Each year, the path from high school to a six-figure salary becomes more competitive. Student populations are increasing faster than top universities and firms can accept them, and the percentage of students who make it through is becoming slimmer and slimmer. What would once set a student apart from their peers is now the bare minimum to have their college application be worth consideration. Despite all of this, millions of students each year embark on the journey to beat the competitive college admissions process, enter into a top university, choose the right field of study, excel in their undergraduate curriculum, and land a six-figure entry-level role.

Gaining Admission into Top Universities

The increasing competitiveness of gaining acceptance into the best colleges and universities is driven largely by increases in the number of college applications to these schools. The Common Application’s data shows steady year-over-year increases in college application volumes to both the most selective and largest institutions in the nation.[1] Less selective institutions with smaller-than-average student bodies have not benefitted from the trend. The most noteworthy spike in college application volumes came in this recent 2021 cycle, driven largely by an influx of students who had previously deferred enrollment–due to the pandemic and by many schools going “test-optional” and “test-blind.” In fact, when comparing this cycle to the previous one, we saw total college application numbers surge by 42% at Harvard, 20% at NYU, 102% at Colgate University, and 16% system-wide at the University of California.[2] [3] Data from the Common Application also shows that college applications from international students have spiked in this most recent cycle, with India and Brazil showing year-over-year increases of 28% and 41%, respectively.[1]

A natural byproduct of surges in college applications is a decrease in college admission rates. Although the number of institutions that have admission rates below 20% is small (approximately 3.4% of all colleges and universities), they are still the most sought after for high-achieving students.[4] These 46 schools, and another 568 out of the 1,364 examined, had admission rates at least 10% lower in 2017 than in 2002.[4] Moreover, the “Ivy League Plus” category of schools (defined as the Ivy Leagues and Stanford University in California, Massachusetts Institute of Technology in Massachusetts, University of Chicago in Illinois, and Duke University in North Carolina), widely regarded as the list of the best colleges in the nation, has seen rates drop by approximately 10% in just the period from 2014 to 2018.

After learning about the highly competitive nature of the college admissions process, high school students may be wondering what their chances of gaining acceptance to top universities are. When looking at the 20 best colleges in the U.S. (as ranked by US News), 2020 data reveals that the average acceptance rate sits at just 8.8% (see Figure 1). This low figure resulted in 580,151 college applications being rejected from these schools combined. Moreover, out of the estimated 2.3 million U.S. high school graduates who enrolled in college in 2020, only 30,618 (approximately 1.4%) attended a top 20 institution.

Figure 1. Admissions Figures for the 20 Best Colleges in the U.S.

| School | Number Applied | Number Admitted | Percent Admitted | Number Attending | Yield Rate |

|---|---|---|---|---|---|

| Stanford | 45,227 | 2,349 | 5.19% | 1,607 | 68.41% |

| Harvard | 40,248 | 2,015 | 5.01% | 1619 | 80.35% |

| Columbia | 40,084 | 2,544 | 6.35% | 1,406 | 55.27% |

| Princeton | 32,835 | 1,848 | 5.63% | 1,155 | 62.50% |

| Yale | 35,220 | 2,304 | 6.54% | 1,554 | 67.45% |

| UChicago | 34,400 | 2,133 | 6.20% | 1,726 | 80.92% |

| Caltech* | 8,367 | 537 | 6.42% | 235 | 43.76% |

| MIT | 20,075 | 1,457 | 7.26% | 1,107 | 75.98% |

| Brown | 36,794 | 2,533 | 6.88% | 1,665 | 65.73% |

| Duke | 39,783 | 3,057 | 7.68% | 1,744 | 57.05% |

| UPenn | 42,205 | 3,404 | 8.07% | 2,400 | 70.51% |

| Dartmouth | 21,394 | 1,881 | 8.79% | 1,193 | 63.42% |

| Northwestern | 39,261 | 3,542 | 9.02% | 2,006 | 56.63% |

| Vanderbilt | 36,663 | 4,083 | 11.14% | 1,604 | 39.28% |

| Johns Hopkins | 27,256 | 1,922 | 7.05% | 1,363 | 70.92% |

| Cornell | 51,500 | 5,514 | 10.71% | 3,296 | 59.78% |

| Rice | 23,455 | 2,555 | 10.9% | 993 | 38.86% |

| WashU* | 25,400 | 3556 | 14.0% | 1742 | 49.00% |

| Notre Dame | 21,273 | 4,055 | 19.1% | 2,203 | 54.33% |

| UCLA | 108,877 | 15,602 | 14.3% | 6,387 | 40.94% |

| Total | 621,440 | 51,289 | Not Meaningful | 30,618 | Not Meaningful |

| Average | 36,516 | 3,345 | 8.8% | 1,850 | 60.1% |

Content Preview

Excelling in Their Time in Undergraduate

The next roadblock in a student’s journey is determining the right major and career path for themselves. In this endeavor, many find themselves lost and lack the proper guidance to find a path that is both fulfilling and complementary to their strengths. In fact, statistics show that 33% of students pursuing a bachelor’s degree will change their major, with 9% changing it more than once.[5] Even after completing a degree, many feel unsatisfied with their decision. A recent study shows that 61% of college graduates would change their majors if they could go back, and the majority of these individuals indicated that their reasoning was either to gain better/more job opportunities or to pursue their passion.[6] Despite the challenges associated with selecting a degree pathway, students must settle their decision early on if they are to excel in their undergraduate studies and graduate on time.

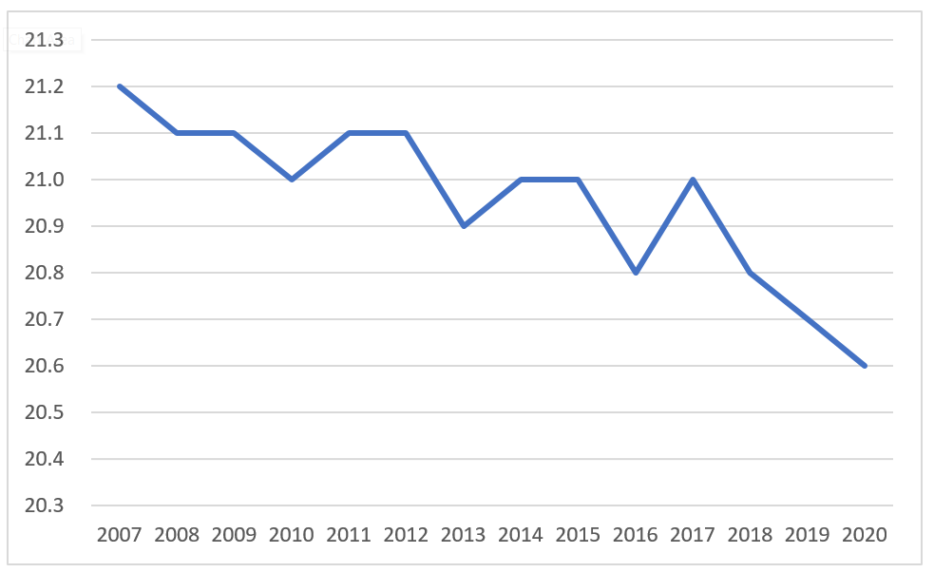

The curriculum at the best colleges’ and universities’ level is, oftentimes, leagues above that of high school. This leaves many students coming in unprepared to pass their classes. In fact, of the approximately 1.7 million students in the 2020 graduating class who took the ACT, only 26% met all four of the test’s College Readiness Benchmarks: benchmarks that represent the level of achievement required for students to have a high probability of success in credit-bearing college courses.[7] [8] Furthermore, national average ACT scores have been down-trending since 2007 (see Figure 2), and 2020’s average of 20.6 is the lowest seen since 1993.

Figure 2. ACT National Average Composite Scores by Year

These figures, showcasing an epidemic of a nationwide lack of college preparedness, are consistent with the narrative illustrated by another metric: low college graduation rates. A study that examined over 580 U.S. public institutions found that the percentage of students who do not graduate on time was 64% for four-year bachelor’s at flagship/very high research institutions, 81% for four-year bachelor’s at non-flagship institutions, and a whopping 95% for two-year associate’s degrees.[9] Even after six years of attending college (deferring graduation for two years), rates remain low with only 57.6% of students graduating at public institutions and 65.4% at private ones.[10] When factoring in the cost of just one extra year of undergraduate education, the true impact of these figures on students and their families becomes apparent. With an average annual cost of tuition and miscellaneous expenses (fees, boarding, books, transportation, etc.) of $22,826 at public institutions and an average annual salary of $53,889 for recent college graduates, students lose out on a combined $76,715 for deferring their graduation by just twelve months.[9] [11]

Excelling in Their Career

After beating the odds of college admissions, gaining acceptance into a top institution, and graduating on time in a field they are passionate about, students begin to face challenges in their career. The most notable of these is starting salary. The list of entry-level roles with close to or above six-figure salaries is slim and congregated in STEM fields such as data science, engineering, and UX design.[12] However, a few high-paying roles can be found in the finance industry, with the most notable salary belonging to investment banking. An entry-level investment banking analyst earns $86,076 on average and can earn anywhere between $130k and $200k in total remuneration.[13] On top of lucrative compensation, investment banking offers major opportunities for career advancement and a high level of transferable skill development. Together, these qualities make the field highly attractive and, therefore, means landing a role is extremely competitive. When looking at the acceptance rates of the top five investment banks, we find that an average of 2.19% of all applicants receive an offer out of a pool of over 28,000 students who apply.[14] Many other fields in finance have similarly attractive compensation structures, including investment analysis, equity research, and management consulting.

All in all, as high school students plan for the four to six years of their lives after graduation, they will begin to recognize the immense challenges that lie ahead. This is where Romero Mentoring comes in. As the leading education and mentoring platform, we prepare students for the college admissions process and for careers in finance. Since our first cohort of students in 2016, we have guided our members and have helped them reach their full potential. Today, with over 370 members belonging to the top universities in the nation including Harvard, Yale, Princeton, and more, we know what it takes to be on the right side of slim statistics. After graduating college, approximately 60% of our members break into high finance roles (investment banking, private equity, hedge funds, and equity research) and earn an average annual total compensation of $118k. Approximately 30% of our members land consulting roles and earn an average of $85k in total annual compensation. The final 10% enter into other fields such as accounting, corporate finance, and operations and bring in $75k annually, on average. Moreover, among students who have completed our programs, we hold a 97% satisfaction rate.

Our solution to the challenges discussed above lies in a single career training and mentorship experience: the Junior Analyst Program. For students looking to excel in college admissions and attend a top university, it provides a unique extracurricular activity and invaluable experience to list on college applications, a solid set of transferable skills, and a letter of recommendation for top-performers who excel in the training and internship. For students looking to excel in their undergraduate curriculum and extracurriculars, it provides knowledge into what major and career they want to pursue, a strong work ethic, an impressive foundation to leverage their applications into student clubs and teams on campus, and a network of alumni at the top universities around the nation. Finally, for students looking to break into Wall Street and land a six-figure entry-level role, it provides a strong set of skills and experience to leverage resumes and job applications, a network of alumni at top financial firms, and insight into the business world and the inner workings of the industry.

Romero Mentoring’s Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the program’s training and internship.

Our Story

Luis Romero, founder of Romero Mentoring, spent five years developing an analyst training program that he wishes he had when he was in college – especially one that gave him access to a complete training and finance internship experience that could advance his career. Since no opportunity like this existed to him at the time, Luis went through a stressful recruiting process like so many others have. He successfully landed a full-time job offer upon graduation and worked as an M&A analyst at Credit Suisse in NYC for two years. He then moved to the buy-side as a junior trader and analyst. After gaining experience there, he created his own fund, Romero Capital, and later become an instructor in financial modeling and valuation. After working with hundreds of professionals and analysts, Luis became committed to creating his own mentoring program because he understood the crucial need for a hands-on, personal experience in the competitive world of finance.

Other Helpful Articles

1. How Much Does a Career on Wall Street Pay?

2. Career Opportunities for Finance Majors

3. Finance Summer Internship Programs: The Recruiting Process, Sample Internships, and How to Land the Role

Sources