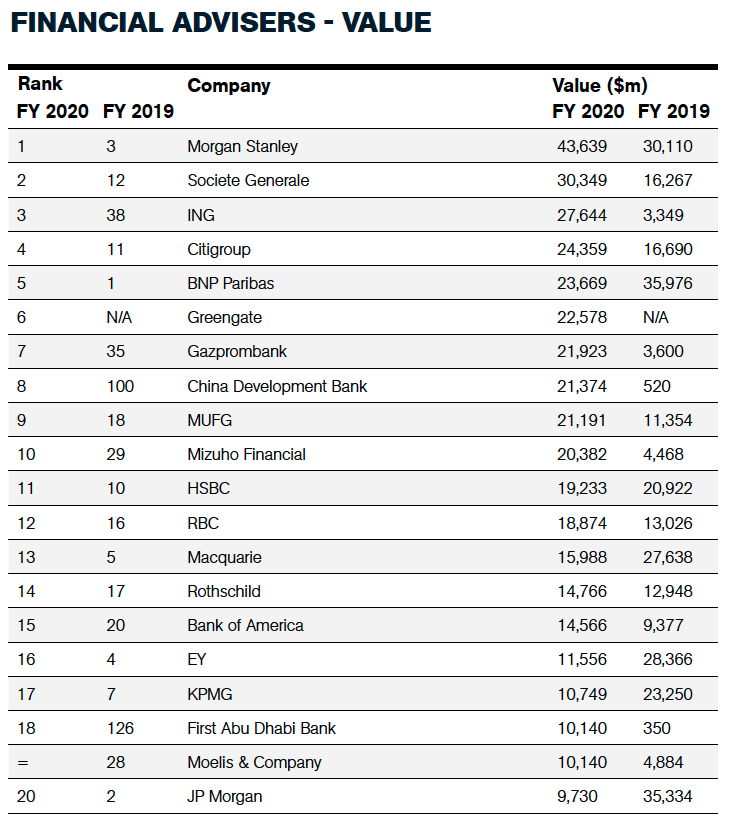

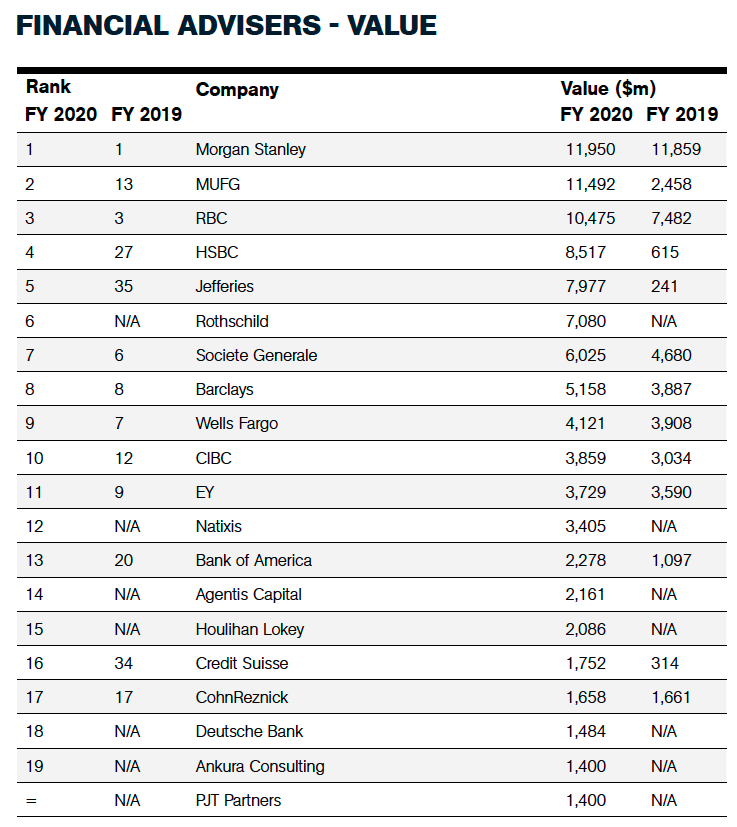

Infrastructure Investment Banking League Tables

From the IJGlobal report, the two figures below represent the value amount created from financial advisers globally and in North America. Overall, global infra deals value a total of $1.43 trillion for over 3,000 transactions.[6] While North America infrastructure finance value and deal count figures amount to $450 billion for 932 deals in 2020, which comes in second after Europe.[6] For financial advisers from the top 20 companies, the value amount created a total of $372 trillion globally and $98 trillion in North America.[6]

If you want to take the initiative and equip yourself with market research, industry knowledge, and your due diligence on the promising infrastructure industry, there are some next steps you can take. Once you build this industry knowledge, it is time to bolster that with fundamental and technical skills that you can apply on the job. There is no better option to gain these professional and technical skills than through the programs offered by Romero Mentoring.

Global:

Source: IJ Global League Tables Full Year 2020

Global:

North America:

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Sources:

- Goldman Sachs Briefings. “The Evolution of Infrastructure Investing.” Goldman Sachs. 4 Feb. 2020.

- Monier, Stéphane. “Investing in the US’ infrastructure recovery.” Lombard Odier. 19 April, 2021.

- Martin, Matthew. “Oil giant Saudi Aramco completes $70 billion takeover of Sabic.” Bloomberg. 17 June, 2020.

- Leaders League. “Mergers & acquisitions, Sector: energy & infrastructure – large-cap.”

- Briefing Room. “FACT SHEET: The American Jobs Plan.” The White House Briefings. 31 Mar. 2021.

- IJGlobal. “IJGlobal League Tables – full-year 2020.” IJGlobal. 02 Feb. 2021