I was recently given the opportunity to sit down and talk with investment banking analyst, Karthik Nataraj. As an aspiring investment banking analyst myself, I wanted to truly understand the world of investment banking, as well as the day-to-day responsibilities. Nataraj, a second-year analyst at Financial Technology Partners in San Francisco, was able to provide key insights into the industry that are applicable to undergraduates looking to break into investment banking, as well as some high-performance tips for interviews and general work. The following are snippets of our conversation.

Main Takeaways:

- Experience builds upon itself.

- Tailor your interview story to address your weaknesses.

- Develop your professional network early, especially during your undergraduate years.

- Gain experience as early and as often as you can.

What has your experience been like breaking into the world of investment banking?

Investment banking (IB) is a difficult industry to break into; there’s so much jargon at a basic level that you need to know in order to do well in interviews. It also definitely doesn’t hurt to know people at the firms and groups you’re interviewing for. Experience also builds on itself, which means that it’s hard to get an investment banking job or internship without having a prior investment banking job or internship.

My experience breaking into IB personally was certainly difficult. I joined the Romero Mentoring program with an interest in finance, wanting to understand how the pricing and valuing of companies worked. I started out with no finance knowledge but eventually developed the vocabulary to begin to understand the questions in the IB interview process. Eventually, I went into the full-time recruiting process and I went in specifically wanting to work at a boutique firm to gain more exposure and experience with clients. I also wanted to work in tech IB and work with high growth, innovative tech companies. FT Partners was a great fit for me and I enjoyed speaking with everyone I met during the interview process, which helped to solidify my decision. I even got the opportunity to speak with the CEO and it was interesting to see the knowledge and perspective he had on FinTech. I definitely worked hard throughout this process but enjoyed getting into the weeds on certain things and learned a ton overall.

What was the greatest experience or advice you received that helped you along your journey into investment banking?

One of the things that became clear to me as I went through the IB recruitment process (which I can articulate more now that I interview candidates myself) is that you need to put yourself in the employer’s shoes when telling your “story”. You need to assess your strengths and weaknesses and then tailor your story to play to your strengths as well as address any apparent weaknesses. Investment banks are like any kind of employer: they hire successful candidates in their field who plan to stick around and contribute to their firm’s success. What that means is they want someone who is going to succeed in their analyst program. If you have never had an IB internship or experience, then you are a “higher risk” hire because you do not know what IB is truly about, or may not do as well from the employer’s standpoint.

During interviews assess your strengths and weaknesses from an employer standpoint and then address those concerns. Address lack of IB internships by talking about times when you have had a significant workload and showcase times when you have been in front of external parties (like clients) and talk about those things so that the interviewer knows that you can handle that type of work as an analyst and will be the type of person to succeed in this role.

If you could go back in time to your undergraduate years at Berkeley, what are some things you would have done differently and why?

I would have joined more finance-related organizations while in college. I was an economics major and I focused my time on econ clubs and research. I know how important the recruiting channels are from finance clubs and business organizations because we use them to find candidates for our firm all the time. A junior banker can say ‘I was in this club – it’s good and the people in it would be a good fit,’ and then you as a candidate, if you’re a part of that ecosystem, stand out as someone we might want to talk to. Collecting your network early is important with people in college as well, which you can also do through these clubs. Juniors and seniors in those clubs are the ones who eventually become full-time employees at the types of firms you might want to join one day.

What was a deal you worked on in investment banking and why was it particularly memorable or impactful to you?

I’ve been lucky to work on some great deals so far even within my first year and a half at FT Partners. One in particular was a capital raise for Remitly, an online remittance company that helps immigrants send money back to their home country. It’s based out of Seattle and it’s one of the hottest fintech companies out there. It has a very innovative, young, and dynamic team.

I worked directly with a Director and another Analyst on this deal, and the small deal team meant that I got to spend a lot of time directly with the client. I was even lucky enough to answer questions directly from investors, and it helped to elevate my game a bit in terms of my role and credibility. I was able to play the Associate role in this deal and get that experience as well, which was great. We helped them complete their Series E equity raise of $135 million led by Generation Investment Management. It later became nominated as a Deal of the Year by Geekwire. This was an incredibly rewarding deal to work on.

As a contemporary question, what are your thoughts on the coronavirus’ impact on the stock market and how has it affected deal making and your day to day?

The situation changes pretty much day-to-day at this point, but essentially with the coronavirus, you have a supply-side problem where supply chains are being disrupted and companies cannot get goods on time because of shipping delays, etc. There is also a demand-side problem because in the longer-term, lots of normal consumer things will be disrupted, like travel, tourism, restaurants, and large purchases, and that is a real demand-side problem.

The question is, will the Fed’s cutting interest rates increase lending and be the factor to solve the supply-side problem and the rapid reduction in demand? It may boost the market in the short term, but in the longer term, the stock market has no idea what could happen or what the economic forecast could be, and this is being reflected in all the volatility now.

In terms of how it’ll impact deal making, tech theoretically has a little bit more insulation from all of this. The stock market is generally down, which means depressed prices and potentially lower earnings. This may mean that strategic buyers will not make huge acquisitions right now. Of course this is speculation right now, but maybe the pendulum will swing to a lot more private deals made by private equity firms. PE firms have a lot of dry powder right now and investors will look for returns elsewhere if they can’t find it in the stock market.

My Reaction and Thoughts on the Interview with Karthik Nataraj

This interview was particularly insightful to me, especially as someone who is looking to go into investment banking. One of the major takeaways from this interview was Nataraj’s view that experience gets compounded and builds upon itself. While seemingly obvious, it really allows for one to see the benefit of going the extra mile in his or her work and taking on additional tasks.

His other suggestion is to get as many experiences and opportunities as you can and as often as you can. This may mean sacrificing that ‘easy semester’ to pick up a seasonal internship or joining another finance club or business organization. In an industry like investment banking, sacrifice and dedication and experience, as evidenced through Nataraj’s story, can help you get a leg up and break into the world of finance.

My own recommendation on how to end up in an investment banking role like Nataraj is to follow his advice and start by getting some experience. Nataraj, for example, began with an internship under Romero Mentoring and I myself am going through the same experience. An internship and technical training under Romero Mentoring can be your first experience upon which you can continually build in order to end up in your dream finance role.

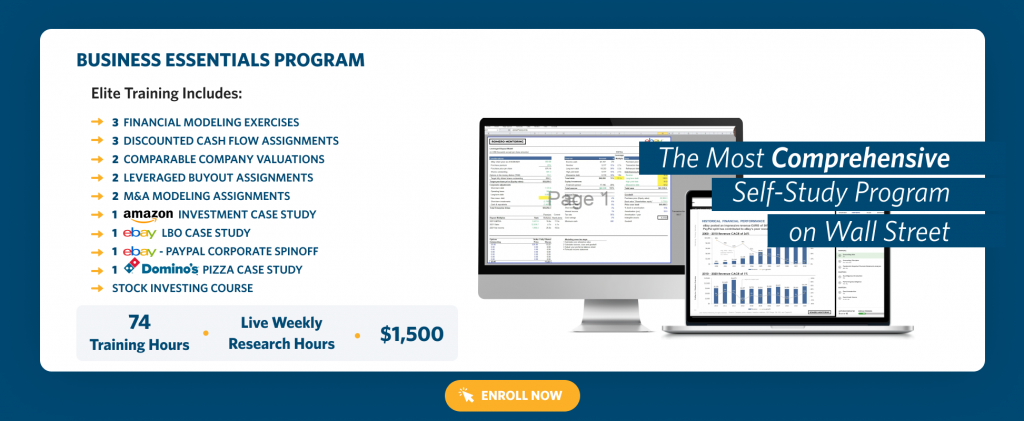

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.