Introduction

Since time immemorial, C-Level Executives have often been found talking about growth. The typical strategy growth options are organic, inorganic, or by external means. Organic growth comes from strategic recruitment, product innovation, geographic expansion, etc. The best example of inorganic growth is acquiring a company to penetrate a different market segment, product line, or geography. Joint ventures, strategic alliances, franchising are all examples of external growth. In the context of this article, we will be focusing on Mergers and Acquisitions as a means of Inorganic Growth.

What are Mergers and Acquisitions?

Mergers and Acquisitions are terms that are used interchangeably but shouldn’t be. A Merger is a combination of two or more companies in which assets and liabilities of a selling firm(s) are consumed by the buying firm.

On the other hand, an Acquisition is the purchase of an asset such as a plant, a division, or even an entire company.[1]

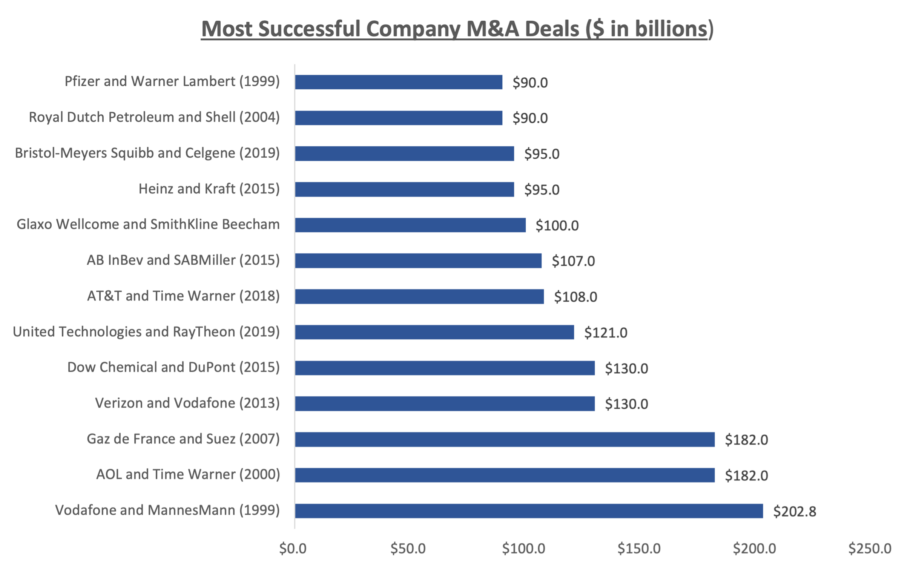

On the surface, both terms might seem the same but in reality, they are completely different. A merger is when two companies join together as peers to become one. An acquisition is when one company buys the assets or shares of another company by paying cash, securities, or other important assets. Below is a list of the biggest M&A deals to highlight the industry size.[1]

Why do companies Merge with and/or Acquire other companies?

The most basic answer to this question boils down to growth. This strategic decision helps companies grow their market share and diversify their business. This gives companies an edge to compete in the market, which allows them to grow faster than their competitors. The second reason why companies merge with or acquire other companies is synergies.[2]

In the business world, synergies are the concept that the value and the performance of two companies combined will be greater than the sum of the separate individual parts. Synergies are mostly related to trimming costs and increasing revenue.[2]

Cost Saving Synergies include shared IT, increased supply chain pricing power, improved sales and marketing, lower wages, and efficient R&D.[3]

Revenue Synergies result from Cross-Selling, Reduction of Competition, and access to new markets. Now the question that arises is if Mergers and Acquisitions are so lucrative to drive growth, why doesn’t every company follow the same path?[3]

Content Preview

Studies put the failure rate of Mergers and Acquisitions somewhere between 70% and 90%

This statistic clearly outlines the risk behind entering into a Merger and/or Acquisition. There are many reasons why a deal could go wrong but for the purpose of simplicity, let us examine the top 3 reasons why deals go bad:

- Overpaying: The most attractive target companies operate under the assumption that if a buyer is willing to pay a premium, then their business is for sale. Hence, buyers must set a limit on the purchase price before starting the negotiation. The direct by-product of overpaying is over-estimating synergies. Achieving the desired cost and revenue synergies is extremely complex and requires great leadership. Lack of leadership, planning, and preparation puts downward pressure on companies to meet their targets.[5]

- Lack of due diligence: Due diligence helps buyers understand what they are buying and eliminates chances of misunderstanding the target company. Many firms skip this process to close the deal as soon as possible. However, what looks good on paper might not look good in practice. This is one of the fundamental causes of why bad deals happen to good people.[5]

- Lack of cultural fit: Culture is a big aspect of any company. This defines the productivity of employees, the core competencies of companies, and is an essential factor in promoting growth. Having said that, a Merger does not happen between two companies, but it happens between two communities. If the views or ideologies of one community do not match with others, it becomes a recipe for disaster.[5]

Let us examine who is behind making these deals happen

When companies are looking to merge with or acquire another company, they typically go to an Investment Bank. Bankers advise companies and execute transactions on their behalf. However, there are two sides to this coin: Sell-Side and Buy-Side. The terms are quite self-explanatory in the sense that the sell-side team helps companies that are looking to get acquired and the buy-side helps companies that looking to acquire other companies.[6]

As an analyst, one’s experience depends on which side they are on and the deal type. Deals are categorized into Targeted and Broad deals. In Targeted deals, buyers and sellers already know what they want. However, in broad deals, one is working on generating leads for both the buyer and seller. Investment Banks typically charge a percentage of the deal as a transaction fee to make deals happen for companies. As an analyst, one’s typical job involves making financial models, preparing management presentations, writing the teaser, CIM, etc.[6]

M&A is the most popular division within Investment Banking but working on deals can be boring and repetitive. Having said that, these deals also bring great learning experiences. M&A deals teach you about several industries, different company structures, negotiating skills, risk, and the importance of efficiency.[6]

Such skills are really transferable and can provide lucrative exit opportunities. M&A Bankers typically find their way into Private Equity, Venture Capitalism, Entrepreneurship, and/or Asset Management. As a college graduate, this industry could be a good place to launch one’s career as the skills learned are unparallel to any other industry.[6]

Conclusion

This article gives you a broad picture of the world of Mergers and Acquisitions and the people working behind the scenes to make it happen. However, this industry is far more complex than it seems as many variables need to be controlled to make deals happen. Buyers and Sellers must understand the business, be aware of their reasons to acquire, and should be involved in the process to reduce the chances of failure. As an Investment Banking M&A Analyst, one should understand the industry structure and best practices to make the most out of the opportunity. Furthermore, they should try to acquire essential skills before starting the job to reduce the steepness of the learning curve. This industry can be overwhelming due to the work hours but could potentially be really lucrative as well.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Other Helpful Articles:

- The Top 5 Investment Banking Books You Need to Read

- Investment Banking Exit Opportunities

- Securing an Investment Banking Internship Offer Coming From a Non-Target School

- A Guide To Work-Life Balance in Finance

References

- “Mergers and Acquisitions from A to Z.” Google Books. Google. Accessed May 27, 2021.

- “Why Do Businesses Merge with or Acquire Other Businesses?” Carson, February 5, 2016.

- Lewis, Marsha. “The Ultimate Guide to Synergies in M&A: Types, Sources, Model.” RSS. DealRoom, March 4, 2021.

- Clayton M. Christensen and Harvard Business Review. “The Big Idea: The New M&A Playbook.” Harvard Business Review, March 8, 2021.

- Patel, Kison. “Top 10 Reasons Why Mergers & Acquisitions Fail.” RSS. DealRoom, March 4, 2021.

- “M&A Investment Banking: Careers, Deals, Exit Opportunities & More.” Mergers & Inquisitions, April 15, 2020.